- Adobe stock is up over 15% so far in 2021 and hit a record high on Sept. 3.

- ADBE is a juggernaut among cloud-based software stocks

- Despite potential short-term volatility in the stock, buy-and-hold investors could regard any further short-term decline in ADBE shares as an opportune entry point

- iShares Expanded Tech-Software Sector ETF (NYSE:IGV): This fund is up 14.1% YTD, and ADBE stock’s weighting is 7.65%;

- 6 Meridian Quality Growth ETF (SXQG): The fund is up 6.2% since inception, and ADBE stock’s weighting is 8.56%;

- Invesco NASDAQ Internet ETF (NASDAQ:PNQI): The fund is up 6.1% YTD, and ADBE stock’s weighting is 7.35%;

- SPDR NYSE Technology ETF (NYSE:XNTK): The fund is up 12.2% YTD, and ADBE stock’s weighting is 3.00%.

Investors in the cloud-based software heavyweight Adobe Systems (NASDAQ:ADBE) have seen their shares gain 15.3% year-to-date and hit an all-time high (ATH) of $673.88 on Sept. 3.

Yet on Oct. 8, ADBE stock closed at $576.86, losing over 14% since that record high. The 52-week range for shares of Adobe has been $420.78-$673.88, while the company’s market capitalization stands at $274.47 billion.

Headquartered in San Jose, California, Adobe is well known for its range of creative software offerings, including Acrobat PDF, Creative Cloud, Photoshop, Illustrator, Lightroom, and Dreamweaver, among others. According to the sales intelligence group Datanyze:

“Adobe Photoshop has the top spot for best Graphics by market share. Followed by Adobe InDesign and Adobe Illustrator.”

The respective market share of each product is 46.48%, 28.62%, and 14.76%.

Recent years have seen many software companies transition from simply selling license-based products into becoming software-as-a-service (SaaS) companies that offer subscription models. And Wall Street loves such recurring revenue-based businesses.

The ‘on-demand’ software model is cloud-based, where companies like Adobe make their products available to users over the Internet. Industry research highlights:

“The global cloud computing market size is expected to reach USD 1,251.09 billion by 2028, registering a CAGR of 19.1% over the forecast period.”

As one of the software names at the forefront of this “digital transformation” through cloud, ADBE stock is widely followed. Readers might be interested to know that five years ago, in October 2016, Adobe shares were shy of $100.

Thus the compound annual growth rate (CAGR) has been close to 42%. In other words, the proverbial $1,000 invested in the company then would now be worth over $5,770.

What To Expect From ADBE Stock

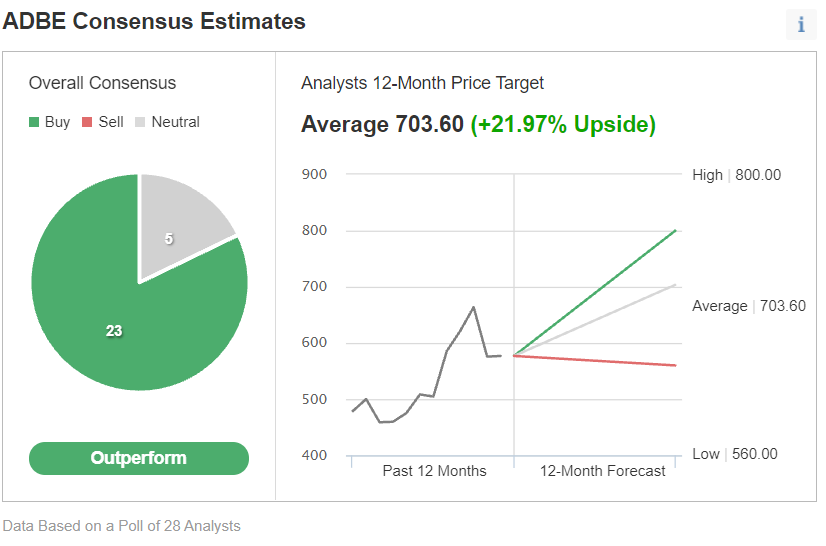

Among 28 analysts polled via Investing.com, Adobe stock has an ‘outperform' rating.

The shares have a 12-month price target of $703.60, implying an increase of about 22% from current levels. The 12-month price range currently stands between $560 and $800.

Trailing P/E, P/S and P/B ratios for ADBE stock stand at 47.6x, 18.18x and 19.05x, respectively. By comparison these ratios for another software giant Salesforce.com (NYSE:CRM) are 108.08x, 11.333x, and 4.8x. On the other hand, they are 23.57x, 5.32x, and 4,23x for the Germany-based SAP (NYSE:SAP).

Readers who watch technical charts might be interested to know that a number of ADBE's short- and intermediate-term oscillators are still cautioning investors. However, the long-term uptrend is still intact.

Meanwhile, October—which seasonally tends to be a volatile and typically weak month for equities—marks the start of the quarterly earnings season. Adobe is expected to report Q4 and FY2021 metrics on Dec. 16. Therefore, in the coming weeks, if broader markets and especially tech shares were to come under pressure, ADBE stock could possibly see further declines.

Our expectation is for ADBE stock to slide toward the $550 level, where it is likely to find relatively strong support. The shares then would likely trade sideways while it establishes a new base.

3 Possible Trades On Adobe

1. Buy ADBE Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in Adobe stock now.

On Oct. 8, ADBE stock closed at $576.86. Buy-and-hold investors should expect to keep this long position for several months while the stock first makes an attempt at the record high of $673.88, returning 16.8% from the current level. Then, the next level to watch would be analysts’ price target of $703.60. Investors should expect to hold this position for several months, if not multiple quarters.

Readers who plan to invest soon but are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With ADBE As A Main Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, those who do not want to commit capital to Adobe stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of such ETFs include:

3. Bear Put Spread

Readers who believe there could be more profit-taking in ADBE stock in the short run might consider initiating a bear put spread strategy. As it involves options, this set up will not be appropriate for all investors.

It might also be appropriate for long-term Adobe investors to use this strategy in conjunction with their long stock. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This trade requires a trader to have one long Adobe put with a higher strike price and one short Adobe put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Adobe shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the ADBE 21 January 2022 570-strike put option. This option is currently offered at $30.58. Thus, it would cost the trader $3,058 to own this put option, which expires in about three and a half months.

At the same time, the trader would sell another put option with a lower strike, like the ADBE 21 January 2022 550-strike put option. This option is currently offered at $23.05. Thus, the trader would receive $2,305 to sell this put option, which also expires in about four months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($30.58 - $23.05) X 100 = $753.00 (plus commissions).

This maximum loss of $753 could easily be realized if the position is held to expiry and both ADBE puts expire worthless. Both puts will expire worthless if the ADBE share price at expiration is above the strike price of the long put (higher strike), which is $570 at this point.

This trade’s potential profit is limited to the difference between the strike prices, i.e., ($570.00 - $550.00) X 100) minus the net cost of the spread (i.e., $753.00) plus commissions.

In our example, the difference between the strike prices is $20.00. Therefore, the profit potential is $2,000 - $753 = $1,247.

This trade would break even at $562.47 on the day of the expiry (excluding brokerage commissions).