- Tech stocks may have faced a turbulent period, but opportunities for long-term growth remain.

- Analysts remain optimistic despite recent volatility, highlighting strong performers like Dell, Sony, and Marvell.

- In this article, we break down why these tech leaders are positioned to thrive amid market challenges.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

After a strong rally earlier this year, the technology sector stumbled as September kicked off, with many stocks experiencing sharp corrections.

This pullback has left some investors cautious, but it's also created opportunities for those looking for value in the long term.

Despite the recent volatility, several stocks in this sector are still showing remarkable potential. Analysts are overwhelmingly optimistic about these names, with most offering buy ratings and none marked as sell.

In the sections below, we’ll explore these top tech stocks, examining why they continue to stand out even in a challenging market environment.

1. Dell Technologies

Dell Technologies Inc (NYSE:DELL) has shown remarkable growth over the past year, far outperforming the S&P 500. The stock is up approximately 39% this year so far, outperforming the S&P 500 index's gain of 15.2%.

Dell's success is underpinned by solid demand for its AI-optimized servers. Orders and shipments of these servers have grown steadily, and this momentum continued in the second quarter of this year.

In addition, Dell's cooled AI servers and robust storage and networking solutions provide a solid foundation for long-term growth, implying that the momentum in its business is likely to be sustained in the coming years.

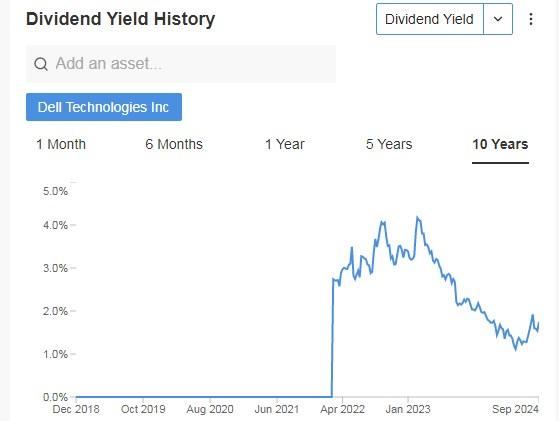

Its annual dividend yield is 1.75%.

Source: InvestingPro

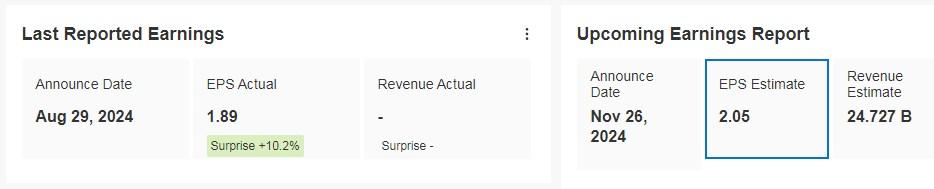

It will report its results for the quarter on November 26. Dell posted had an 83% increase in net income in the second quarter of its fiscal year, reaching $846 million. Its net income also showed a 9.1% growth.

Source: InvestingPro

Beyond AI, Dell will also benefit from a recovery in PC sales. By focusing on commercial PCs, high-end consumer models, and gaming devices, Dell is well-positioned to bolster its earnings and enhance shareholder value.

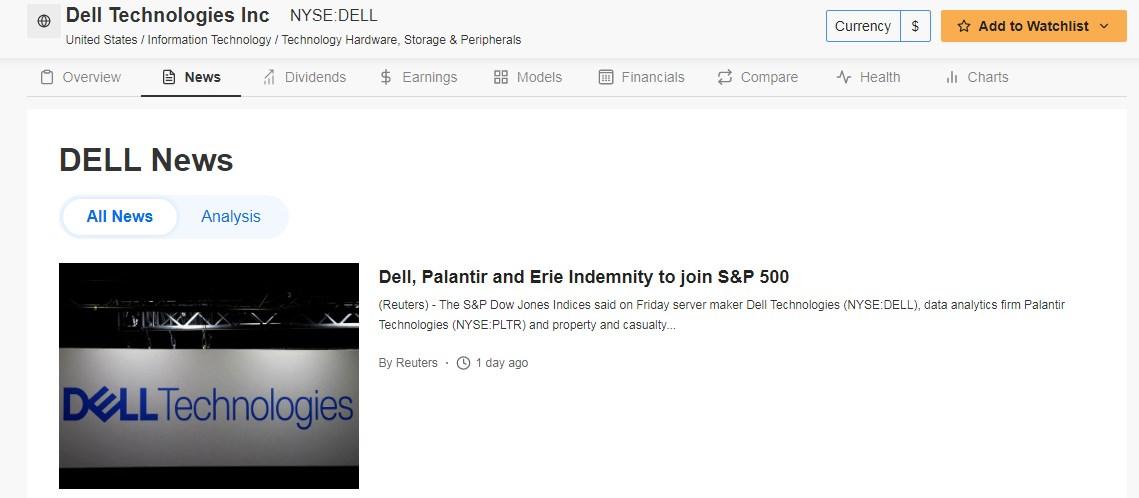

Dell (along with Palantir Technologies (NYSE:PLTR) and Erie Indemnity) will join the S&P 500 as part of its latest quarterly weighting change, replacing American Airlines (NASDAQ:AAL), Etsy (NASDAQ:ETSY) and Bio-Rad Laboratories Inc (NYSE:BIO). The changes will take effect before the opening bell on Sept. 23.

Source: InvestingPro

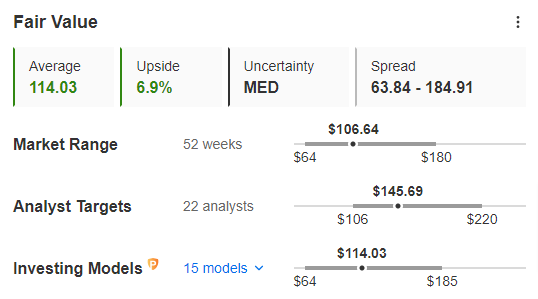

Currently, it is trading at a discount of 6.9%, as its price target on fundamentals would be at $114.

The market sees potential at $149.70.

Source: InvestingPro

2. Sony

Sony (NYSE:SONY) is a Japanese multinational company based in Tokyo (Japan) and one of the world's leading manufacturers of consumer electronics: audio and video, computers, photography, video games, and cell phones.

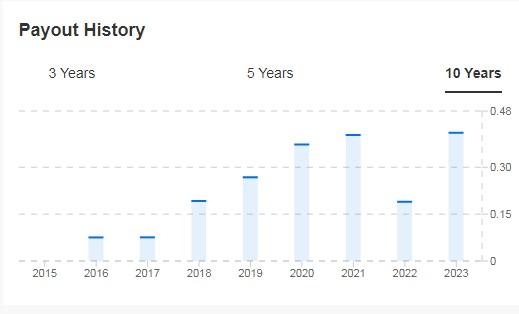

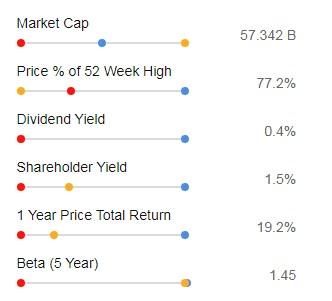

Its dividend yield is 0.46%.

Source: InvestingPro

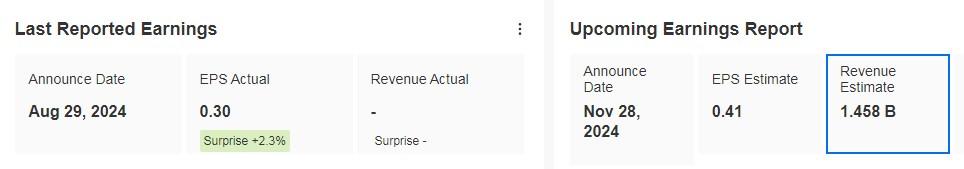

On November 8, we will know its income statement. The expected increase in profit until its fiscal year 2026 (the fiscal year in Japan starts in April) would be 14%.

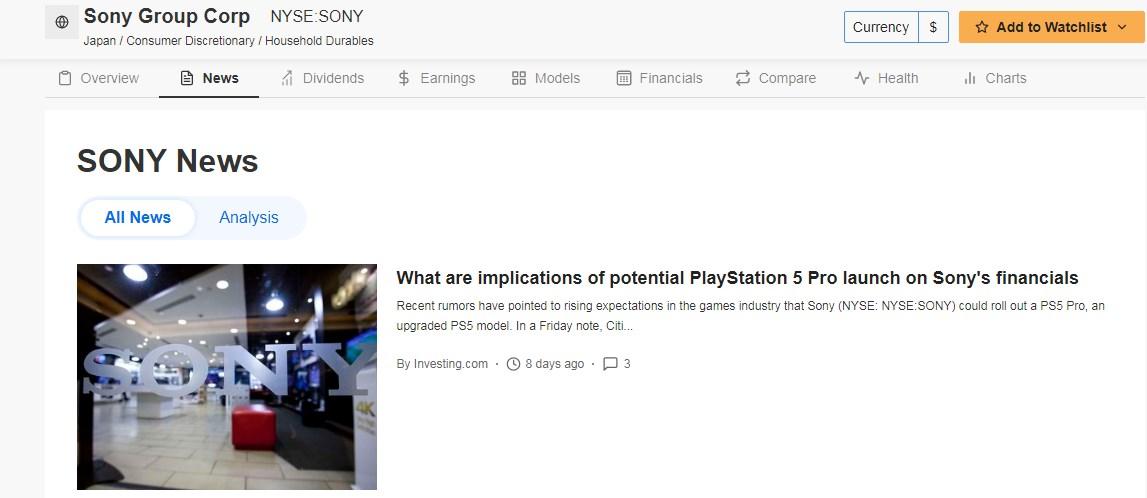

There have been strong rumors that Sony could launch a PS5 Pro, an improved model of the current PS5. If true, it could improve margins and increase profits to some extent, although it would depend on the cost of goods sold structure.

Three reasons would support the rumor being true:

- Launching a Pro model now, five years after the launch of the original PS5, aligns with a natural product cycle, especially since Sony launched the PS4 Pro three years after the PS4.

- Sony's decision to participate in the Tokyo Game Show in 2024, after a five-year absence, suggests that the company could be planning a significant announcement.

- The introduction of rival consoles could push Sony to counter with an improved PS5 model.

Source: InvestingPro

It features 22 ratings, of which 20 are buy, 2 are hold and none are sell.

The market gives it a potential at $115.48.

Source: InvestingPro

3. Marvell Technology

Marvell Technology (NASDAQ:MRVL) develops and produces semiconductors and related technology. Founded in 1995.

Its dividend yield is 0.36%.

It will release its results for the quarter on November 28. It expects 135% earnings growth in the three-year period.

Source: InvestingPro

Marvell Technology is at the forefront of a shift in the global data center landscape, driven by the rapid adoption of artificial intelligence technologies and is uniquely positioned to benefit from the growing demand for AI-driven data centers.

It also leads the electro-optics market with over 60% market share, which is interesting as this sector is expected to experience explosive growth of 150% by 2024 and 50% by 2025.

Its beta is 1.45, which means that its shares move in the same direction as the market but with greater volatility and movement.

Source: InvestingPro

The market sees potential for it at $92.16.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.