- Central bank decisions from the RBA, BOE, and SNB will dominate the forex market this week.

- Traders should watch for potential volatility, particularly in USD/CHF and AUD/USD pairs.

- With both pairs under bearish pressure, we will try and analyze the technical of each pair.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The upcoming week presents a compelling opportunity for active traders, particularly in the forex market. Central bank decisions from the Bank of Australia (RBA), Bank of England (BOE), and Swiss National Bank (SNB) will be the primary focus.

While the market anticipates the RBA and BOE to maintain current interest rates, the RBA could deviate if inflation remains stubbornly high. The SNB, known for its recent surprise rate hike, adds an element of uncertainty that could trigger volatility.

Currency pairs like USD/CHF and AUD/USD are particularly susceptible to these potential moves, making technical analysis a valuable tool for preparing a trading strategy.

RBA to Hold Rates Steady

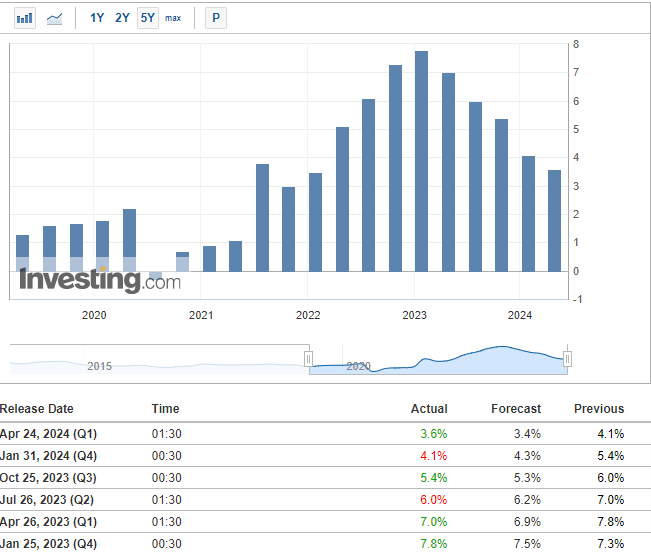

The RBA will be the first to announce its decision tomorrow, with the consensus expecting rates to remain at 4.35%. However, Australian officials remain vigilant and prepared to implement rate hikes if needed to counteract persistent inflationary pressures.

Australia's quarterly inflation readings, last released in April, indicated a decline, though not as steep as anticipated by market consensus.

Next in line is the Swiss National Bank, where we are set to learn the successor to the outgoing Chairman Thomas Jordan. Martin Schlegl, the current vice chairman and Jordan's longtime colleague, is the frontrunner for the position.

Schlegl's appointment would likely signal a continuation of the SNB's policy of swiftly responding to macroeconomic changes, including unanticipated interest rate adjustments.

Later on Thursday, the Bank of England (BOE) will announce its policy decision. The market anticipates the BOE's first interest rate cut to occur after the July general election, likely in August or September, with a reduction of 25 basis points.

AUD/USD and USD/CHF - Technical Overview and Trading Ideas

The USD/CHF currency pair is currently in a local consolidation phase, with a strong support area around the 0.8900 price level.

The supply side continues to exert pressure on this support level. Should a breakthrough occur, it could pave the way for a decline towards the 0.8740 target.

Conversely, if the pair manages to break above the 0.9000 level, this bearish scenario will be negated, indicating a potential shift in market sentiment.

Meanwhile, the AUD/USD pair has been moving in a broader sideways trend since early May. The supply side appears poised to retest the lower band, which lies just below the 0.6600 level.

If sellers manage to breach this level, attention should shift to the demand zone around 0.6480. This scenario is more likely if the Reserve Bank of Australia (RBA) maintains its current interest rate stance and refrains from raising rates.

Both currency pairs are at critical junctures, and their movements will be significantly influenced by upcoming central bank decisions and economic data releases. Traders should closely monitor these levels and be prepared for potential market volatility.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.