- Shares of Devon Energy have returned almost 12% so far this year

- Current share price supports a lucrative dividend yield of 7.3%

- Long-term investors could consider buying DVN shares at current levels

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

- First Trust Nasdaq Oil & Gas ETF (NASDAQ:FTXN)

- Invesco S&P 500® Equal Weight Energy ETF (NYSE:RYE)

- Pacer US Cash Cows Growth ETF (NYSE:BUL)

- First Trust RBA Quality Income (NASDAQ:DDIV)

Long-term shareholders of Oklahoma-based Devon Energy (NYSE:DVN) have seen the value of their investment increase by 79% over the past 52 weeks and 11.9% so far this year.

By comparison, Dow Jones U.S. Oil and Gas Index has gained more than 19% so far this year. Meanwhile, shares of other oil and gas peers, such as Pioneer Natural Resources (NYSE:PXD) and EOG Resources (NYSE:EOG), have returned 13.2% and 11.2% so far in 2022, respectively.

Source: Investing.com

On June 9, DVN shares went over $79 to hit a multi-year high. But since then profit-taking has kicked in, coupled with recent declines in the price of oil. The stock’s 52-week range has been $24.05-$79.40, while the market capitalization currently stands at $32.7 billion.

Recent Metrics

Devon Energy released Q1 figures on May 2. The top line benefited from soaring oil and gas prices. Revenue increased 85.9% year-over-year to $3.8 billion. Adjusted earnings came in at $1.88 per share, up 35.3% YoY. Cash and equivalents ended the quarter at $2.63 billion.

On the results, CEO Rick Muncrief commented:

“This strong financial performance has enabled us to dramatically accelerate the return of capital to shareholders by declaring the highest dividend in Devon’s history and by expanding our share-repurchase program to further bolster per-share results.”

In 2021, Wall Street took notice when Devon Energy launched a fixed-plus-variable dividend program. The company currently offers a robust dividend yield of 7.3%. In addition to a fixed component, the dividend payout includes a variable component funded by excess free cash flow.

During the first quarter, the company generated a record $1.3 billion free cash flow. As a result, share-repurchase authorization also increased by 25% to $2 billion.

Meanwhile, Devon is likely to hike dividends, following the closing of its recent acquisition of RimRock's oil wells in the Williston Basin for $865 million. The board intends to increase the fixed quarterly dividend by 13% after the transaction finalizes.

Prior to the release of the Q1 results, DVN traded at $58. At the time of writing, it was $49.60, down roughly 14%.

What To Expect From Devon Energy Stock

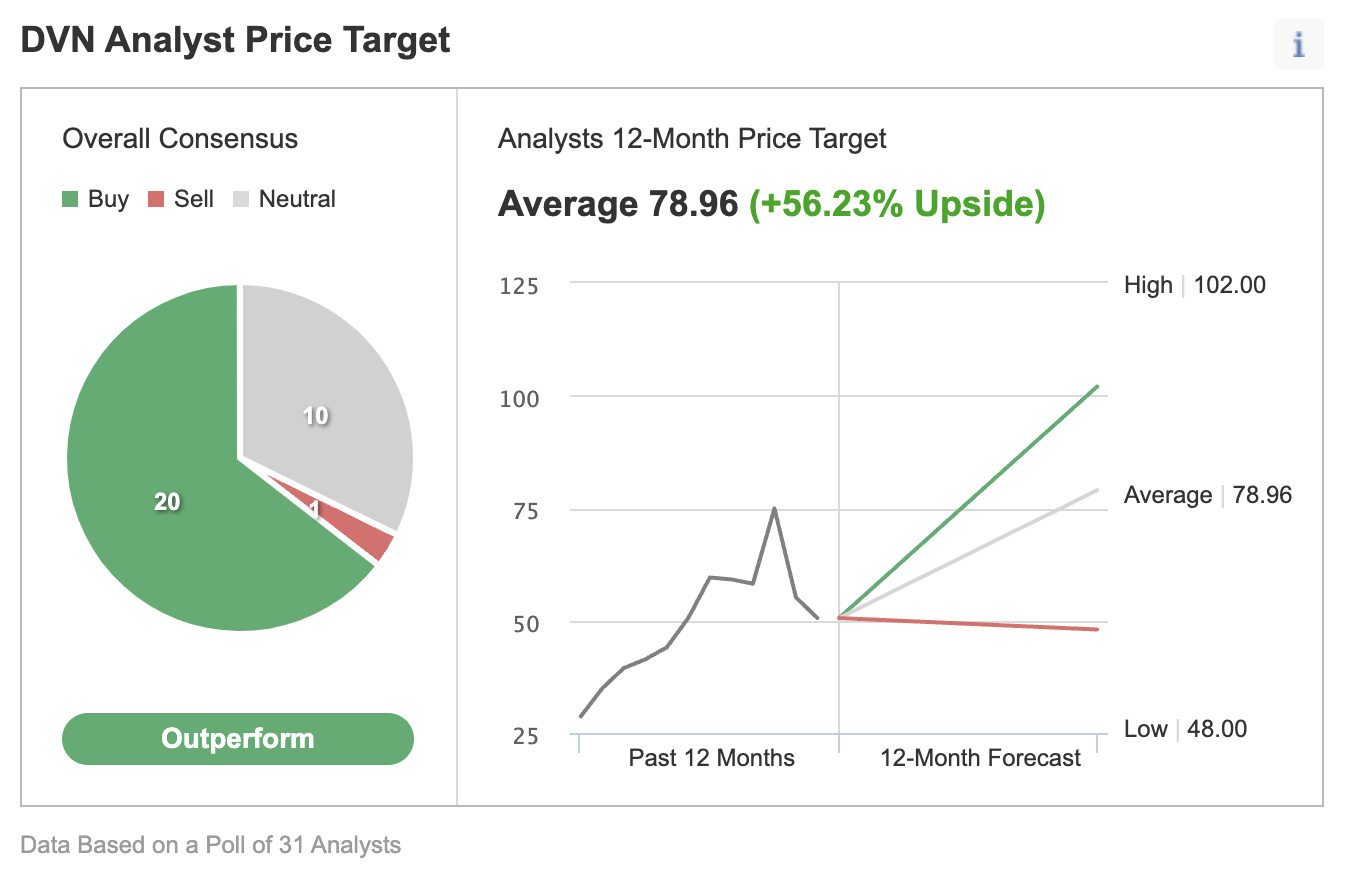

Among 31 analysts polled via Investing.com, DVN stock has an "outperform" rating, with Wall Street pegging its 12-month median price target at $78.96. Such a move would suggest an increase of more than 56% from the current price. The 12-month target range stands between $48 and $102.

Source: Investing.com

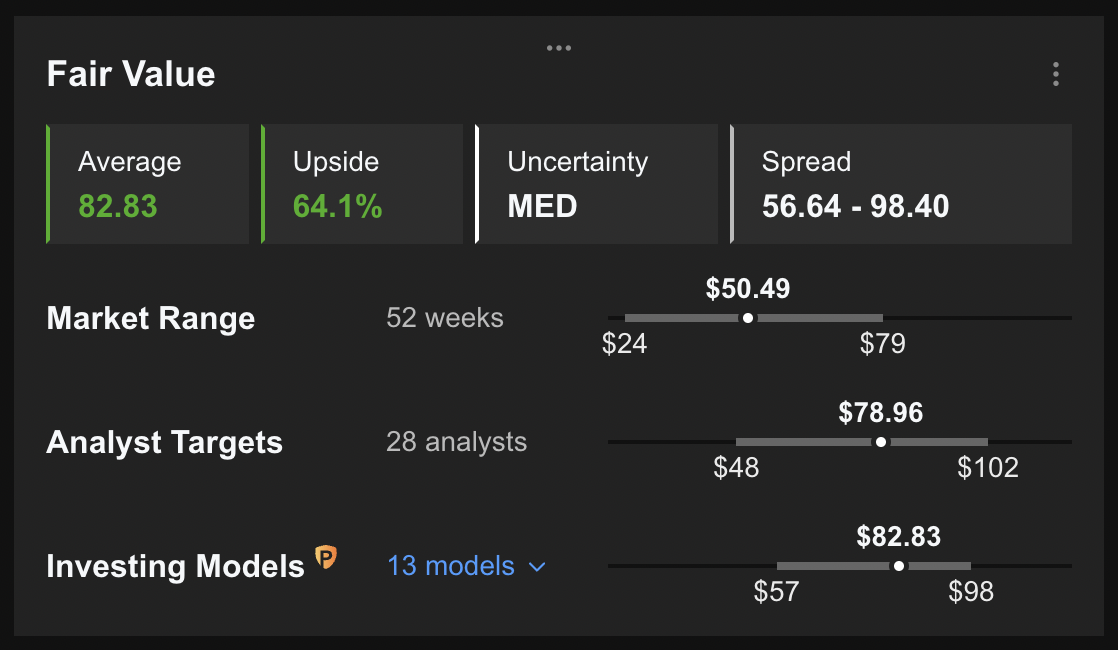

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for DVN stock on InvestingPro stands at $82.83.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase around 64%.

We can also look at DVN’s financial health as determined by ranking more than 100 factors against peers in the energy sector.

For instance, in terms of growth and profitability, it scores 4 out of 5. Its overall score of 4 points is a great performance ranking.

At present, DVN’s P/E, P/B and P/S ratios are 9.7x, 3.7x and 2.3x, respectively. Comparable metrics for peers stand at 16.8x, 2.0x and 2.4x, respectively. These figures reveal that the fundamental valuation for DVN stock looks slightly undervalued compared to its peers in the industry.

Given the recent decline in the price of oil, our expectation is for DVN stock to build a base between $47 and $52 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding DVN Stock To Portfolios

Devon Energy bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $78.96, as per the target provided by analysts.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has DVN stock as a holding. Examples include:

Finally, those who are experienced with options could also consider selling a cash-secured put option—a strategy we regularly cover. Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own DVN shares for less than their current market price of $49.60.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on DVN stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Puts On DVN

Price Now: $49.60

Let's assume an investor wants to buy DVN stock, but does not want to pay the full price of $49.60 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for DVN stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured DVN put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Oct. 21. As the stock is $49.60 at time of writing, an OTM put option would have a strike of $45. This put option is currently offered at a price (or premium) of $5.15.

An option buyer would have to pay $5.15 X 100, or $515, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future and also it is the seller’s maximum gain. The put option will stop trading on Friday, Oct. 21.

If the put option is in the money (meaning the market price of DVN stock is lower than the strike price of $45) any time before or at expiration on Oct. 21, this put option can be assigned. The seller would then be obligated to buy 100 shares of DVN stock at the put option's strike price of $45 (i.e. at a total of $4,500).

The break-even point for our example is the strike price ($45) less the option premium received ($5.15), i.e., $39.85. This is the price at which the seller would start to incur a loss.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in DVN stock in the coming weeks.

Investors who end up owning DVN shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.