- European dividend giants are preparing to reward shareholders in April and May.

- So in this piece, we will analyze three European stocks offering great dividend yields that you can buy before the cut-off date.

- For those keen on investing in European dividends, we will also look at an interesting ETF enabling us to do so.

- Investing in the stock market, want to get the most out of your portfolio? try InvestingPro. Sign up NOW and take advantage of up to 38% off for a limited time on your 1-year plan!

- Iveco Group NV (BIT:IVG)

- Rubis (OTC:RBSFY)

- Bper Banca SpA ADR (OTC:BPXXY)

- UniCredit (LON:0RLS) SpA ADR (OTC:UNCRY)

- Gr Sarantis SA (AT:SRSr)

- Daimler (OTC:MBGAF) Truck Holding AG (ETR:DTGGe)

- Laboratorios Farmaceuticos ROVI (BME:ROVI)

- BBVA (BME:BBVA)

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

European companies are gearing up to distribute dividend payments in April and May and this article will analyze three European stocks ideal for regular dividend income.

If individual stock investment isn't your preference, stay tuned until the end for insights on a special ETF.

Meanwhile, here are three reliable European dividend stocks to consider for steady cash flow:

1. BBVA

Banco Bilbao Viscaya Argentaria (NYSE:BBVA) is one of the largest European banks. It was founded as Banco de Bilbao on May 28, 1857, in Bilbao, where it is headquartered.

On April 10, the company will pay a dividend of $0.34 per share. To receive this dividend, you need to own shares before April 8.

And on April 29, the company will announce its earnings for the quarter. Analysts predict a growth of +8.2% in earnings per share (EPS) and +6.8% in revenues for 2024.

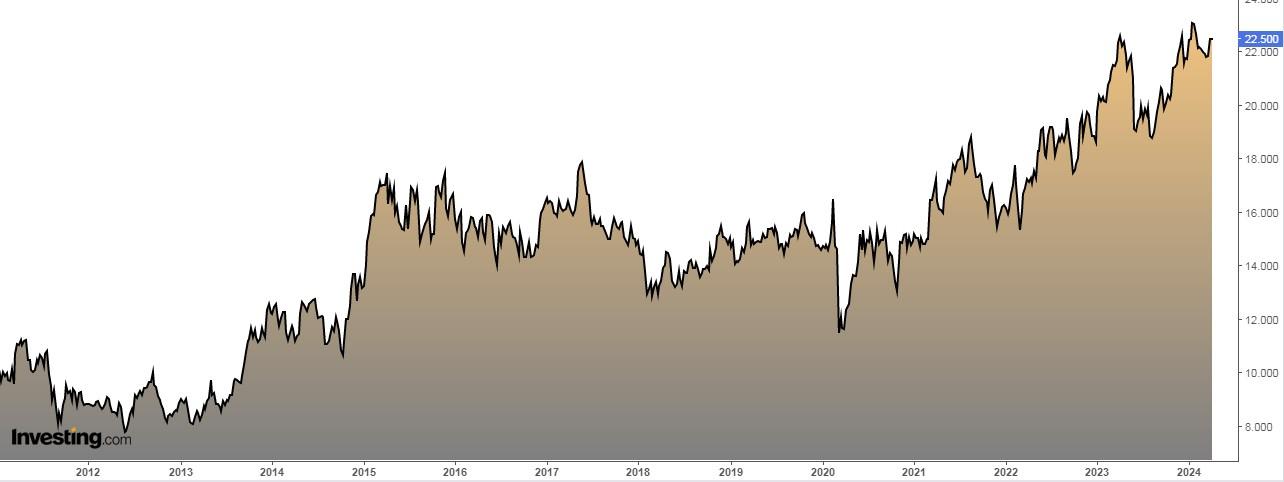

The company's shares have increased by +79.17% in the last 12 months.

According to InvestingPro models, the company's current stock price is above its target price of $10.40.

2. Deutsche Telekom

Deutsche Telekom (OTC:DTEGY) (ETR:DTEGn) is a German telecommunications company based in Bonn. It was formed in 1996 when the former state-owned monopoly Deutsche Bundespost was privatized.

On April 15, the company will pay a dividend of 0.77 euros per share to shareholders who own shares before April 11.

The company will release its financial results on May 16. Analysts expect a 13.3% increase in earnings per share (EPS) and a 2.3% rise in revenues for 2024.

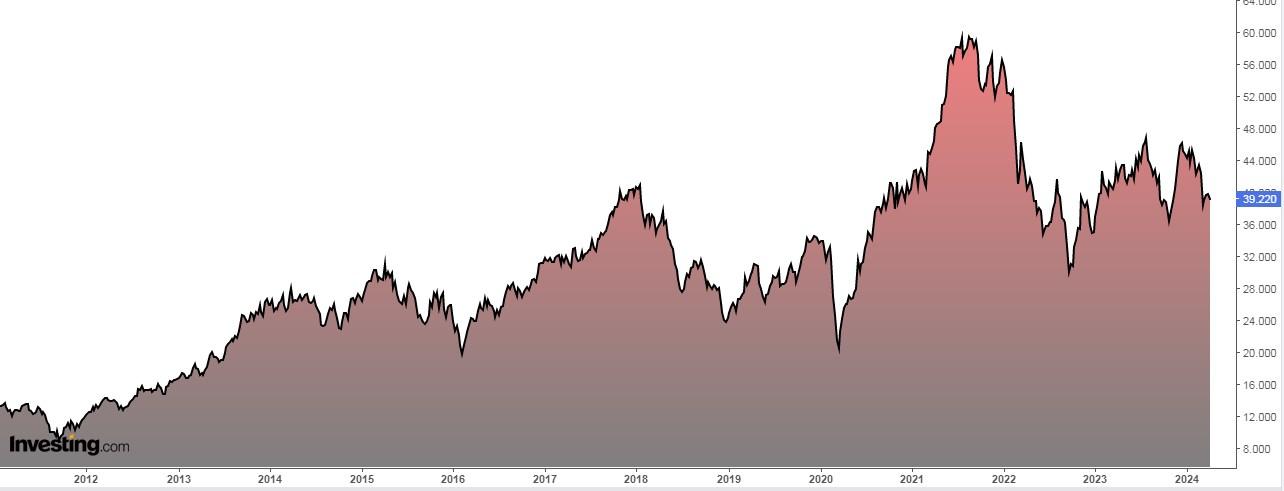

Over the past year, the company's shares have increased by 2.85%.

The market views the company's potential stock price at 26.90 euros, while InvestingPro's valuation models suggest an objective valuation of 26.40 euros.

3. Deutsche Post

Deutsche Post (OTC:DHLGY) (ETR:DHLn) is a German postal company founded in 1995. Its headquarters are located in Bonn.

The company will distribute a dividend of EUR 1.85 per share on May 8, requiring shareholders to hold their shares before May 6 to qualify.

Quarterly financial reports are anticipated on May 7, with a projected revenue increase of +2.8% for the year.

Over the past year, its shares have experienced a decline of -3.60%.

Market consensus suggests a potential upside, estimating a target price of 45.83 euros. Conversely, InvestingPro models indicate the stock as undervalued, with a target price of 48.77 euros.

Bonus: 1 ETF to Invest in for European dividends

The MSCI Europe index set a new record for dividend payouts. In 2023, companies in this index distributed €407 billion in dividends.

For 2024, the estimate is €433 billion, showing a 6.5% increase from last year. By 2025, it could reach €460 billion, a 13% rise from 2023.

Meanwhile, Morningstar identified the top dividend-yielding stocks for the first quarter of this year:

Also, for investors interested in European dividends, there's a special ETF: ProShares MSCI Europe Dividend Growers ETF (NYSE:EUDV).

***

Are you investing in the stock market? To determine when and how to get in or out, try InvestingPro.

Take advantage HERE & NOW! Click HERE, choose the plan you want for 1 or 2 years, and take advantage of your DISCOUNTS.

Get from 10% to 50% by applying the code INVESTINGPRO1. Don't wait any longer!

With it, you will get:

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.