Markets were turbulent in 2023 while generally trending higher. A big summer rally was given back in weeks during October, followed by a fast rebound, which brought the S&P 500 back to nearly all-time highs by the end of the year. However, most of the rally in 2023 had been thin, with gains being driven by what has been coined by the financial media as the Magnificent 7.

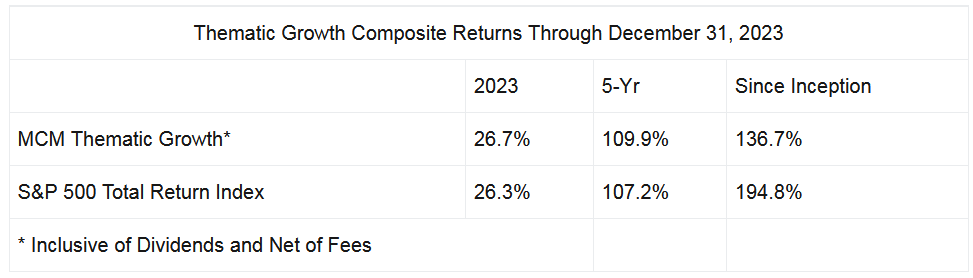

Fortunately, the Mott Capital Thematic Growth Composite has been a big beneficiary of the rally in mega-cap growth, owning Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), and Amazon (NASDAQ:AMZN), which have helped to push the composite higher in 2023 by 26.7%, including dividends and net of fees, compared to the S&P 500 Total Return Index gain of 26.3% over the same period.

The composite’s long-term approach to investing has helped generate returns over the S&P 500 Total Return Index during the past five years, with the composite rising by 109.9% versus a SPY return of 107.2%. Since its inception, the composite has risen 136.7% versus an S&P 500 Total Return Index of 194.8%.

This past year, Mott Capital Management remained committed to the long-term thematic growth strategy but has focused mostly on holding on to higher quality stocks while carrying a large cash buffer to hedge against downside risks to the market.

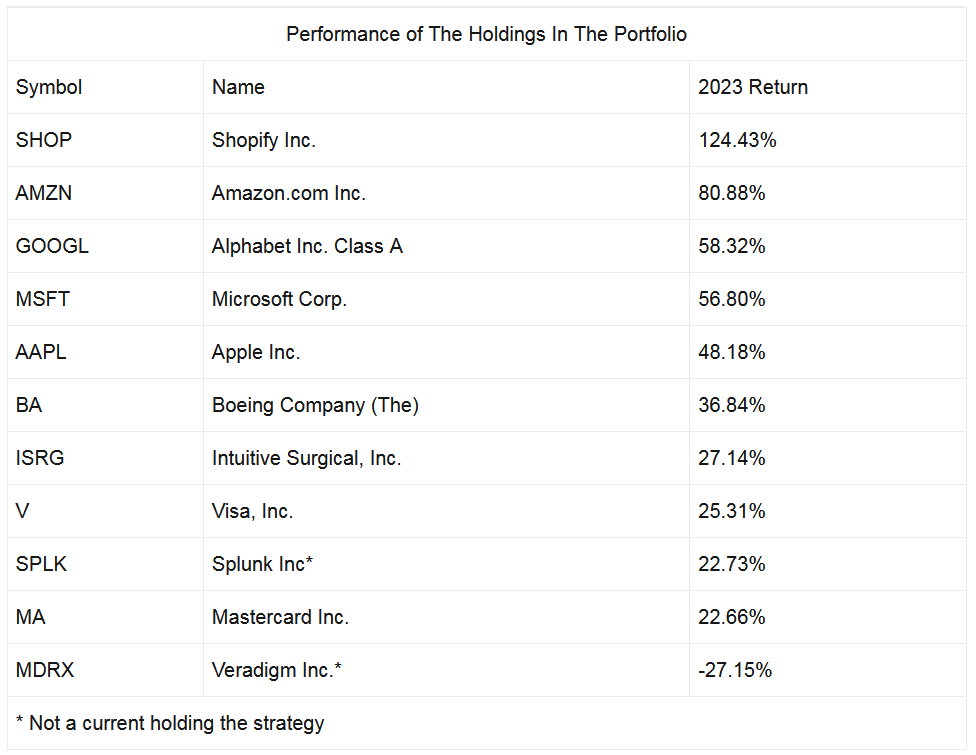

The table above shows the performance of all the strategies’ holdings over the year. However, Splunk (NASDAQ:SPLK) and Veradigm were removed from the portfolio at differing points in 2023 to raise more cash to hedge against broader market risks.

Stocks Appear Expensive

The concern for downside risks remains because rates have surged in 2023, with the 10-year Treasury Note climbing to around 4% by the end of 2023 from around 3.7% at the start of the year.

But because the S&P 500 rallied, the current earnings yield for the S&P 500 fell to 4.51% from around 5.40% at the start of 2023. This resulted in the spread between the earnings yield of the S&P 500 and the 10-year Treasury to contract to just 41 bps, which is the narrowest spread since 2002, suggesting stocks are expensive relative to bonds.

Betting on Rate Cuts

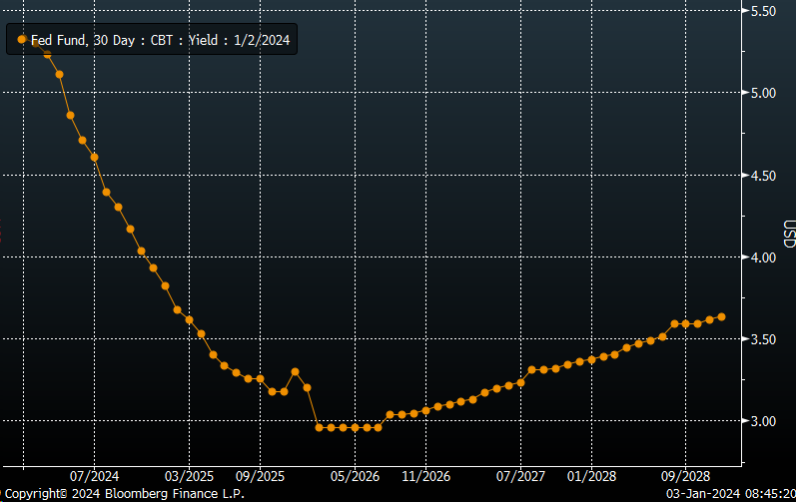

Additionally, the market appears to be betting that the Fed will aggressively cut interest rates in 2024, given the shape of the Fed Funds Futures curve, which shows the Fed Funds rate falling to around 3.9% by December 2024.

However, the latest Summary of Economic Projections from the FOMC in December showed the Fed expected the overnight rate to be around 4.6% at the end of 2024. The danger is that if that market has bet wrong on rate cuts and the Fed isn’t as aggressive in cutting rates as the market is pricing, it could result in rates moving up and stocks moving down in the first quarter of 2024.

Mott Capital thinks that the market is betting wrong on Fed rate cuts in 2024 and that the Fed will deliver fewer cuts than the market has priced in.

Waiting For More Reasonable Prices

It isn’t to say that the strategy is outright bearish on the market or the economy. But it does mean that one needs to be careful not only of what they own but also of not chasing markets higher and paying valuations that make little sense given the present uncertainty and interest rate risk. Because if the Fed doesn’t deliver on rate cuts, the stock market will likely see a steep drawdown.

In 2022, the strategy used drawdowns to buy positions in Intuitive Surgical (NASDAQ:ISRG), Shopify (NYSE:SHOP), Boeing (NYSE:BA), and Amazon because, at the time, the valuations seemed to make sense, while their longer-term growth potential seemed strong.

Additionally, the market sentiment had just turned unfavorable due to the fear of how high-interest rates may have to climb in a world with high inflation. Those bets paid off in 2023.

Additionally, the portfolio still owns positions in Visa (NYSE:V) and Mastercard (NYSE:MA) because these two positions seem like good inflation hedges since, as the prices rise, Mastercard and Visa fees rise as well.

While the invested strategy size is smaller at roughly 60 to 65% invested in equities than what it would normally be in a better outlook, the higher cash levels of around 35 to 40% should act to hedge the strategy against downside risk.

But, more importantly, it should allow the strategy to buy additional names when the time and valuations make more sense, especially given the long-term nature of the strategy, as done in 2022.