- September is expected to be another volatile month on Wall Street amid a trio of major market-moving events.

- All eyes will be on the upcoming U.S. jobs report, CPI inflation data, and the Fed’s big rate decision.

- As such, investors should brace for more violent swings and sharp moves in the weeks ahead.

- Looking for a helping hand in the market? Members of Investing Pro get exclusive ideas and guidance to navigate any climate. Learn More »

- In my opinion, the August employment report will emphasize the remarkable resilience of the labor market and support the view that additional rate hikes will be necessary to cool the economy.

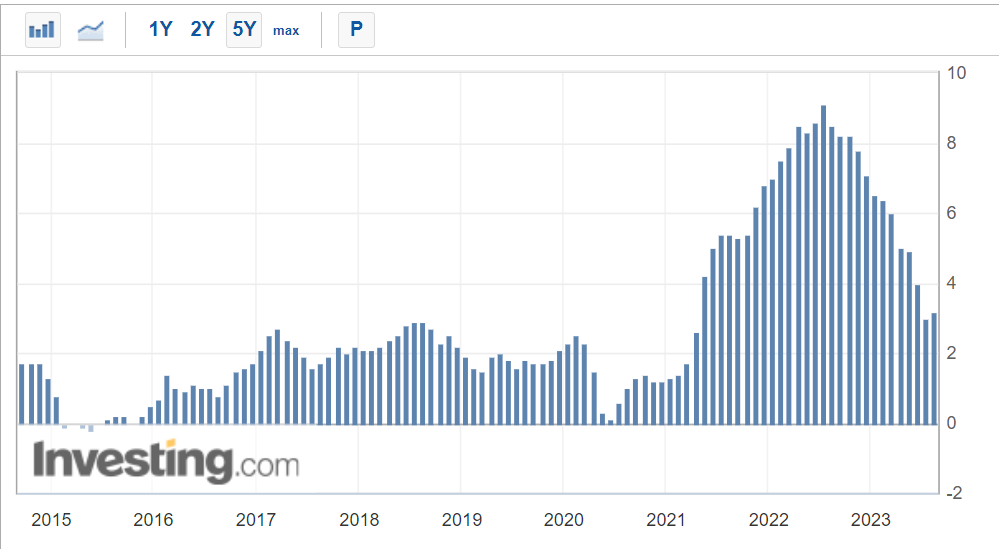

- I believe the CPI report will underscore the material risk of a fresh increase in inflation, which is already running far more quickly than what the Fed would consider consistent with its 2% target range.

- Therefore, I hold the opinion that the current environment is not indicative of a Fed that will need to pivot on policy, and there is still a long way to go before policymakers are ready to declare a mission accomplished on the inflation front.

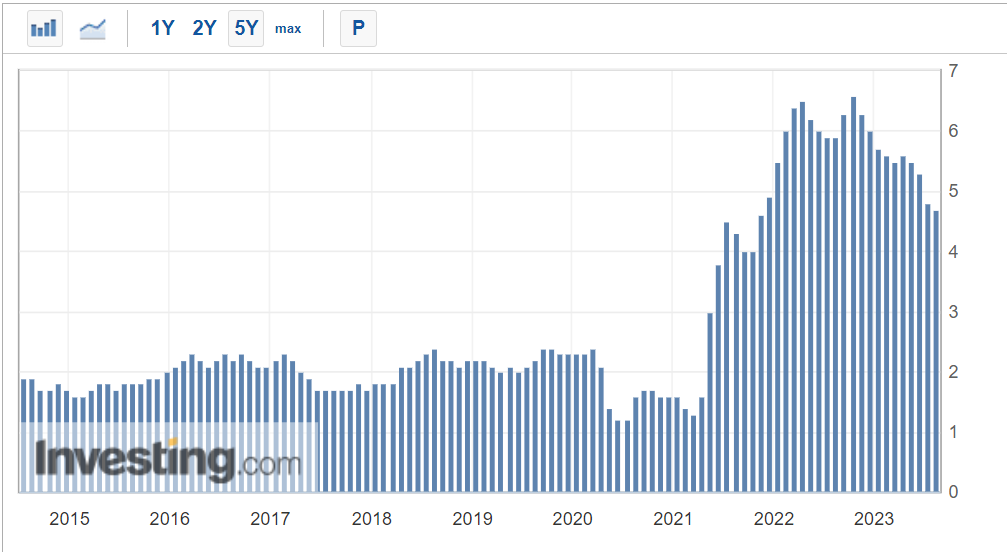

- Even as inflation remains stubbornly high and the economy holds up better than expected, I currently believe the Fed will decide to hold off on hiking rates at its September meeting. That would leave the policy rate in its current 5.25%-5.50% range.

- With that being said, I expect the FOMC’s statement will reiterate that the central bank remains committed to achieving its 2% inflation goal and that policymakers will make data-driven decisions on a meeting-by-meeting basis.

- In addition, I believe Powell will stick to his hawkish stance in the post-meeting press conference and repeat his message from Jackson Hole that there is still more work for the Fed to do to cool inflation.

- That would leave the door open to another rate hike before the end of 2023, possibly at the Fed’s November meeting. In fact, traders see a roughly 50% chance of the Fed funds rate ending the year in a 5.50%-5.75% range. At the same time, hopes of seeing rate cuts by early 2024 have almost completely faded.

- The Fed is at risk of committing a major policy error if it begins to loosen monetary conditions too soon, which could see inflationary pressures begin to pick up again. If anything, the Fed has more room to raise interest rates than to cut them, presuming it follows the numbers.

With just two trading days left in August, Wall Street’s three major indexes are on track to end the month with losses as fresh uncertainty surrounding the Federal Reserve's rate plans rattled investors.

Through Tuesday's close, the blue-chip Dow Jones Industrial Average and the benchmark S&P 500 are both off by about 2%, while the tech-heavy Nasdaq Composite is down 2.8% and is slated to book its worst monthly decline since December 2022.

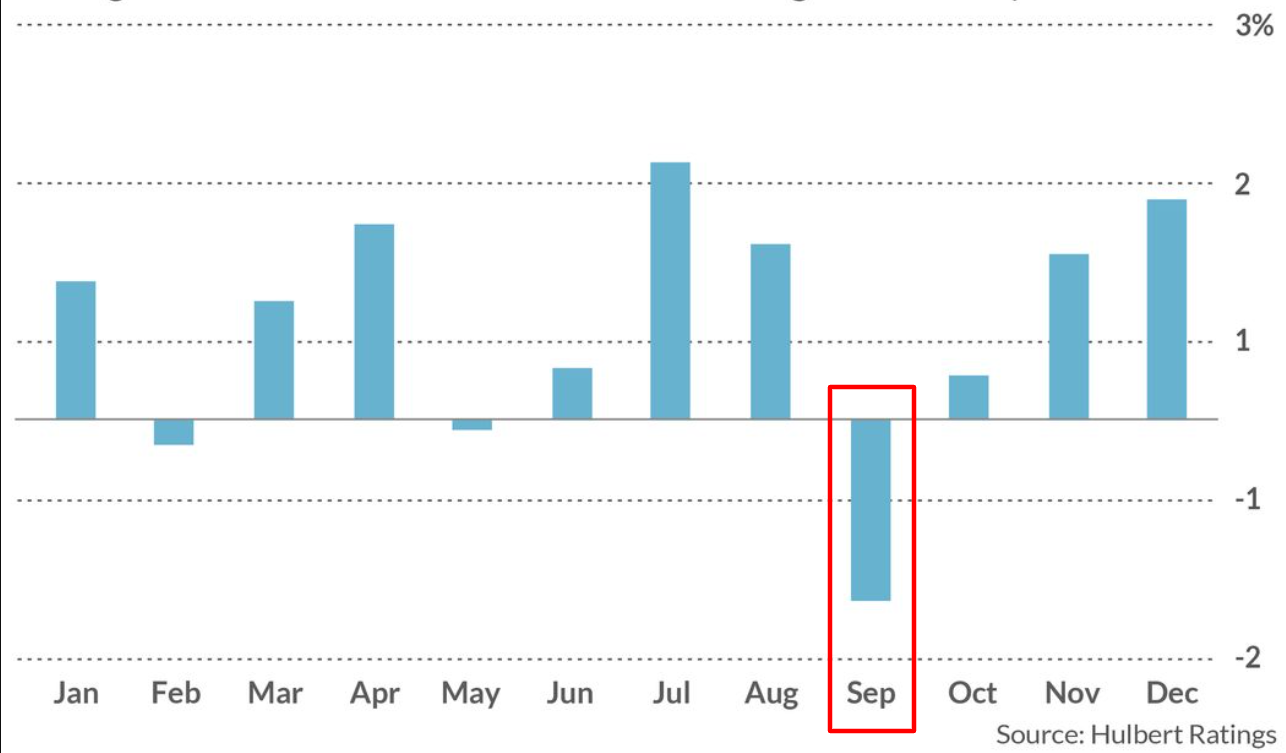

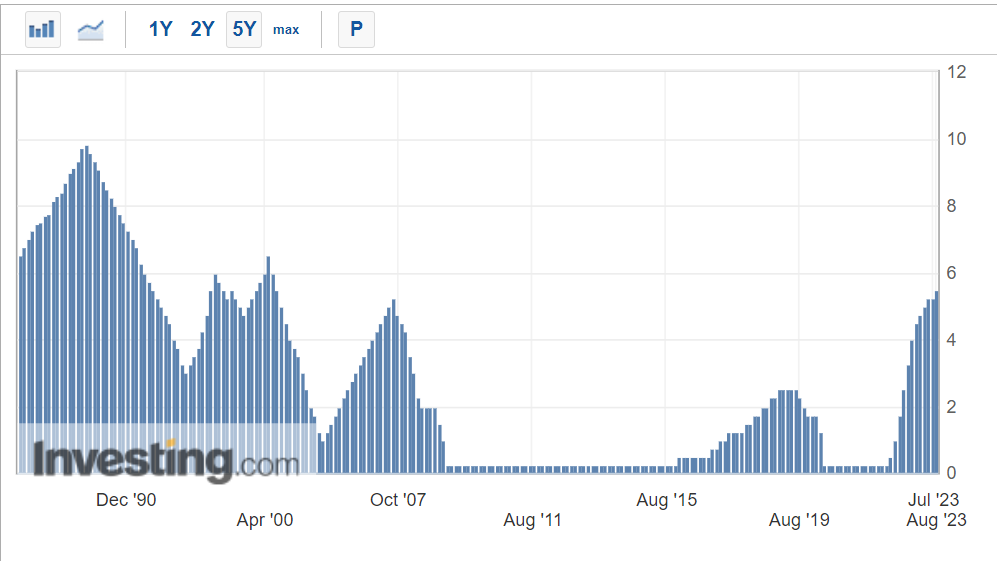

As a stormy August comes to an end, history says investors should brace for further turmoil in September, which is the worst month of the year for the stock market on average. Some have dubbed this annual sell-off as the "September Effect."

Since 1897 - the first full year of the Dow Jones Industrial Average’s existence - the blue-chip index has suffered an average loss of around -1.2% in September. That compares to an average gain of roughly +0.8% for the other months of the calendar.

The Dow sank almost 9% last September as investors worried about the Federal Reserve’s aggressive rate hike plans to combat soaring inflation.

Source: Hulbert Ratings

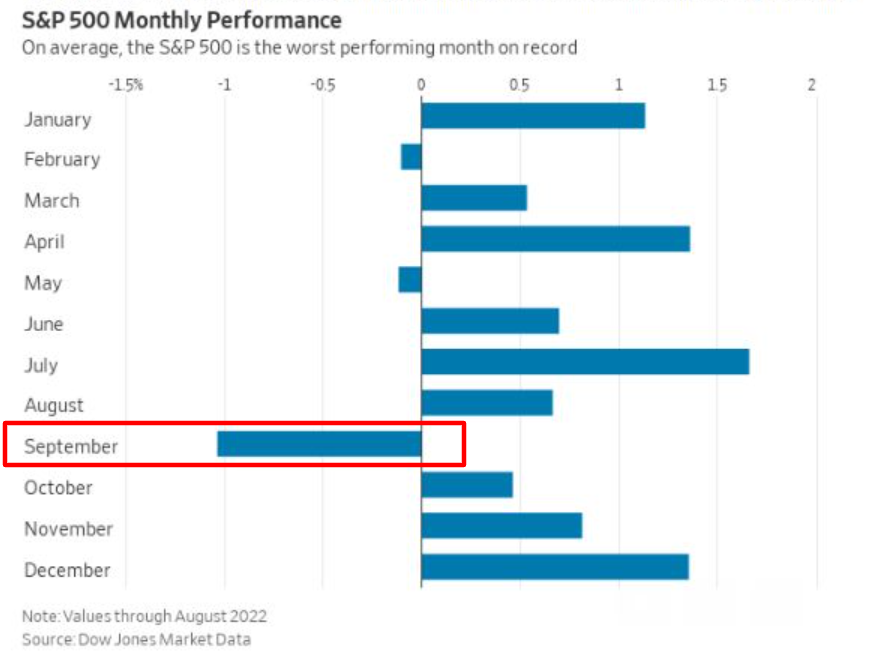

Meanwhile, the benchmark S&P 500’s average September return dating back to 1928 is negative -1.1%, also the worst of any month of the year. That includes a 9.3% plunge in September 2022.

Source: Dow Jones Market Data

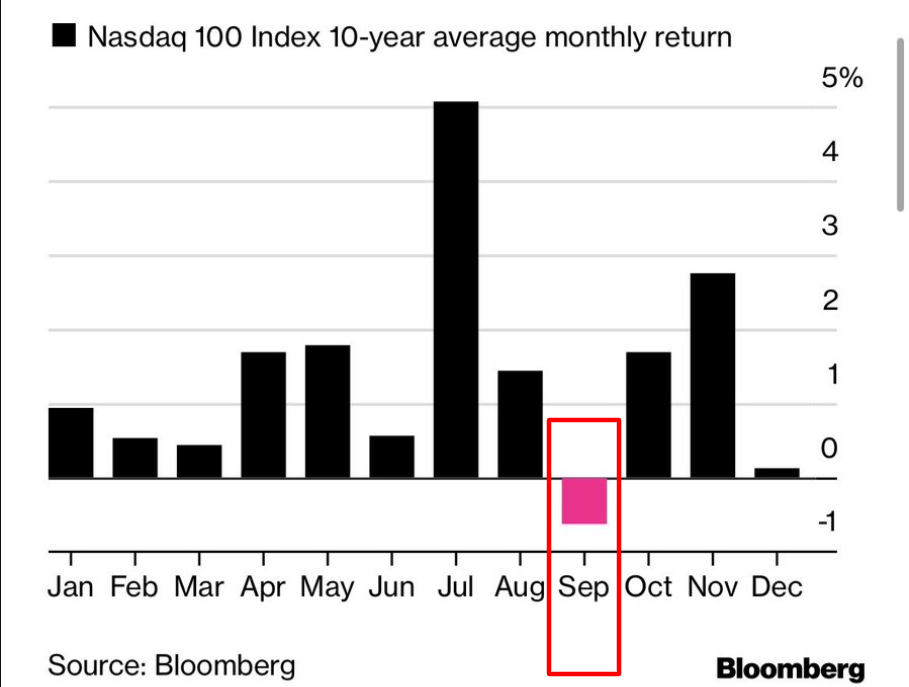

The same is true for the Nasdaq 100 Index, which has declined by an average of -0.8% in September over the last decade - the only month of the year with a negative return. The tech-heavy index sank 10.6% in September last year.

Source: Bloomberg

With investors continuing to gauge the outlook for interest rates, inflation, and the economy, a lot will be on the line in the weeks ahead. As such, here are three key dates to watch as the calendar flips to September:

1. Friday, September 1: U.S. Jobs Report

The U.S. Labor Department will release the August jobs report at 8:30 AM ET on Friday, September 1, and it will be key in determining the Federal Reserve’s next rate move.

The consensus estimate is that the data will show the U.S. economy added 170,000 positions, according to Investing.com, slowing from jobs growth of 187,000 in July.

The unemployment rate is seen holding steady at 3.5%, one tick above a recent 53-year low of 3.4%, a level not seen since 1969. It's worth noting that the unemployment rate stood at 3.7% precisely a year ago, in August 2022.

Meanwhile, average hourly earnings are expected to rise 0.3% month-over-month, while the year-over-year rate is forecast to increase 4.4%, which is still way too hot for the Fed.

Prediction:

2. Wednesday, September 13: U.S. CPI Data

The August CPI report looms large on Wednesday, September 13, at 8:30 AM ET, and I believe it could be hotter than July’s 3.2% year-over-year pace, keeping pressure on the Fed to maintain its fight against inflation.

As per Investing.com, the consumer price index is forecast to rise 0.3% on the month after edging up 0.2% in July. The headline annual inflation rate is seen accelerating to 3.4% from the 3.2% increase in the previous month.

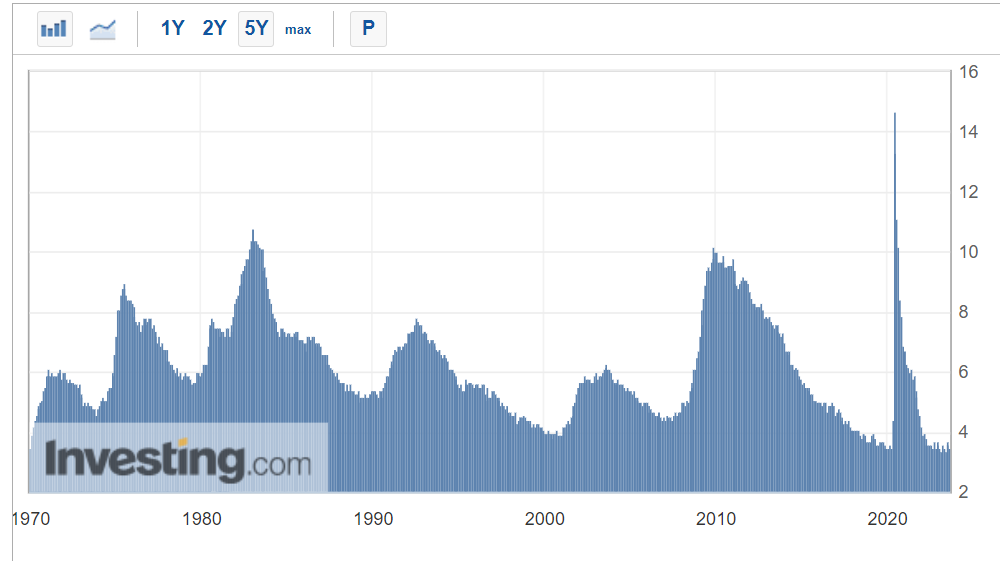

CPI peaked at a 40-year high of 9.1% last summer and has been on a steady downtrend since, however, prices are still rising at a pace far more quickly than the 2% rate the Fed considers healthy.

Meanwhile, the core consumer price index — which does not include food and energy prices — is expected to increase 0.2% on the month and 4.6% from a year ago.

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction:

3. Wednesday, September 20: Fed Rate Decision

The Federal Reserve — which has hiked interest rates in 11 of its last 12 meetings — is scheduled to deliver its September policy decision at 2:00 PM ET on Wednesday, September 20.

The central bank raised its benchmark Fed funds rate by a quarter-percentage-point in July to a range between 5.25%-5.50% (which is the highest level since January 2001) in its ongoing battle to contain inflation.

As of Wednesday morning, financial markets see an 86% chance of the central bank holding rates at current levels and a 14% chance of a 25-basis point rate hike, according to the Investing.com Fed Rate Monitor Tool.

Fed Chair Powell will hold what will be a closely watched press conference shortly after the release of the Fed's statement as investors look for fresh clues on how he views inflation trends and the economy and how that will impact the pace of monetary policy tightening.

Powell, in a speech at an economic summit in Jackson Hole, Wyoming last week, said policymakers would "proceed carefully as we decide whether to tighten further," but also made clear that the central bank has not yet concluded that its benchmark interest rate is high enough to be sure that inflation returns to the 2% target.

Prediction:

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.