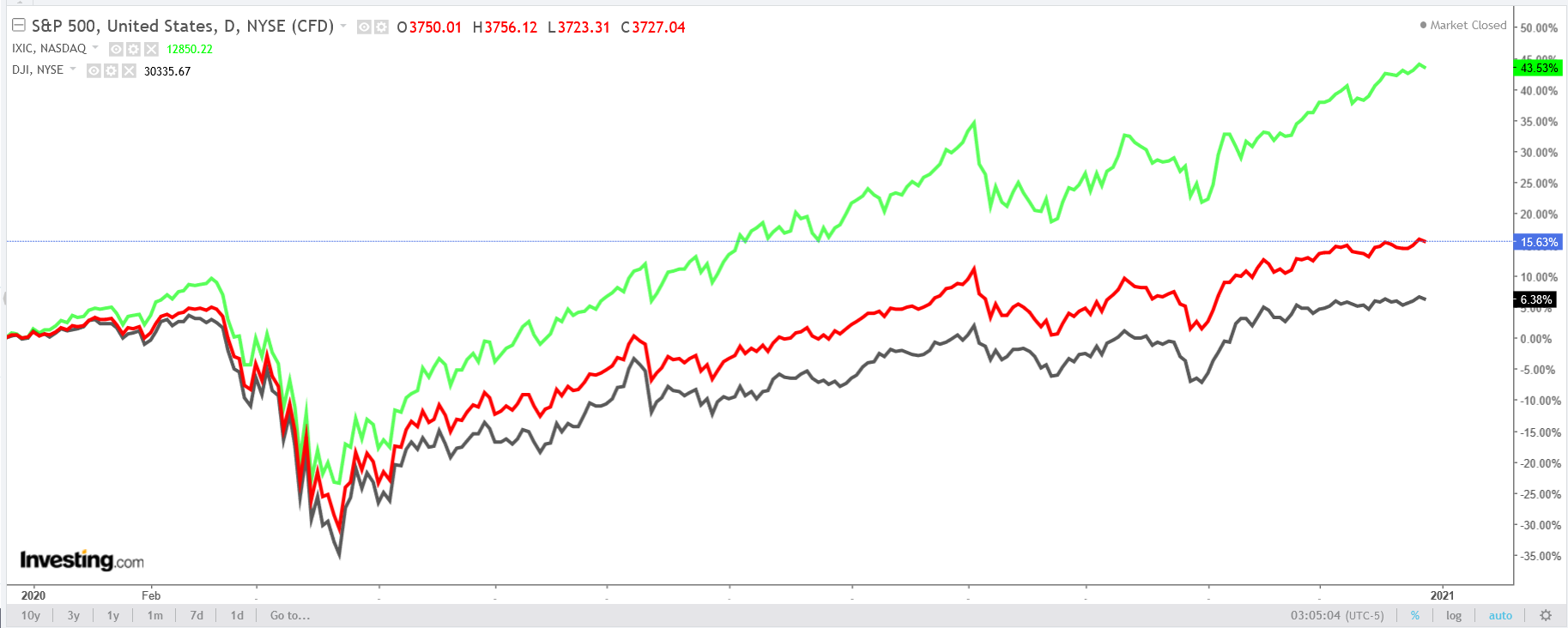

2020 was another powerful year for U.S. stocks across the board, with Wall Street’s major indexes all ending the year with surprisingly robust gains as the potent combination of fiscal stimulus, easy monetary policy, and vaccine rollouts helped alleviate concerns over the ongoing coronavirus health crisis.

The tech-heavy NASDAQ Composite surged 43% year-to-date, the benchmark S&P 500 climbed 15.4%, while the Dow 30 rose 6% in 2020.

Though there remain plenty of reasons to be cautious about the stock market in 2021, the three proven winners below are likely to keep providing shareholders with impressive returns in the year ahead.

1. Apple

Apple shares (NASDAQ:AAPL) soared in 2020 and are well-positioned to continue their march higher in 2021. The iPhone maker’s stock is on track to finish the year near its highest level on record, having soared nearly 84%, well outpacing the S&P 500.

AAPL stock—which started the year at $74.06—touched a new all-time high of $138.78 on Tuesday, before closing at $134.87.

The Cupertino, California-based tech giant, which approved a four-for-one stock split in August, has a market cap of $2.27 trillion, making it the most valuable company trading on the U.S. stock exchange.

What fueled the stock's 2020 rally? Signs of booming demand for the company's line of new 5G-enabled iPhone 12 models, which were released in October and immediately became the world's best-selling 5G phones.

Additionally, Wall Street was encouraged by expansion in its wearables segment, which include AirPods and the Apple Watch, as well as in its subscription services business, such as iTunes Music, Apple TV+ and Apple Arcade.

Looking ahead to 2021, Apple is expected to see continued momentum from robust iPhone sales. The iPhone maker plans to ramp up production of its phone models next year to the tune of 20% to 30%, according to reports.

The tech and consumer conglomerate is also poised to enjoy a further boost from growing speculation that it is planning to make an electric vehicle by 2024, which will include breakthrough battery technology and lidar sensors.

Taking all this into consideration, we expect Apple’s stock to continue its strong uptrend over the next 12 months.

2. Shopify

Widely considered one of the big winners of 2019, Shopify (NYSE:SHOP) stock enjoyed another year of blockbuster gains in 2020. Its shares surged nearly 195% as the booming e-commerce software platform saw higher-than-usual activity during the coronavirus health crisis.

SHOP, which started the year at $403.99, reached an all-time high of $1,285.00 on Dec. 22. It settled at $1,171.61 yesterday, giving the Ottawa-based e-commerce company a market cap of around $136.7 billion.

The high-flying Canadian-based company, which helps merchants set up online retail venues and manage their brands, reported positive earnings surprises for all four quarters of the year, easily surpassing Wall Street’s expectations for profit and sales.

In a sign of how well Shopify’s business performed during the pandemic, revenue soared 82% in the first nine months of 2020 when compared to the same timeframe in the preceding year.

In addition, gross merchandise volume (GMV), a key metric used in the e-commerce sector to measure transaction volumes, grew 46% in the first quarter, 119% in the second quarter, and 109% in the third quarter.

With consumers increasingly shifting their shopping habits online in the wake of the COVID-19 outbreak, we anticipate the positive trend in Shopify to continue in the new year thanks to its status as one of the leading names in the e-commerce sector.

3. Cloudflare

Cloudflare (NYSE:NET) set the market on fire this year, with shares of the content delivery network and web security firm rocketing an astonishing 347% in 2020.

The San Francisco, California-based tech company benefited from strong demand for its cloud-based networking and cybersecurity services due to the spike in internet traffic amid the ongoing COVID-19 pandemic.

NET stock, which began the year at $17.24, rallied to a record high of $88.75 on Dec. 22, ending at $76.40 last night, earning the cloud networking and security solution provider a valuation of $22.6 billion.

Cloudflare reported earnings and revenue which easily topped views in each quarter this year, reflecting the growing demand for its web security, content delivery, and enterprise networking services and solutions.

The network security firm said it had over 3.2 million customers as of the end of the third quarter, of which more than 100,000 are paying customers. Even more impressive, the number of large customers that spend at least $100,000 annually jumped to 736. The company also signed a deal with its first-ever $10 million-a-year customer.

Despite its monstrous run-up and stretched valuations, we expect Cloudflare’s stock to continue its remarkable performance in 2021 thanks to its emerging status as one of the leading names in the fast-growing cloud and edge computing sector.