- High-quality companies with sustainable dividend payouts provide income safety to long-term investors

- Canada’s largest telecom operator, BCE is looking quite attractive if you’re planning to invest in a stable, less volatile stock

- Tech giant Texas Instruments is another solid name to add to your income portfolio

- Yield: 6.34%

- Quarterly Payout: $0.695

- Market Cap: $40 billion

- Yield: 3.55%

- Quarterly Payout: $0.88

- Market Cap: $419 Billion

- Yield: 2.96%

- Quarterly Payout: $1.24

- Market Cap: $153 billion

If I had to choose just one asset class to park my retirement savings, I would definitely go with large-cap dividend-paying stocks. These companies have strong business models, thus generating regular and secure cashflows for their shareholders in the long run.

Investing in such companies makes more sense in today’s challenging economic environment when investors face multiple threats to their portfolios in the shape of stubbornly high inflation, rapidly rising interest rates, and a slowing economy.

High-quality companies with above-average sustainable dividend payouts may provide some insulation from market volatility and prolonged uncertainty. Their strong balance sheets, essential products and services, and large global footprint help give investors considerable annualized returns. Below, I’ve identified three such stocks:

1. BCE

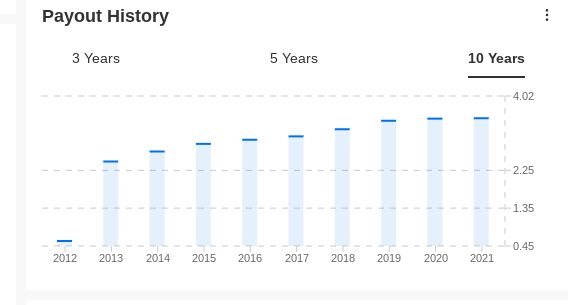

Canada’s largest telecom operator, BCE (NYSE:BCE) is looking quite attractive if you’re planning to invest in a stable, less volatile stock. Its dividend yield rose above 6% during the past week, reaching close to its highest level over the past ten years.

High yields are often considered a risk sign as investors seek more premiums to hold stock. But that isn’t the case when it comes to Canada’s largest telecom operator.

Source: InvestingPro

History tells us that those investors who bought BCE when its yield rose above average made excellent returns in the preceding months. Another reason to keep BCE in any long-term dividend portfolio is that the Toronto-based company is well-positioned to benefit from Canada’s growing population.

Maher Yaghi, an analyst at Bank of Nova Scotia, said in a note to clients last month that the net number of wireless customers among publicly-listed Canadian service providers grew by 450,000 in the second quarter. That was the best second-quarter growth for numbers going back 15 years.

The note adds:

“The combination of a pickup in population growth versus recent trends and a more open economy is likely leading to a better uptake in wireless services. Both of these factors are likely to have a sustainable impact on loading [or acquired customers] in the next few quarters.”

2. Exxon Mobil

Despite the inherent volatility associated with energy stocks and the industry’s cyclical nature, I strongly recommend adding some of the sector’s global players to your retirement portfolio.

One of the biggest uncertainties keeping some income investors on the sidelines is whether they can trust an energy company paying high dividends if oil prices drop in a downturn.

Exxon Mobil (NYSE:XOM), the U.S.'s largest integrated oil and gas company, is among more traditional income stocks, like insurance companies, banks, and cigarette makers, with higher quality resources and sustainable dividends. XOM belongs to the S&P 500’s 64-member dividend aristocrat group, a title they received after raising dividends for 25 straight years.

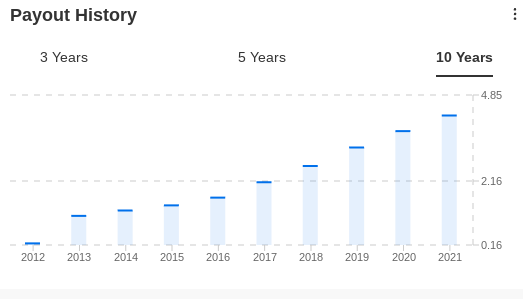

Source: InvestingPro

In the current environment, when energy markets are tight and oil prices are relatively higher, Exxon shows spending restraint and reduces its debt load. That capital discipline makes me confident that its current $0.88 a share quarterly dividend is safe and will continue to rise over the longer term.

Exxon, which surpassed its previous quarterly profit record by more than $3 billion in the second quarter, told investors in July that global energy supplies will remain tight and expensive for the foreseeable future.

The company may have seen the earnings peak in the current cycle after oil prices weakened in recent weeks, but its stock is a good long-term bet to earn growing dividends.

3. Texas Instruments

Tech giant Texas Instruments (NASDAQ:TXN), which produces electronic products, including chips that are used in many diversified industries, is another solid name to add to your income portfolio.

TXN gets the most significant chunk of its sales from industrial equipment manufacturers. It also produces semiconductors that go into everything from vehicles to home electronics and space hardware, helping it weather the downturn, which is hitting other chip stocks quite hard. The company gave an upbeat forecast for the current quarter in July, with sales and profit projections coming in ahead of Wall Street estimates.

Source: InvestingPro

But the biggest attraction for long-term investors is the company’s dividend program, which has been growing yearly for the past 19 years. Last month, the company authorized $15 billion in share repurchases and boosted its quarterly dividend by 8% to $1.24 a share.

Through its robust share buyback program, the Dallas, Texas-based TXN has reduced its outstanding shares by 47% since the end of 2004.

With its payout ratio of around 50%, TI is in a comfortable position to continue to hike its dividend going forward. In addition, the company’s long-term growth prospects are bright with the number of electronics being added to cars and machinery.

Disclosure: The author owns shares of BCE and Exxon. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.