- Bitcoin's march toward historic highs has ignited a surge in altcoins.

- Ethereum, breaking out of an ascending channel and surpassing the $3,315 resistance, faces a pivotal moment.

- Meanwhile, Solana, rallying after a minor pullback, eyes the critical $125-$135 resistance on the weekly chart.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Bitcoin's surge to record highs has cascaded bullish momentum into the altcoin market. As institutional demand has grown individual investors have also shown greater interest in the crypto space, leading to growing fund inflows into the crypto space.

This has propelled trading volumes to $200 billion, well above the average daily range of $30 - 50 billion in a calm market.

As a result, other cryptocurrencies like Ethereum, Solana and meme coins like Dogecoin and Shiba Inu have started gaining.

Ethereum's positive momentum is relatively calmer, while Solana, has shown greater bullish strength over the weekend. Memecoins, particularly DOGE and SHIB, have taken the spotlight this week, making significant jumps.

In today's analysis, we aim to pinpoint critical levels for ETH, SOL, DOGE, and SHIB based on recent price action.

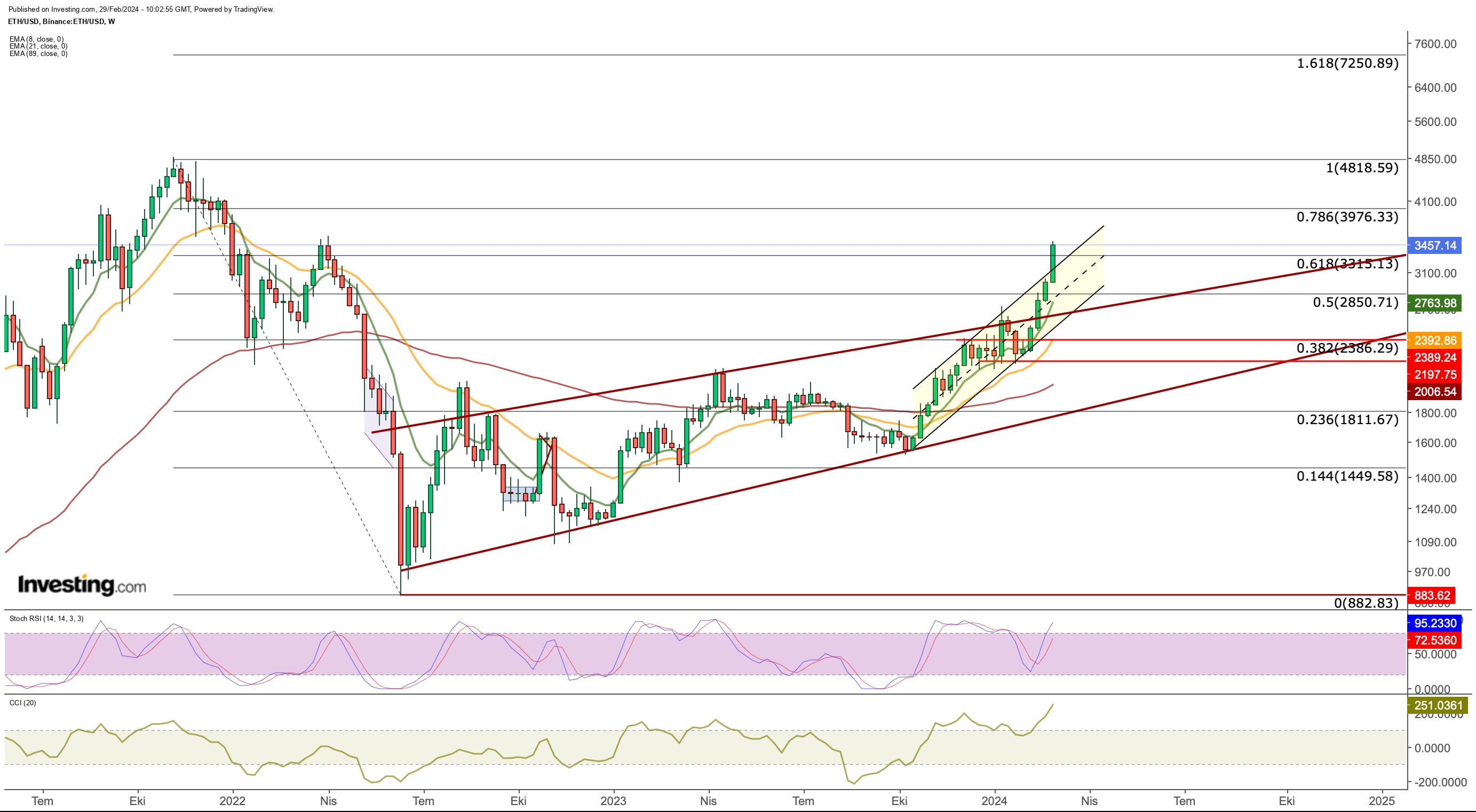

1. Ethereum Breaks Out

Ethereum has been on a relentless uptrend since early February, with support from the lower band of the ascending channel we've been tracking since October.

The cryptocurrency, which formed a clear daily candle at $3,000 on the last day of last week, increased its momentum after breaking the ascending channel to the upside and decisively broke the long-term resistance level of $3,315 (Fib 0.618).

This price zone had worked as resistance during its recovery efforts in the correction phase starting from the peak.

Therefore, ETH must close above $3,315 for the week on its way to the $4,000 target. If this happens, the cryptocurrency technically has no obstacles on its way toward the $3,975 level.

The only obstacle at this point is the possibility that investors may start taking profits after this week's rapid purchases.

In this case, it will become important to maintain the $ 3,315 level, which tends to return to support. Below this value, we can see that the correction movement may begin in daily closures.

The Stochastic RSI on the weekly chart continues to signal that the bullish momentum may continue.

Ethereum has two dynamics to support the uptrend along with the overall positive sentiment in the market, the first of which is the Dencun update which has the potential to make transactions on the network more efficient.

The other catalyst is the high likelihood that spot Ethereum ETFs will be approved as we enter the summer months.

These two important developments could help Ethereum maintain its upward trajectory in the coming weeks.

However, given the fact that things can change quickly because of the volatile nature of the market, it is useful to carefully follow the $ 3,315 zone in possible retracements.

2. Solana Needs to Stay Above $135

SOL has rallied once again after a limited pullback at the beginning of the year.

SOL, which recaptured the $ 100 level at the beginning of the month, managed to gain ground on this psychological price level and then turned its direction upwards again this week.

For SOL, which retested the December peak today, the $ 125 - $ 135 area on the weekly chart stands as an important resistance zone.

In case of a weekly close above this zone, the cryptocurrency will be included in the rising channel again and its next short-term target may be towards $ 165.

If this trend continues, other levels to follow will be $200 and the last peak will be $260, as seen on the chart.

If the resistance area holds, a retracement towards $105 may come. However, on the weekly SOL chart, where positive momentum remains intact, the Stochastic RSI remains just above the oversold zone.

In case the cryptocurrency stays above the $135 resistance, the indicator will generate a bullish signal.

3. Dogecoin Hovers Above Key Fib Level

With this week's bounce, Dogecoin has neutralized all its short-term resistances and moved the Fibonacci expansion zone.

Today, the Fib 1,618 level at $0.124 will act as the nearest support level for the cryptocurrency. The cryptocurrency, which failed to close weekly above this value in October 2022, saw a rapid retreat.

Considering the volatility in the Memecoin market, it would not be wrong to expect a correction in daily closes below this value.

If the momentum continues, $ 0.15 can be the next target price. Another scenario is that if the positive outlook in the market continues, DOGE will stay above $ 0.124 and create a new trading area in this region.

Amid a pullback, a support line as low as $ 0.114 may form below $ 0.124.

4. Shiba Inu: Can it Break Out of the Long-Term Sideways Band?

SHIB followed a similar pattern to DOGE this week, rallying from $0.00001 at the start of the week to $0.000014 as demand for the market increased.

Since June 2022, the cryptocurrency, which has been moving sideways in a wide area, has attempted to break this wide band range for the first time in nearly two years.

In the short term, the $ 0.00001370 level remains an important resistance for SHIB, if this value is exceeded.

The next target could be the Fib 2.618 value at $0.000016. If this breakout fails, Fibonacci levels up to $ 0.0000126 will be followed as support points.

In a possible pullback, the possibility of seeing a retest towards the recent peak at 0.0000118 increases.

However, it is also technically possible that SHIB could rally if it breaks the long-term trading area that could extend to an average of $0.000014.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,427.8% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code INVPROGA24 at checkout for a 10% discount on all InvestingPro plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.