- After the failed assassination attempt last week, Trump's chances of getting elected are on the rise.

- This is evident in the financial markets, as the probability of a victory starts getting priced in.

- In this piece, we will take a look at how financial markets could react to a potential trump victory.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Markets have been pricing in increased odds of Donald Trump returning to the White House following the failed assassination attempt this weekend.

The so-called 'Trump trade,' which has the flagship Trump Media & Technology Group (NASDAQ:DJT) as the most straightforward way to bet on it, actually extends well beyond the stock market.

Along with DJT - which jumped 31% yesterday - gold, Bitcoin, and bonds also gained. Several other market sectors are also garnishing growing attention following the repricing of an eventual Trump win.

Conversely, others have already begun to feel the impact of the changing political environment.

So, regardless of whether you believe the Republican will be reelected or not, let's take a look at 3 ways to profit from the trend.

1. A Bullish Bet on Stocks

S&P 500 closed higher on Monday, continuing its ascent to new highs. Speculation swirls around a potential resurgence under former President Trump, which could spark a fresh rally in stocks, particularly benefiting sectors poised for reduced regulatory constraints and increased business freedom. This optimism fuels expectations of bolstered company earnings driving stock prices higher, albeit unevenly across sectors.

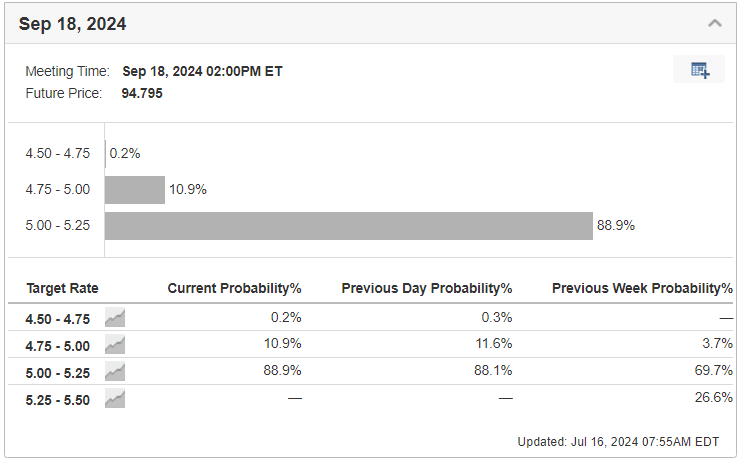

Meanwhile, Trump's vocal disagreement with current Fed policies, led by Jerome Powell, would cause a big shift in expectations of future rate cuts, potentially boosting stocks.

2. Avoid Renewables, Prefer Oil Stocks, Big Tech

Monday saw U.S. oil stocks surge with Occidental Petroleum Corporation (NYSE:OXY) climbing 1.31% and Exxon Mobil (NYSE:XOM) gaining 1.71%. In contrast, alternative energy firms like Nextera Energy (NYSE:NEE) faced heightened selling pressure in anticipation of a Republican resurgence.

These companies heavily rely on government subsidies to compete against traditional energy counterparts, and a potential Trump administration could curtail public funding for green initiatives.

Despite potential tensions, Trump's focus on economic expansion may lead to favorable policies for tech giants, essential in countering Chinese competition. However, Meta (NASDAQ:META) might face continued scrutiny due to past conflicts.

3. US-Based Stocks Will Benefit but Be Wary of Rising Inflation, Fiscal Deficits

Internationally, tighter trade relations loom with new tariffs targeting companies reliant on foreign production or those eyeing the U.S. market.

A crucial concern gripping the markets is the trajectory of U.S. debt. According to a recent Wall Street Journal analysis, most analysts anticipate that a GOP administration could lead to higher inflation, government deficits, and borrowing costs.

Bottom Line: Trump's Image Is Changing and a Victory Won't Shock Markets

The U.S. government bond yield briefly spiked to 4.25% on Monday before easing in early Tuesday trading. This fluctuation highlights a critical shift: unlike the market turmoil following Trump's 2016 victory over Hillary Clinton, current sentiment suggests diminished apprehension.

Analysts no longer view Trump with the same degree of uncertainty and fear. Back then, he represented an unpredictable wildcard, with markets reacting sharply. Today, however, his potential return to office is seen as a plausible scenario already factored into market expectations. Notably, influential figures like Tesla)'s Elon Musk and hedge fund manager Bill Ackman recently voiced public support for Trump, underscoring growing confidence in his candidacy among key financial players.

This evolving narrative suggests a recalibration in market reactions and expectations, marked by a tempered response to political developments that were once considered high-risk events.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips.

Don't miss this limited-time offer!

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.