- The environment of fear and risk aversion has made many quality dividend stocks much cheaper

- For long-term investors, who are building a portfolio that generates passive income, this is a good time to put their money to work

- Stocks with high cash returns outperform in periods of slowing economic growth

It's becoming growingly challenging for investors to pick winners in this market amid fears that a string of aggressive rate hikes by the Federal Reserve will lead the US economy into a recession.

But there is a silver lining. The environment of fear and risk aversion has made many quality stocks with solid fundamentals and sustainable dividends much cheaper.

Thus, for long-term investors interested in building a portfolio that generates healthy passive income, this is an excellent time to put their money to work. If you fall in this group, I recommend finding a few quality dividend-growth stocks to keep them over the long run.

According to a note by Goldman Sachs this week, stocks with high cash returns outperform in periods of slowing economic growth. Goldman's chief U.S. equity strategist, David Kostin, said in a note Monday:

"In the mid-1970s, high dividend yield stocks struggled to compete with rising cash yields and lagged the S&P 500. By contrast, companies with the highest dividend growth outperformed even as bond yields climbed as high as 17%."

Keeping this theme in mind, below are two such stocks that have weakened considerably this year and have the potential to rebound:

1. Verizon Communications

At first look, Verizon Communications (NYSE:VZ) doesn't seem like a safe dividend bet. Its stock is under constant pressure as the largest U.S. wireless carrier struggles to win subscribers in a competitive telecom market where players offer deep discounts to win new business.

The New York-based company reported only adding 8,000 monthly wireless phone subscribers in the third quarter, well below analysts' predictions. In contrast, Its rival AT&T (NYSE:T) reported strong profit and subscriber growth last month.

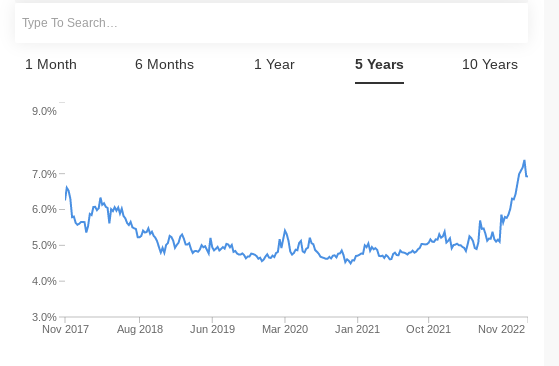

But this weakness is temporary, in my view, and offers long-term investors an attractive opportunity to lock in a 7% dividend yield from the company, which has a consistent track record of paying dividends. Large institutional investors looking for value in a market where it's hard to find yield have bought VZ stock in recent months.

Source: InvestingPro

Funds run by Capital Group, Federated Hermes Inc., Invesco Ltd., GQG Partners, and other firms snapped up millions of Verizon shares in the three months that ended June 30, according to Bloomberg data.

There are also signs that the worst in VZ stock, which has fallen 27% this year, is behind us. The company has introduced many new plans that have increased foot traffic in stores in the past few months.

Fee increases implemented earlier in the year are expected to boost revenue by $1 billion in the second half. The company says it plans a cost-savings program that will reduce annual expenses between $2 billion and $3 billion by 2025.

VZ pays a $0.6525 per share dividend, which translates into a 6.9% annual yield at the current market price. The company has raised its dividend for the 16th straight year.

2. FedEx Corp

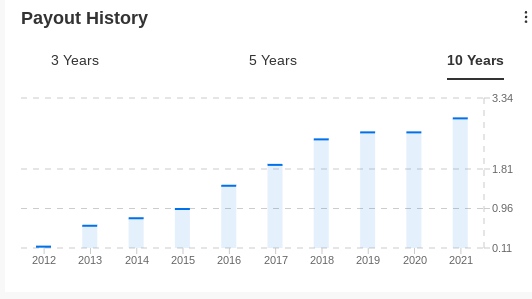

Global freight and logistics giant FedEx (NYSE:FDX) is another dividend-growth stock offering value to income-seeking investors after its 40% plunge this year. The company pays $1.15 a share quarterly payout, with an annual yield reaching nearly 3%.

As part of a deal with investment management firm D.E. Shaw this summer, the Memphis, Tennessee-based giant hiked its quarterly dividend by more than 50%, restructured its board of directors, and promised to cut costs to fight the highest inflation rate in the U.S. in 40 years.

Source: InvestingPro

As the world's largest cargo airline and a major provider of parcel delivery services, FedEx's business touches many industries, from consumer goods to pharmaceuticals. For that, the company's performance is usually a proxy of how the broader economy is doing.

There is no doubt that the current harsh economic environment and the cost pressures have damaged FedEx's margins. Still, the company generates enough cash flows to cover its $1.15 per share quarterly payout rather comfortably.

In the preceding quarter, FedEx generated a free cash flow of about $1 billion, sufficient enough to cover nearly $200 million of dividend bills for the quarter.

With the stock trading at the same level as in January 2020—prior to the pandemic—, I don't see a major downside risk from here. And if the company's turnaround efforts succeed, long-term investors could make hefty capital gains in addition to dividend growth.

Disclosure: At the time of writing, the author doesn't have a position in stocks mentioned in this article. The views expressed in this article are solely the author's opinion and should not be taken as investment advice.