Exchange-traded funds (ETFs) have become popular investing vehicles in recent years. As of October, there were close to 2,700 ETFs listed on US exchanges with almost $7 trillion under management. A year ago, that number was less than 2,220.

Today, we introduce two thematic funds that have been recently listed. Interested readers should note that these funds are small and without any substantial trading history. Therefore, potential investors should do further due diligence before hitting the ‘buy’ button.

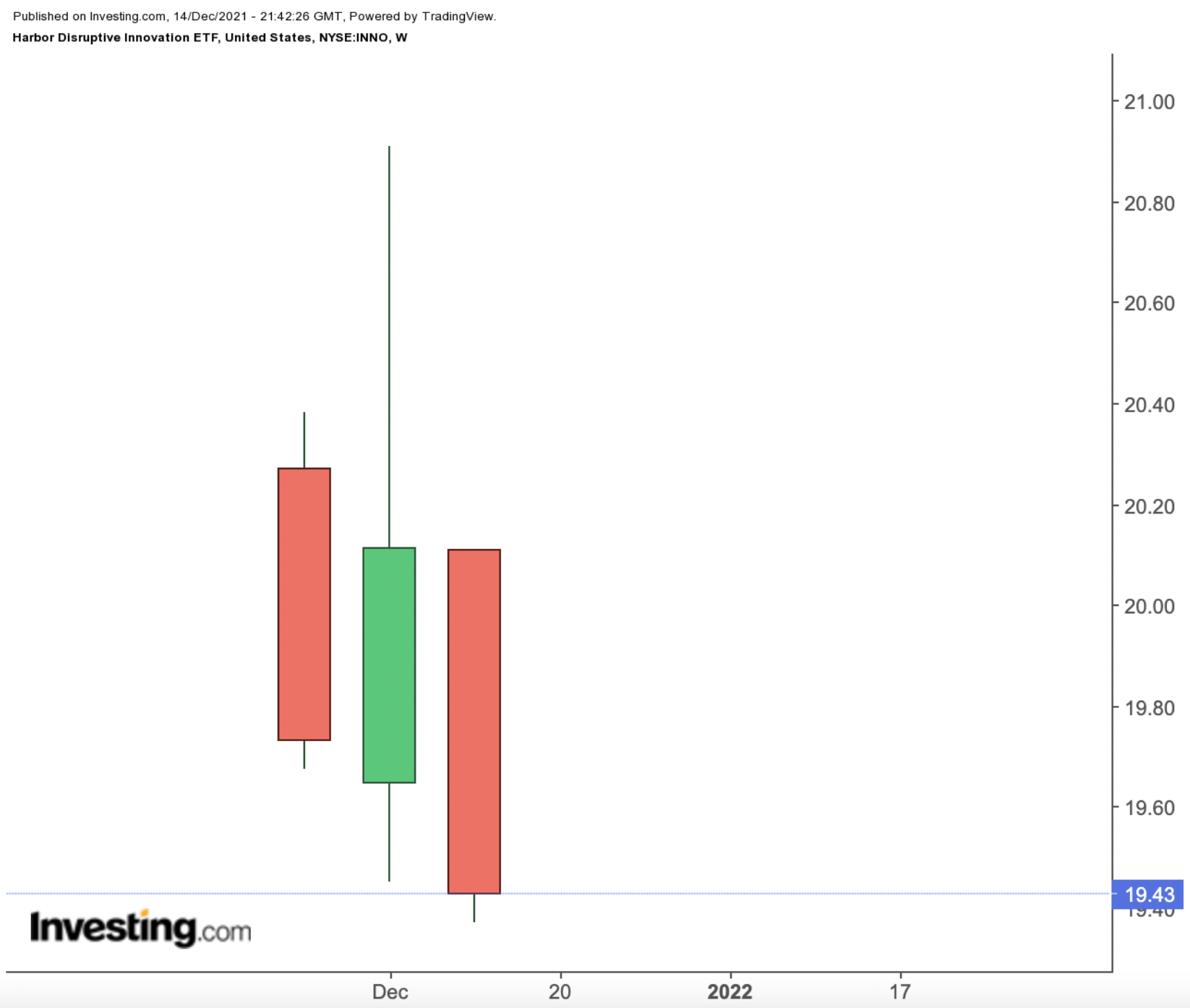

1. Harbor Disruptive Innovation ETF

- Current Price: $19.43

- 52-Week Range: $19.37 - $20.91

- Expense Ratio: 0.75% per year

In the 1990s, the late Clayton Christensen of Harvard Business School coined the term disruptive innovation. That expression “describes a process by which a product or service takes root initially in simple applications at the bottom of a market and then relentlessly moves up market, eventually displacing established competitors.”

Examples of disruptive innovation include smartphones like the iPhone by Apple (NASDAQ:AAPL), streaming services by Netflix (NASDAQ:NFLX), discount retailers Aldi and Lidl, online reference service Wikipedia or the home-stay platform Airbnb (NASDAQ:ABNB).

Meanwhile, according to MSCI, disruptive technologies “can transform our lives, businesses and even the global economy. [They] challenge traditional industries [and] have exceptional growth potential.”

Although disruptive innovation and disruptive technology do not refer to the same concept, understandably there is a certain overlap between the two. The Harbor Disruptive Innovation ETF (NYSE:INNO) invests in businesses that are at the center of these leading-edge, transformative developments, business models and technologies. The fund started trading in early December.

INNO is an actively-managed ETF. The top 10 names make up about a third of net assets of almost $6 million.

Leading stocks include the semiconductor-equipment supplier Lam Research (NASDAQ:LRCX), semiconductor and artificial intelligence heavyweight NVIDIA (NASDAQ:NVDA), technology giant Microsoft (NASDAQ:MSFT), e-commerce and cloud-computing leader Amazon (NASDAQ:AMZN); electric vehicle darling Tesla (NASDAQ:TSLA); and software-as-a-service (SaaS) name ServiceNow (NYSE:NOW).

The fund started trading on Dec. 2 at an opening price of $20.27. It closed yesterday at $19.43.

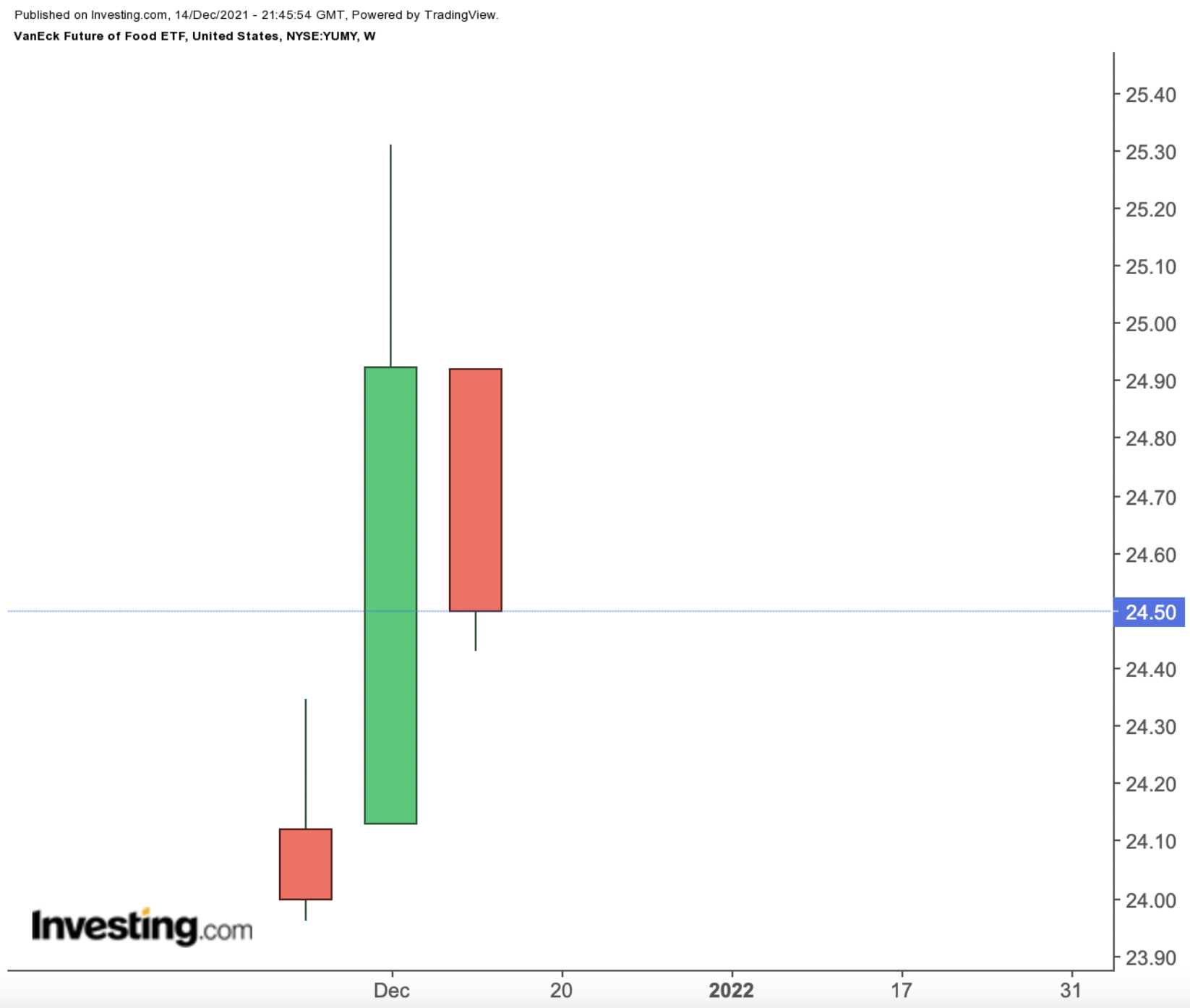

2. VanEck Future of Food ETF

- Current Price: $24.50

- 52-Week Range: $23.96 - $25.31

- Expense Ratio: 0.69% per year

Emerging technologies are also impacting the food industry. The global population, which stands close to 8 billion people, is expected to reach almost 10 billion by 2050. Such a growth rate will put a strain on natural resources as well as various industries, including food and agriculture. Meanwhile, climate change and evolving consumer preferences are affecting what we eat and drink also.

Therefore, Wall Street is paying close attention to new and established companies operating in these segments. Among the trends in the limelight are “vertical farming, precision farming, alternative proteins and agricultural biotechnology.”

Recent metrics show “total global investment in agri-food tech companies in 2020 surged to $22.3 billion—$5 billion in ag-tech and $17.3 billion in food-tech—and continues to grow at 50% compound annual growth rate (CAGR, 2010-2020).”

The VanEck Future of Food ETF (NYSE:YUMY) is another actively-managed fund that gives access to global agri-food technology and innovation. For instance, these firms might lead or benefit from environmentally sustainable agriculture, increased agricultural productivity or food innovation.

YUMY, which has 50 stocks, also began trading in early December. The leading 10 names make up about 38% of net assets of $2.5 million.

In terms of sectors, we see consumer staples (42.1%), followed by materials (34.6%), industrials (14.7%) and information technology (3.0%). More than 57% of the companies come from the US. Next in line are companies from Switzerland (8.37%), Denmark (6.45%), Sweden (5.24%), Canada (3.54%) and Mexico (3.52%).

Among the top names on the roster are the leading agricultural name in seed and crop protection Corteva (NYSE:CTVA); Oatly (NASDAQ:OTLY), which produces oat-based alternatives to dairy products; Appharvest (NASDAQ:APPH), which focuses on technology to make farming more sustainable; Switzerland-based fragrance and flavor group Givaudan (OTC:GVDNY); and Ingredion (NYSE:INGR), which provides food ingredients.

The fund opened at $24.29 on Dec. 2. It closed yesterday at $24.50.