- As markets digest the latest inflation data, bets on a 25 bp cut are rising.

- However, economic uncertainty still looms and could spark market volatility.

- Amid this, investors can consider buying solid dividend-paying stocks with good upside potential.

- You can discover winning stocks today by accessing the free Investing.com screener here!

U.S. inflation for August came in largely as expected, with the headline number easing to 2.5% from 2.9% in July.

However, a slightly higher-than-expected core CPI, which excludes food and energy, briefly rattled Wall Street but the S&P 500 pared its losses and ended the day higher.

The rebound was driven by a tech rally led by Nvidia (NASDAQ:NVDA), which helped offset fading hopes for a 50 bp interest rate cut from the Federal Reserve next week.

As investors digest the latest CPI data, expectations for a 25-basis point cut have increased, but economic uncertainty still looms.

In times like these, it’s wise to focus on quality stocks that haven’t yet reached their full potential due to temporary setbacks or cyclical factors.

How to Identify Dividend Paying Stocks With High Upside Potential?

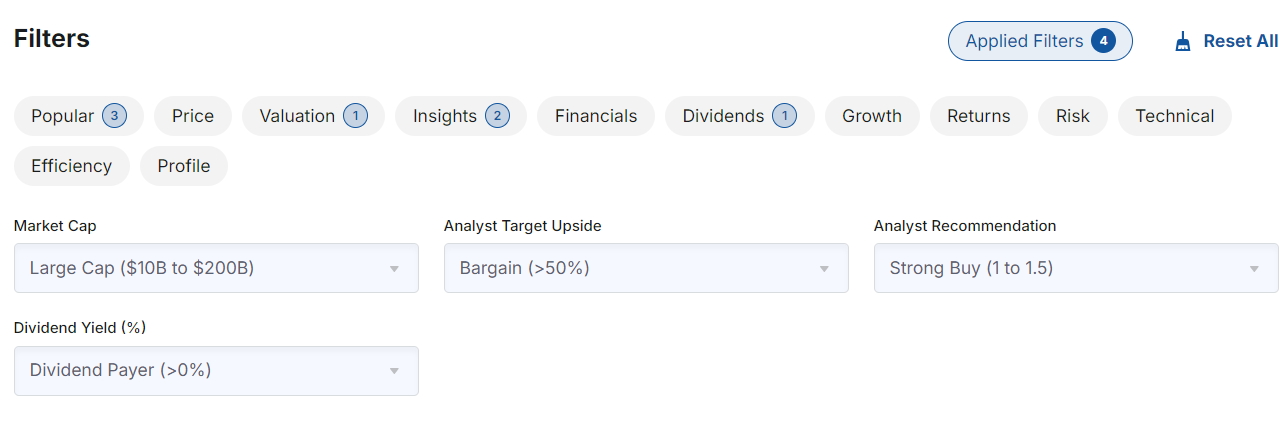

To pinpoint high-potential stocks, I used the investing.com screener to identify analyst favorites that boast significant upside and pay dividends. I set the following criteria:

- Market Capitalization: Large Cap ($10 billion to $200 billion)

- Analyst Target (NYSE:TGT) Rise: Bargain (>50%)

- Analyst Recommendations: Strong Buy (1 to 1.5)

- Dividend Yield: Dividend payer (>0%)

You can replicate this screener by clicking here.

This search yielded 17 stocks. To further refine the list and reduce risk from market volatility, I applied additional filters:

- Fair Value Uncertainty: Minimum/Medium

- Undervalued Fair Value Rise: 18% to 50%

Among those 17, I picked out the 3 stocks that could make great additions to your portfolio to prepare it for volatile times amid economic uncertainty.

Top 3 Discounted Stocks With Significant Upside Potential

Here are three standout stocks from the filtered list:

1. Tencent (HK:0700) Music Entertainment Group

Tencent Music Entertainment Group (NYSE:TME) is the leading entertainment platform in China, specializing in music streaming, online karaoke, and live streaming.

As of September 11, 2024, InvestingPro estimates a 35.8% upside from the current trading price. Analysts have set a target price of $14.69, about 52% higher than the $9.75, which was yesterday's closing price.

2. Schlumberger NV

Schlumberger NV (NYSE:SLB) is a global leader in energy technology, offering integrated solutions for the oil and gas industry.

InvestingPro’s Fair Value indicates a potential upside of 33.4%. Analysts have set a target price of $64.88, reflecting strong bullish sentiment among them.

3. NetEase

NetEase (NASDAQ:NTES) operates in China's communication services sector, providing online gaming, music streaming, smart learning, and content delivery.

Source: InvestingPro

According to InvestingPro, NetEase's Fair Value is $96.96, up 24% from its closing price of $78.17 yesterday. Analysts set a target price of $116.13, suggesting considerable upside potential.

InvestingPro users can replicate this stock selection or customize their own using the platform’s free screening features.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.