Global financial markets are being whipsawed this week. Stocks on Wall Street have been suffering one of their worst selloffs of the year, as concerns over the spread of the Omicron coronavirus variant spook sentiment. No wonder—Omicron appears to be far more transmissible than previous variants, according to early studies.

While it is still difficult to determine the economic impact of the fast-spreading strain of the virus, the three names below are likely to be among the beneficiaries from the current COVID wave.

1. Pfizer

- Year-To-Date Performance: +60.1%

- Market Cap: $330.9 Billion

Pfizer (NYSE:PFE) has emerged as one of the big winners from the race to deliver a COVID-19 vaccine. A standout performer in the booming pharmaceutical sector this year, Pfizer has been reaping the benefits of the unprecedented global vaccination drive against the pandemic.

In fact, Pfizer’s COVID shot, developed along with German drug maker BioNTech (NASDAQ:BNTX), has quickly become one of the best-selling products in the US pharmaceutical giant’s history.

The New York City-based company raised its 2021 full-year sales forecast for its COVID-19 vaccine by 7.5% to $36 billion when it reported blowout third quarter earnings and revenue on Nov. 2. It also lifted its outlook for 2022, as it signs deals with more countries for booster doses and obtains full approval to administer the vaccine to children.

Pfizer warned last week that the pandemic would last until 2024, and stated that it expects to start a clinical trial for an updated version of its vaccine tailored to combat the Omicron variant in January. The company announced plans to develop a three-dose vaccine regimen for children ages 2 to 16.

In addition, the drug maker has also developed a yet-to-be-launched COVID-19 antiviral pill, which PFE claims has near 90% efficacy in preventing hospitalizations and deaths in high-risk patients. The pill awaits the FDA’s authorization.

Shares of PFE started the year at $36.81, ending Tuesday’s session at $58.95, not far from a record high of $61.71 reached on Dec. 20. At current levels, the pharmaceutical firm—which has outperformed other notable names in the sector, such as Johnson & Johnson (NYSE:JNJ), AstraZeneca (NASDAQ:AZN), Merck (NYSE:MRK), and Eli Lilly (NYSE:LLY)—has a market cap of $330.9 billion.

Year-to-date, Pfizer shares have gained roughly 60%, easily outpacing the comparable returns of both the Dow Jones Industrial Average and the S&P 500.

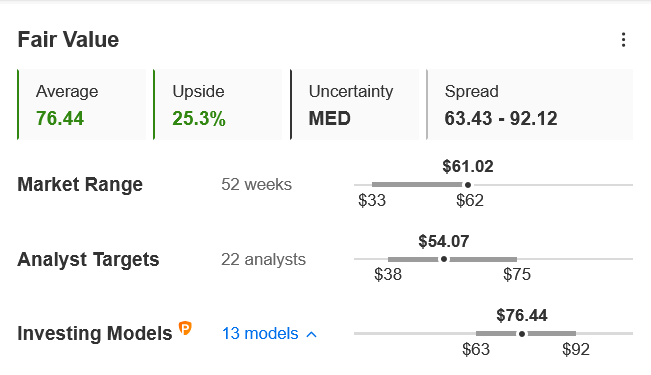

We expect Pfizer, which has become one of the chief vaccine makers, to continue to outperform amid the current Omicron variant outbreak. While analysts are a little more conservative, the quantitative models in InvestingPro point to 25% upside from current levels to $76.44/share.

I

Chart: InvestingPro

2. Thermo Fisher Scientific

- Year-To-Date Performance: +38.5%

- Market Cap: $254.3 Billion

One of the world’s largest producers of diagnostic test kits, laboratory hardware and supplies, Thermo Fisher Scientific (NYSE:TMO) has been a top performer in the healthcare sector this year thanks to robust demand for its coronavirus testing products. It also supplies raw materials for COVID-19 vaccines and therapies.

The Waltham, Massachusetts-based company, which received FDA emergency use authorization for its SARS-CoV-2 test in March 2020—earned $2.05 billion in the third quarter from sales of its coronavirus-related products and services. Considering the current spike in worldwide cases of the Omicron variant, Thermo Fisher is likely to see a boost in global demand for its testing kits heading into year-end and early 2022.

Thermo Fisher reported upbeat earnings and revenue on Oct. 27 and boosted its full-year guidance by $1.2 billion to $37.1 billion, up 15% from a year earlier. It forecast COVID-19 response revenue for the year would rise to $7.7 billion from $6.7 billion.

In a sign that bodes well for the future, the scientific instruments maker also raised its revenue guidance for 2022 by $200 million to $40.5 billion, highlighting how well Thermo Fisher’s business has performed amid the current market environment.

Shares of the medical equipment maker have outperformed the S&P 500 by a wide margin in 2021, climbing almost 40% with just a week remaining in 2021. TMO, which started the year at $465.78 and soared all the way to a record high of $666.65 on Nov. 26, closed at $645.34 on Tuesday, earning the healthcare company a valuation of $254.3 billion.

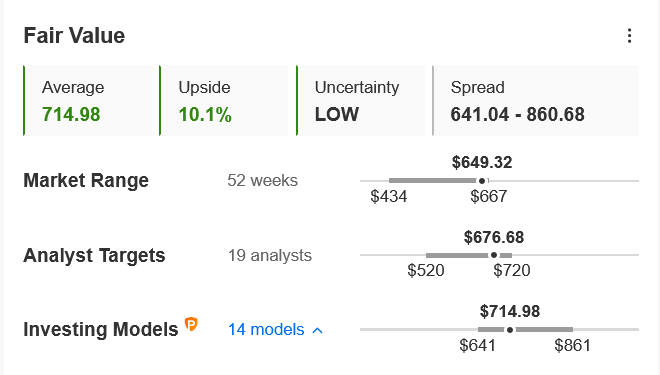

With worries surrounding the Omicron variant continuing to dominate sentiment, Thermo Fisher should continue to enjoy an upswing to its already-stellar financial performance heading into the new year. Indeed, quantitative price models in InvestingPro point to 10% upside from current levels to $714.98 per share.

Chart: InvestingPro

3. Datadog

- Year-To-Date Performance: +80.3%

- Market Cap: $55.4 Billion

Datadog (NASDAQ:DDOG), which provides a security monitoring and analytics platform for software developers and information technology (IT) departments, has enjoyed a remarkable run this year. Shares of the New York City-based software-as-a-service company, which counts names such as FedEx (NYSE:FDX), AT&T (NYSE:T), and Airbnb (NASDAQ:ABNB) as customers, have jumped 80% year-to-date, as it benefits from surging demand for its cloud observability solutions across the enterprise segment.

DDOG began trading at $98.44 on Jan. 1 and rallied to an all-time high of $199.68 on Nov. 17. Tuesday saw it reach $177.49, earning the high-flying enterprise software maker a valuation of over $55 billion.

Datadog looks poised for further gains in the weeks ahead as the current remote work environment resulting from the coronavirus health crisis fuels demand for its cloud-based cybersecurity software services.

Not surprisingly, the SaaS company posted financial results that crushed Wall Street’s profit and revenue forecasts in each quarter this year as the COVID pandemic forced businesses to accelerate digitization trends and cloud migration.

For its most recent period, Datadog announced year-over-year earnings growth of 160% to $0.13 per share on Nov. 4, while revenues surged 75% to a record $270.5 million, reflecting soaring demand for its cloud-based security tools.

Indeed, Datadog said it had 1,610 customers with annual recurring revenue of $100,000 or more as of Sept. 30, up nearly 60% from 1,015 in the year-ago period.

Looking ahead, Datadog's guidance for the current quarter ending in January made clear that the software maker does not expect any slowdown in the coming months. The company stated it expected its revenue forecast to grow by roughly 64% from a year earlier to another all-time high of $291 million.