1Spatial (SPA) announced a three-year contract worth c $0.8m with the State of Montana for its Next Generation 911 solution. The Montana contract, along with recent large contract wins, the accelerating pace of new business, the transition to a higher-margin SaaS business, increased collaboration among data users and success with the ‘Land and Expand’ strategy should support a c 6% CAGR through FY23 and improved margins. We remain encouraged by the long-term potential of the geospatial industry and see scope for further acceleration. While it does trade at a sizable discount to its software peers in terms of price/revenue and EV/EBITDA multiples, we see opportunities for the gap to be reduced, and now is the time for SPA to capitalise on them.

Recent contract wins and transition to SaaS model

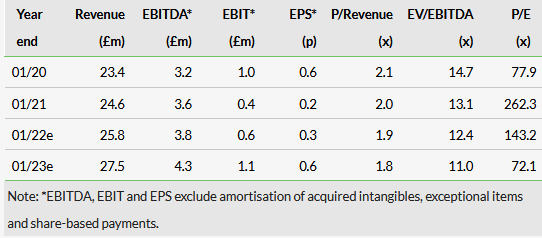

1Spatial has announced a three-year contract worth c $0.8m with Montana to implement its Next Generation 911 solution. This Montana win, the seventh US state to choose the 911 solution, recent large multi-year contract wins and solid sales growth of 8% y-o-y in H122 point to SPA’s successful execution of its three-year transition plan. We forecast steady revenue growth of 5% to £25.8m in FY22e and 6% to £27.5m in FY23e. We see gross and EBITDA margins improving over FY22 and FY23 as SPA continues its transition to a SaaS model focused on high-margin recurring licence revenue.

LMDM: Opportunity in growing market

As technologies like smartphones and digital mapping continue to advance, their dependency on spatial information for physical assets, buildings and so on has increased the need for precise and correct location data. Combined with the trend of increased collaboration between firms, the rapidly transforming geospatial industry is expected by Markets and Markets to enjoy c 12% growth in the medium term, providing a significant opportunity for SPA’s Location Master Data Management (LMDM) business, where it is considered a market leader.

Valuation: Gradually reducing the gap

1Spatial trades at 12.4x FY22e EV/EBITDA, a significant discount to its software peers, and using a peer multiple of 27.7x implies a share price of 99p, about 117% above the current price. While much of the discount reflects SPA’s current lower growth and margins, if the pace of contract wins is maintained and 1Spatial continues to execute on its land and expand strategy, we anticipate there could be a reduction in this valuation gap.

Share price performance

Business description

1Spatial’s core technology validates, rectifies and enhances customers’ geospatial data. The combination of its software and advisory services reduces the need for costly manual checking and correcting of data.

Company description: Digitally mapping the world

1Spatial provides LMDM software, solutions and business applications to businesses and governments working with geospatial data – information on where people, buildings, pipes, roads and many other objects are located. As customers build digital maps of energy systems for electrical vehicle charging stations, map the piping for utilities to manage customers in real time, verify locations for 911 emergency services, record where assets can be found to reduce the risk of flooding and generate national maps to support green and COVID-19 related projects, more and more geospatial data are required and created. 1Spatial’s software tools improve the quality and accuracy of these location data and ensure they are efficiently deployed for use. Ultimately, 1Spatial’s LMDM products allow clients to unlock the value in their geospatial data, ‘enabling better decisions and greater insights.’ Note the term ‘geospatial’ data is often interchanged with ‘location’ or ‘spatial’ data and those terms will be used interchangeably throughout this report.

The 1Spatial Platform is a key element of SPA’s business model. It consists of a set of software components that are data and system agnostic, giving it the flexibility to work across a wide variety of data systems and system platforms. The goal is to ensure the location master data are current, complete, correct, consistent and compliant, thus giving customers the ability to use their geospatial data on any device, anywhere and anytime. That is, SPA’s technology allows users to capture large amounts of complex geospatial data in various formats, conduct error checks and integrate those data into third-party geographic information systems (GIS). It is based on an established, customisable rule set that performs the error check on geospatial data. Unlike traditional master data management, LMDM covers both spatial and non-spatial data and enables customers to better manage both types.

1Spatial has made significant investments in its cloud infrastructure, as its platform can be deployed as a SaaS solution in the cloud, on-site or a combination of the two. With its solutions now running in the cloud, this makes them even more scalable. As customers generate more and more location data, 1Spatial’s platform scales up with the growing quantities of location data. For instance, the increasing number of mobile devices and IoTs are producing even larger spatial datasets, and as it operates in the cloud, 1Spatial’s platform’s ability to check, validate, correct and update all this information is not limited by on-site data resources. As it builds its elastic, multi-tenant cloud platform, this should support its increasing market penetration and scalable growth.

1Spatial’s ability to automate the error-checking process, its domain expertise, extensive experience with geospatial data and data agnostic approach all provide SPA a distinct competitive advantage over others in the LMDM space such as Esri and IQGeo. Furthermore, a key competitive advantage for 1Spatial is that it has one of the only platforms (1Integrate), to our knowledge, that can control, integrate and validate such large, complex amounts of geospatial data from multiple sources.

As Exhibit 1 displays, 1Spatial segments itself by geographic locations, as it operates across the globe with most of its business originating in Europe, UK/Ireland and the United States. While it is headquartered in Cambridge, UK, its clients include a wide variety of enterprise customers around the world, including Ordnance Survey, the UK government’s Geospatial Commission, the city of Marseille, the Land and Property Services in Northern Ireland, several US states (California, Michigan, etc), Google (NASDAQ:GOOGL), Northern Gas Networks and the Bureau of Meteorology in Australia. 1Spatial generates both recurring revenues (licences, support and maintenance) and one-time items such as services and perpetual licences as shown in Exhibit 2. Note that perpetual licences are a legacy source of revenue, and SPA has stopped actively selling perpetual licences, as its focus is on recurring term licences. Moreover, the emphasis is on developing pure cloud-SaaS revenue through its business apps.

Click on the PDF below to read the full report: