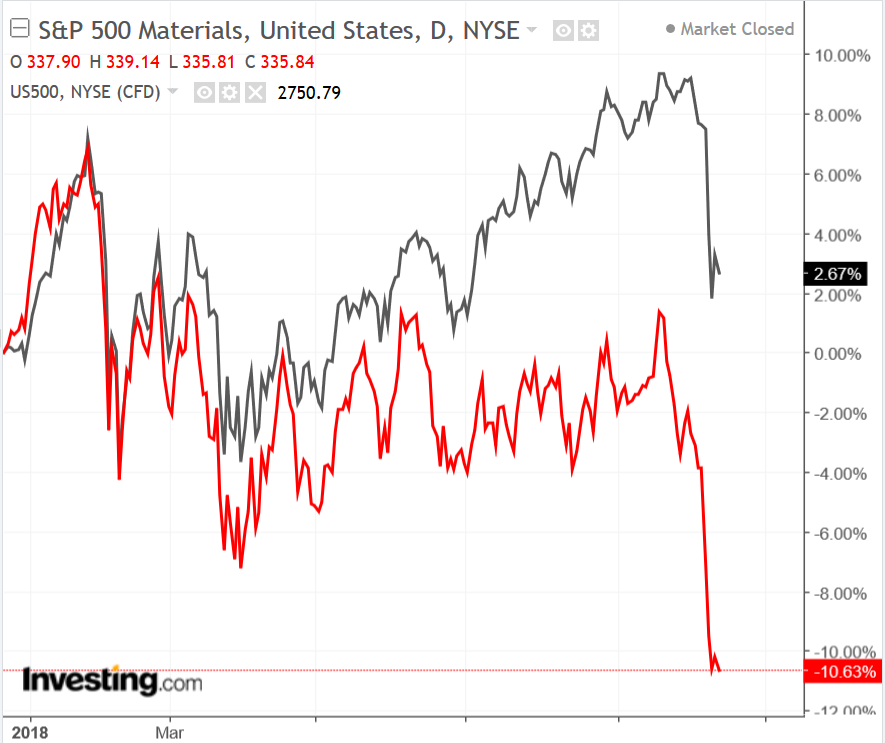

It's been a brutal year for basic materials shares. The S&P 500 Basic Materials Index is down roughly 11.3% year-to-date versus a 5.1% gain for the broader market as investors continue to punish the sector.

A number of factors have been blamed for the downbeat performance including sluggish raw material prices, softening demand in China, and pressure from a strong dollar. Accordingly, Q3 earnings results will need to be pretty robust in order for companies in the sector to have any hope of flipping that negative view.

Consensus expectations anticipate that the Materials sector will deliver the third highest year-over-year earnings growth of all eleven sectors at 25.0%, according to FactSet, outstripping the 19.1% earnings growth rate predicted for the S&P 500.

At the industry level, all four industries in the sector are predicted to report double-digit earnings growth: Metals & Mining (+46%), Construction Materials (+33%), Containers & Packaging (+29%), and Chemicals (+20%). Major basic materials companies on the S&P 500 are expected to start reporting Q3 results at the end of this week.

Below we highlight three of the most attractive names in the sector. Each is worth considering ahead of earnings.

1. Cleveland-Cliffs

Formerly known as Cliffs Natural Resources, Cleveland-Cliffs (NYSE:CLF) is the largest producer of iron ore pellets in North America. It is also a supplier of metallurgical coal to the global steel-making industry.

Cleveland-Cliffs operates six iron ore mines in Michigan, Minnesota and Eastern Canada, and three coking coal mines in West Virginia and Alabama. Cliffs also owns 80.4% of Portman, an iron ore mining company in Australia, serving the Asian iron ore markets with direct-shipping fines and lump ore.

The company is expected to report Q3 earnings per share (EPS) of $0.67 on revenue of $722.31 million when it releases results before the market opens on Friday, October 19. That would mark a 73% year-on-year EPS increase from the same quarter last year, when Cleveland-Cliffs posted much more modest earnings of $0.18 per share on revenue of $670.94 million.

Shares have been on a tear this year. The stock is up 63.4% since January, versus an 8.2% decline for the industry. Currently trading at $11.8 per share, Cleveland-Cliffs hit a new 52-week high of $13.10 on September 26. The stock looks poised for further capital appreciation, as it benefits from increasing demand for iron ore.

2. The Mosaic Company

Through it subsidiaries, the Mosaic Company (NYSE:MOS) produces and markets concentrated phosphate and potash crop nutrients worldwide. The company operates via three segments: Phosphates, Potash, and International Distribution.

Mosaic owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products. The company is scheduled to report Q3 2018 results on Monday, November 5 after the closing bell. Wall Street is looking for EPS of $0.64 cents on revenue of $2.92 billion.

For the same period last year, Mosaic posted earnings of $0.43 per share on revenue of $1.98 billion. Shares, which are currently trading at $33.13, have rallied 29.1% this year, driven by the company's upbeat earnings outlook, along with strong demand and pricing fundamentals for crop nutrients.

Healthy prospects from its acquisition of Vale’s Vale Fertilizantes business in early January should bode well for the stock going forward. The buyout turned Mosaic into one of the leading fertilizer manufacturing and distribution companies in Brazil, putting it in an excellent position to capitalize on the rapidly growing Brazilian agricultural market.

3. Ball Corporation

As the world's largest manufacturer of recyclable metal beverage and food containers, Ball Corporation (NYSE:BLL) is best known for its early production of glass jars, lids, and related products used for home canning. The company operates in five segments: Beverage Packaging, North and Central America; Beverage Packaging, South America; Beverage Packaging, Europe; Food and Aerosol Packaging; and Aerospace.

Ball is expected to report Q3 earnings per share (EPS) of $0.59 on revenue of $2.8 billion when it releases results during pre-market hours on Thursday, November 1. If the company meets expectations, it would represent a gain of around 12% from earnings per share of $0.52 in the same period a year earlier.

Thanks to its expanding geographic footprint, Ball shares, currently trading at $46.10, have gained 21.8% so far this year. However, declines in domestic beer consumption, a slowdown in Brazil and demand volatility in the EMEA (Europe, Middle East and Africa) region remain headwinds.