- October’s history suggests a potential Bitcoin rally ahead.

- Positive on-chain metrics are fueling bullish sentiment.

- Political developments could improve the crypto's market outlook.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Bitcoin investors are on the lookout for any signs of a potential rally, especially amid "Uptober." This month has historically favored the world's leading cryptocurrency, and this year might be no different.

With the crypto breaking back above $60,000 followed by a move above $65,000 after a prolonged period of consolidation, investors are wondering about the potential for a continued uptrend.

With that in mind, here are three compelling reasons why this bullish momentum could stick around.

1. Bullish Sentiment Fuels Market Activity

Since the all-time highs reached in March, Bitcoin has navigated a broad consolidation phase, but last week marked a significant shift. The bulls roared back, pushing the price above the crucial $60,000 mark.

Historical data backs this up; October has seen positive performance in 9 out of the last 12 years, reinforcing expectations for this month.

Additionally, news that the bankrupt Mt. Gox exchange has postponed creditor repayments for another year alleviates fears of a potential sell-off, creating a more favorable environment for buyers.

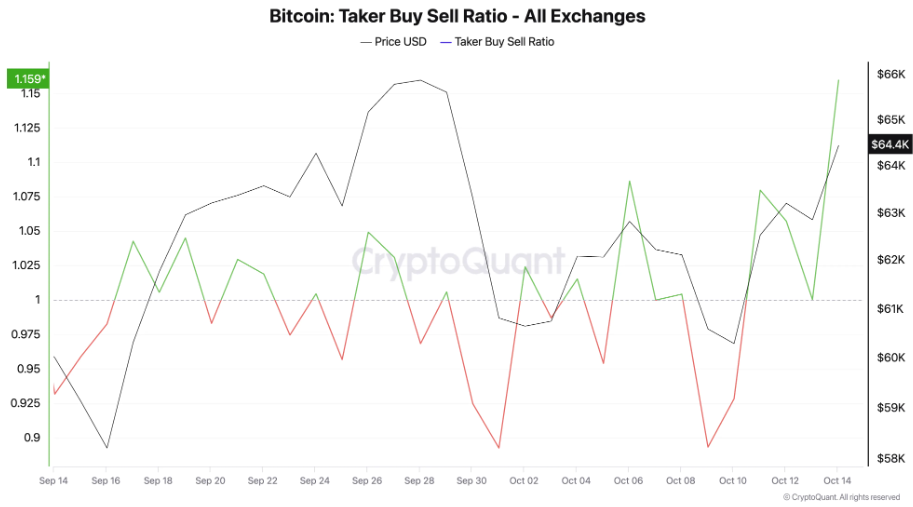

2. Positive On-Chain Signals Bolster Confidence

On-chain metrics paint an encouraging picture for Bitcoin traders. Recently, Bitcoin ETFs recorded a substantial net inflow of $253 million—the highest in over two weeks.

This influx indicates growing institutional interest, which typically signals confidence in price appreciation.

Source: CryptoQuant

Conversely, new deposits on trading exchanges dropped to weekly lows of under 41,000 coins, suggesting that traders may be more inclined to hold onto their assets rather than sell.

This decrease in supply on exchanges supports a bullish narrative, as fewer available coins could drive prices higher.

3. Political Developments Favor the Crypto

As the US presidential election approaches, candidates are increasingly vocal about their stance on cryptocurrencies.

Donald Trump has expressed support for digital currencies, advocating for Bitcoin to be part of the country’s strategic foreign exchange reserves.

This potential shift positions the US as a significant demand player in the cryptocurrency market. Meanwhile, Kamala Harris is also addressing the crypto space, proposing clear regulations that could legitimize and stabilize the market long-term.

While some of her proposals may initially seem unfriendly, the overall direction toward regulation could ultimately foster a more robust market environment.

Bitcoin: Technical Outlook

Bitcoin has demonstrated resilience in recent months, with attempts to dip below $50,000 consistently met by strong demand. This behavior has led to the formation of a saucer pattern—a technical indicator that typically signals future price increases.

Currently, traders are eyeing the supply zone of around $70,000 as the next target. If Bitcoin breaks through this level, it could set the stage for another assault on its historical highs.

In conclusion, with historical trends, positive on-chain signals, and supportive political developments, Bitcoin traders have plenty of reasons to stay optimistic.

As the market evolves, keeping a close eye on these factors could prove crucial for anyone looking to capitalize on this bullish momentum.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.