- Stocks on Wall Street are in rally mode after the Fed stuck to its dovish rate cut outlook.

- Tech shares are expected to extend their march higher as investors bet the sector stands to gain the most from lower rates.

- As such, investors should consider adding these two under-the-radar stocks to their portfolio.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

- 2024 Year-To-Date: +15.7%

- Market Cap: $17.5 Billion

- Fair Value Upside: +17.9%

- 2024 Year-To-Date: +6%

- Market Cap: $34.3 Billion

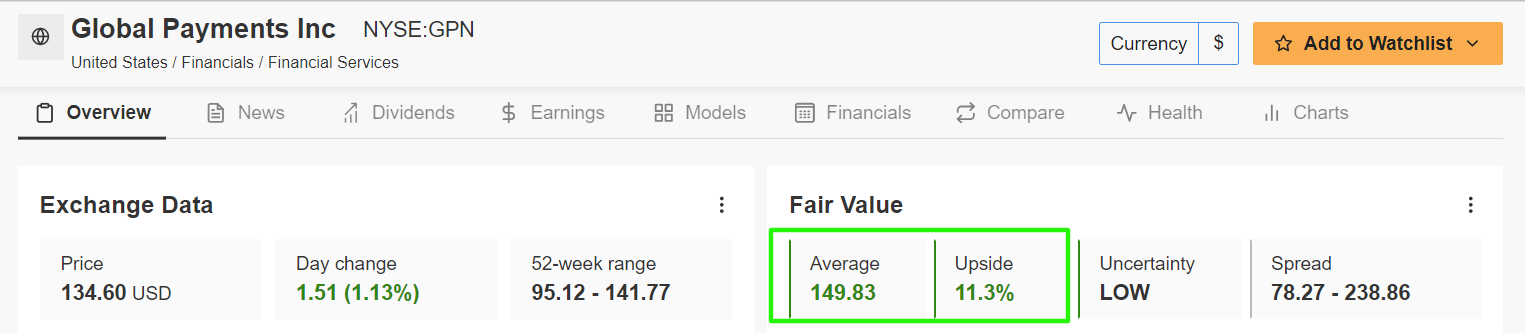

- Fair Value Upside: +11.3%

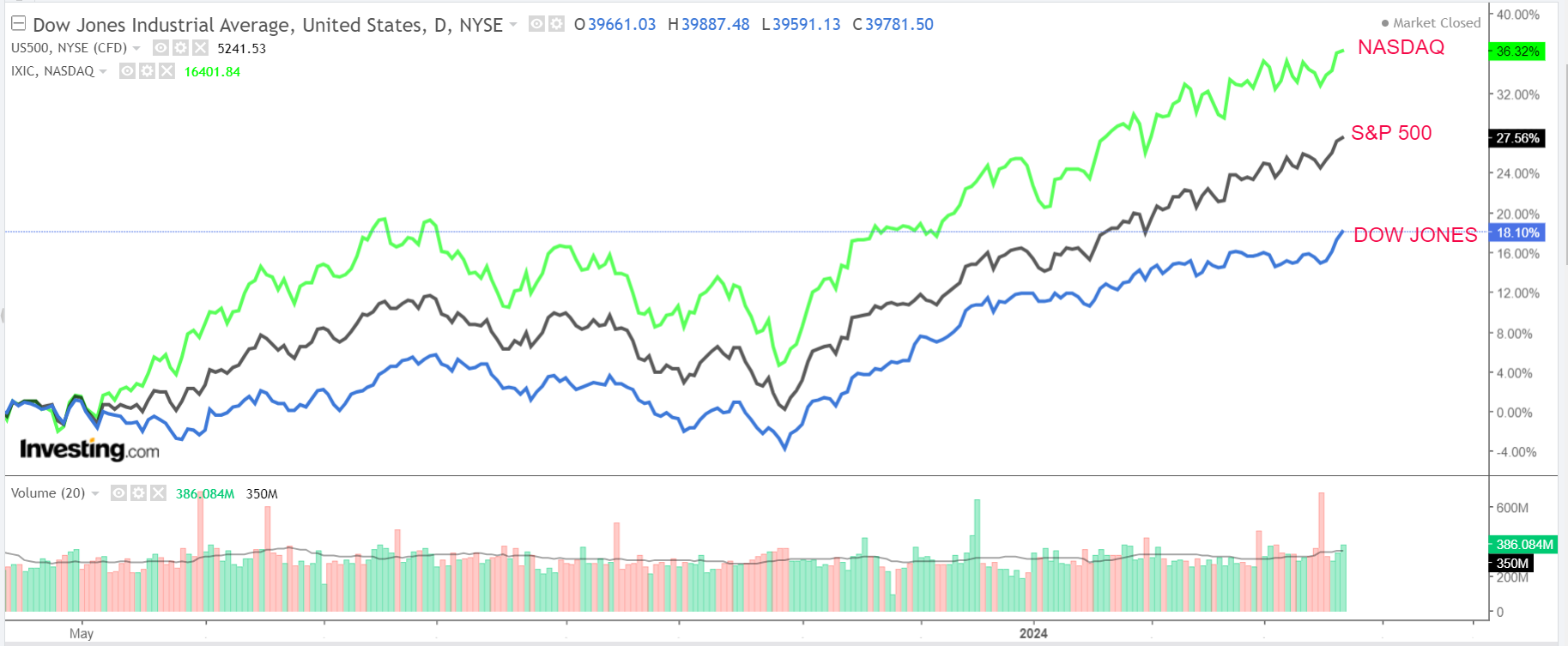

Stocks on Wall Street rallied sharply this week, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all notching new record highs. Source: Investing.com

Source: Investing.com

Investors piled into the three major indexes after the Federal Reserve eased investor jitters by keeping interest rates unchanged and indicating they still expect three rate cuts before the end of 2024.

Technology stocks responsible for powering the recent market rally extended their march higher as investors bet the sector stands to gain the most from lower rates.

Against this backdrop, beating on the right companies may mark the main be the difference between scoring great profits or underperforming.

That's where our predictive AI stock-picking tool can prove a game-changer. For less than $9 a month, it will give you the best companies in the market on a monthly basis for sustained market outperformance.

Subscribe now and never miss another bull market again by not knowing which stocks to buy!

Now, using the power of InvestingPro, let's dive into two great buys at the moment, namely Okta (NASDAQ:OKTA) and Global Payments (NYSE:GPN) - both of which stand out as promising candidates for long-term success and value creation.

1. Okta

Widely considered as one of the leaders in the fast-growing identity and access management space, Okta is a solid pick going forward as it looks to be one of the main beneficiaries of the continuing growth in cybersecurity spending in today’s digital landscape.

Shares have been on a major uptrend since the start of the year, gaining about 16% so far in 2024, as the security software maker benefits from strong demand from large enterprises for its cloud-based identity and access management tools.

Nonetheless, OKTA remains a far cry from its record high of $294 touched in February 2021. At current valuations, Okta has a market cap of $17.5 billion, a steep discount to its peak valuation of $42 billion.

Source: Investing.com

As businesses continue to adopt cloud-based technologies and remote work becomes the norm, the need for robust identity and access management solutions will only increase.

Okta's strong customer base and innovative product offerings position it for continued growth in this space.

Furthermore, the San Francisco, California-based company leverages AI and machine learning algorithms to enhance security protocols and streamline user authentication as it seeks to bolster its cloud-based offerings.

In a sign of how well Okta’s business has performed in recent months, the identity-and-access management specialist reported fourth-quarter financial results that blew past Wall Street’s earnings and revenue estimates on February 28.

It also provided an upbeat outlook for the months ahead.

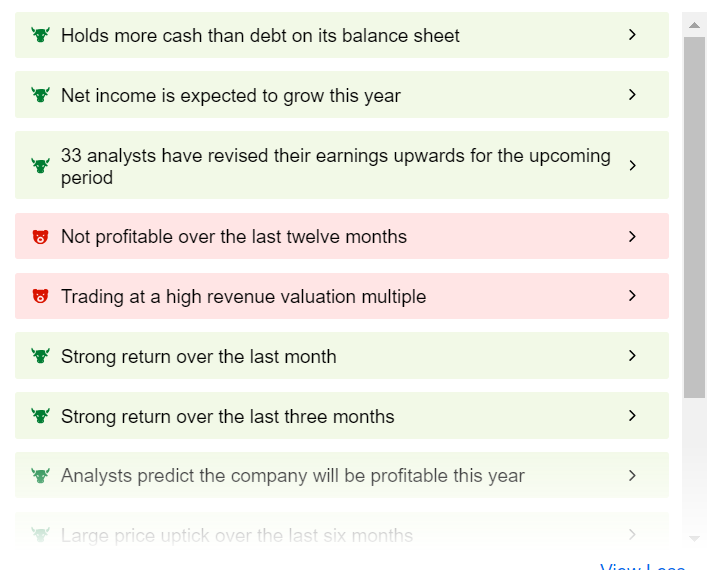

ProTips Headwinds: As ProTips points out, Okta’s share profile is fairly positive, with several bullish tailwinds working in its favor, including strong earnings prospects, and a robust profitability outlook.

Source: InvestingPro

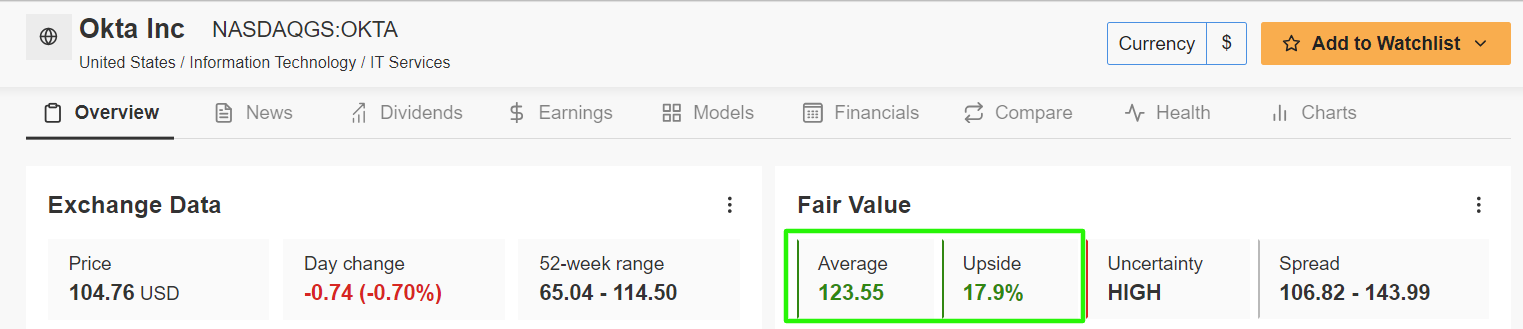

‘Fair Value’ Price Target (NYSE:TGT): It is worth noting that the quantitative models in InvestingPro point to a gain of 17.9% in OKTA stock from Thursday’s closing price of $104.76.

Source: InvestingPro

That would bring shares closer to their ‘Fair Value’ price target of $123.55.

2. Global Payments

Global Payments (NYSE:GPN) represents a compelling investment opportunity amid the prevailing dovish stance of the Federal Reserve, thanks to its strong fundamentals, favorable growth prospects, and promising valuation metrics.

As one of the leading payment processors worldwide, Global Payments boasts a vast clientele of approximately 4 million merchants and businesses spanning various sectors and industries. The company offers a comprehensive suite of payment processing services, including card acceptance, digital payments, e-commerce solutions, and more.

The Atlanta, Georgia-based payment technology and software solutions provider has seen its stock gain 6% since the start of 2024.

Source: Investing.com

As businesses seek to streamline their payment processes and adapt to evolving consumer behaviors, Global Payments' innovative solutions offer a compelling value proposition.

Furthermore, the fintech firm maintains a strong financial position, positioning it well to capitalize on emerging opportunities and navigate potential challenges in the dynamic payment processing landscape.

Global Payments’ fourth quarter update released last month made it clear that the company is executing well amid the current economic backdrop, with revenue rising 8% year-over-year to reach $2.19 billion.

Moreover, the company approved an increase in its share repurchase authorization program to $2 billion.

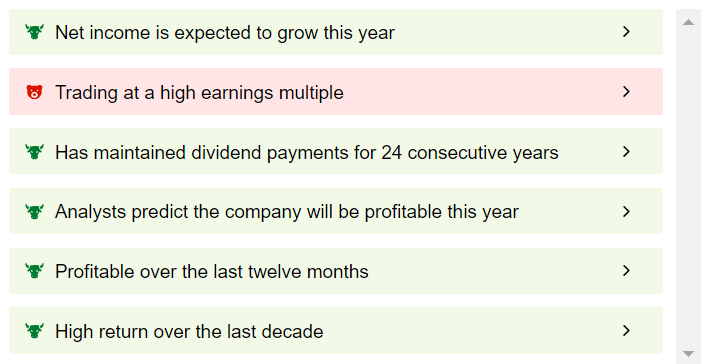

ProTips Headwinds: InvestingPro’s ProTips highlights several positive trends Global Payments has working in its favor, including rising net income prospects, improved profitability trends, and a healthy growth outlook.

Source: InvestingPro

ProTips also mentions that Global Payments has maintained its annual dividend payout for 24 consecutive years thanks to ample free cash flow levels.

‘Fair Value’ Price Target: According to InvestingPro, GPN's ‘Fair Value’ price target implies upside potential of 11.3%.

Source: InvestingPro

Such a move would take shares to $149.83 from last night’s closing price of $134.60.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.