- Institutional investors increased equity exposure in Q1 2023

- Warren Buffett’s Berkshire Hathaway bought shares in Capital One, Bank of America, and Citigroup, while selling positions in U.S. Bancorp and Bank of New York Mellon

- Michael Burry’s Scion Asset Management bought shares in PacWest, New York Community Bancorp, and Western Alliance

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of Investing Pro get exclusive access to our research tools and data. Learn More »

The highly awaited 13F reports for Q1 2023 are here, shining a light on what the biggest fund managers have been buying and selling during the tumultuous period marked by the bank crisis, subsiding inflation, and slowing interest rate hikes.

Overall, institutional investors saw Q1 as a buying season, with many funds indicating an increase in equity exposure. Among the most interesting developments, investors reported buying the dip in solid yet oversold financial companies, consumer discretionaries, and semiconductors.

For those who don’t know, 13F filings are a legal requirement for institutional investment managers with over $100 million operating in the US stock market. These forms reveal the manager's holdings of publicly traded securities, including stocks and exchange-traded funds (ETFs), as of the quarter's end prior to the filing.

For retail investors, they are a valuable tool for glancing into the investment approaches employed by some of the most successful investors on the planet.

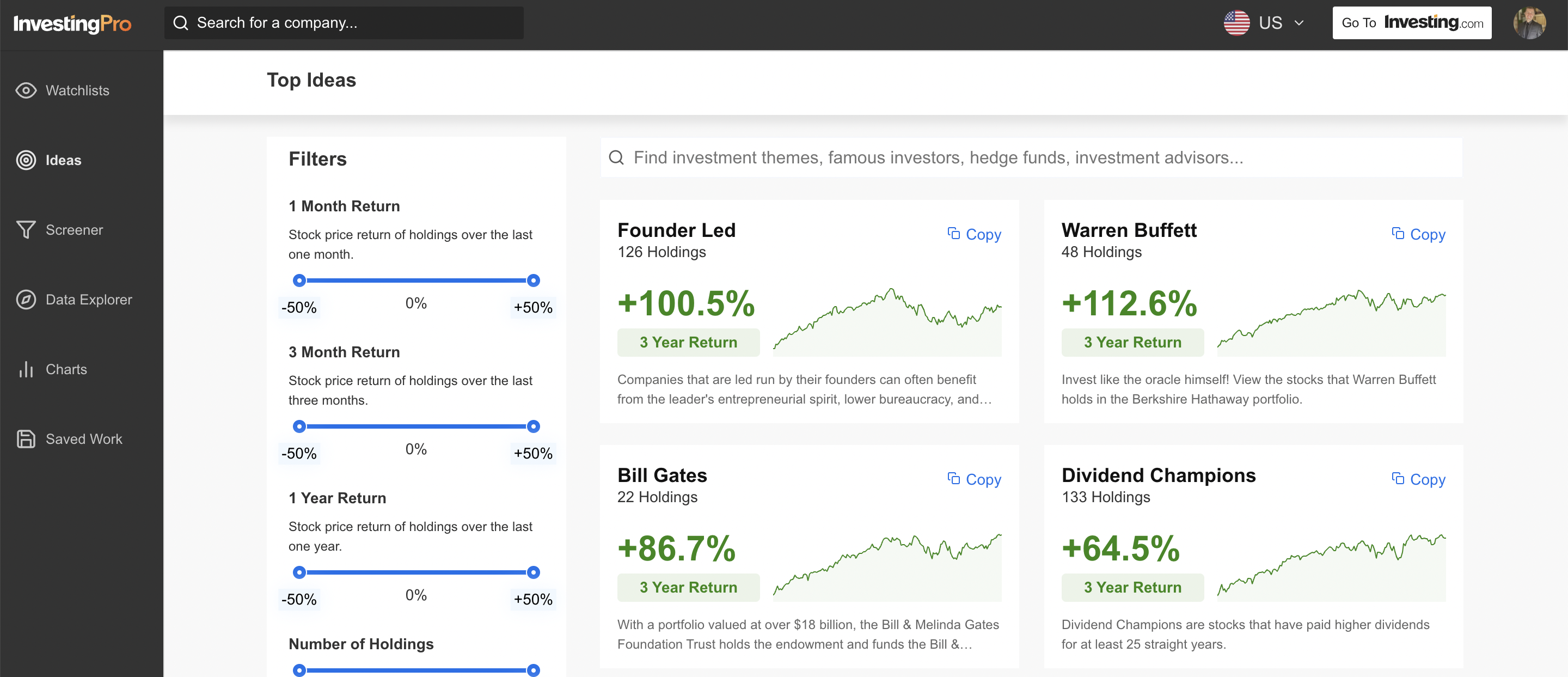

InvestingPro grants you access to the 13Fs of every major investor operating within the US at the click of a button. By just clicking on “ideas” and then choosing the name of the fund manager you want more information on, investors will have access to their SEC filings — along with other relevant data from their holdings, such as Ranking Tables, Sector Concentration, and Holdings Summary.

Source: InvestingPro, Top Ideas Screen

Let’s take a deep dive into the main insights from Q1 13Fs. InvestingPro users can do the same analysis for every major name in the market just by signing up on the following link. Try it out for a week for free!

Burry Scoops Up Regional Banks Amid Selloff

A couple of months ago, at the height of the banking crisis, I wrote:

“There are several long-term opportunities in the US financial sector amid the recent selloff for those willing to do the research work.”

Interestingly enough, that’s precisely the approach that Michael Burry was taking at that time. According to the most recent 13F filing of his firm, Scion Asset Management, the famous Big Short investor added 250,000 shares in PacWest Bancorp (NASDAQ:PACW), 850,000 shares in New York Community Bancorp (NYSE:NYCB), and 125,000 shares of Western Alliance Bancorporation (NYSE:WAL) during Q1 this year.

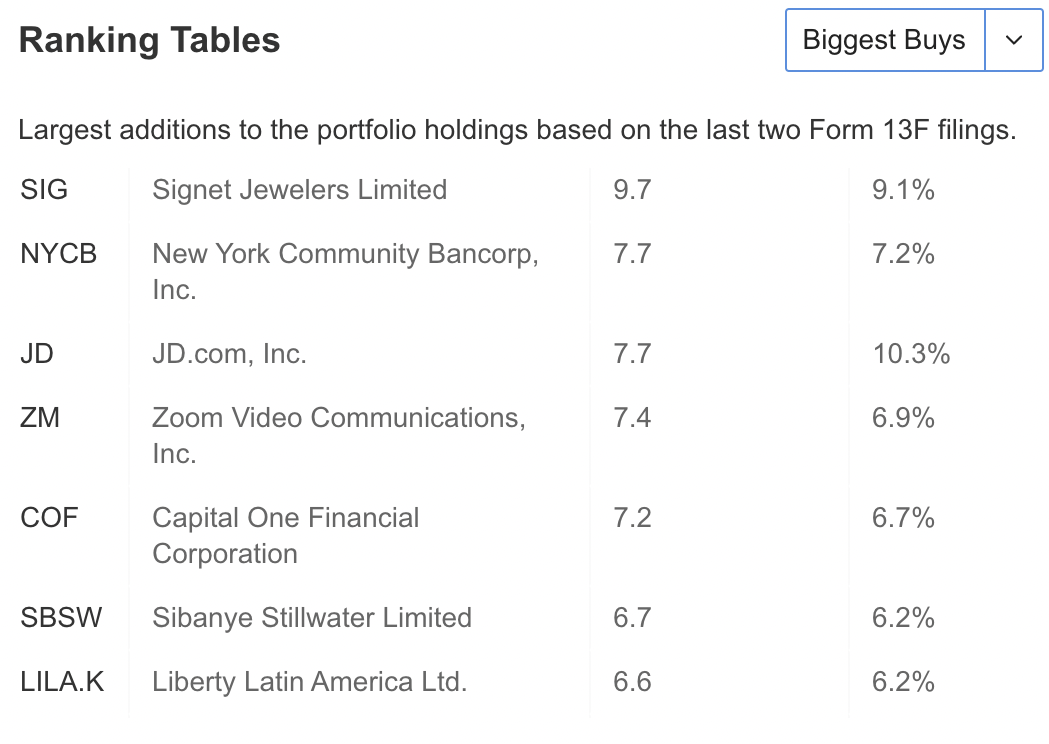

Burry's Scion Asset Management also bought a significant amount of shares in Signet Jewelers (NYSE:SIG) and Zoom Video Communications (NASDAQ:ZM).

Here's the full list of Burry's biggest acquisitions in the quarter, found on InvestingPro:

Source: InvestingPro, Investor Overview Screen

The contrarian investor that made a name by shorting the US housing market right before the Global Financial Crisis in 2008 also scooped up shares of Wells Fargo (NYSE:WFC), showing that the increased exposure to the banking sector is not only limited to smaller, regional banks.

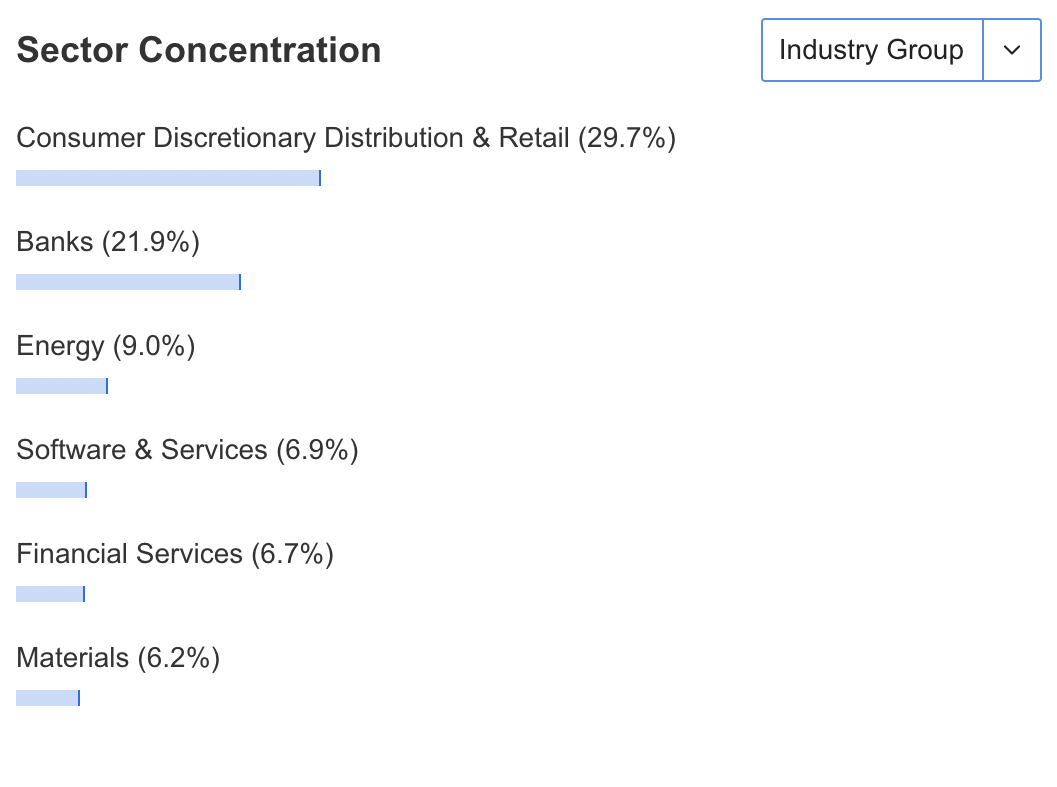

Lastly, Burry boosted his bullish bets on the Chinese resurgence by increasing his stake in the country’s e-commerce giants JD.com (NASDAQ:JD) and Alibaba Group Holdings (NYSE:BABA). The recent acquisitions have completely changed Burry’s portfolio composition, as seen from the InvestingPro tool.

Source: InvestingPro, Investor Overview Screen

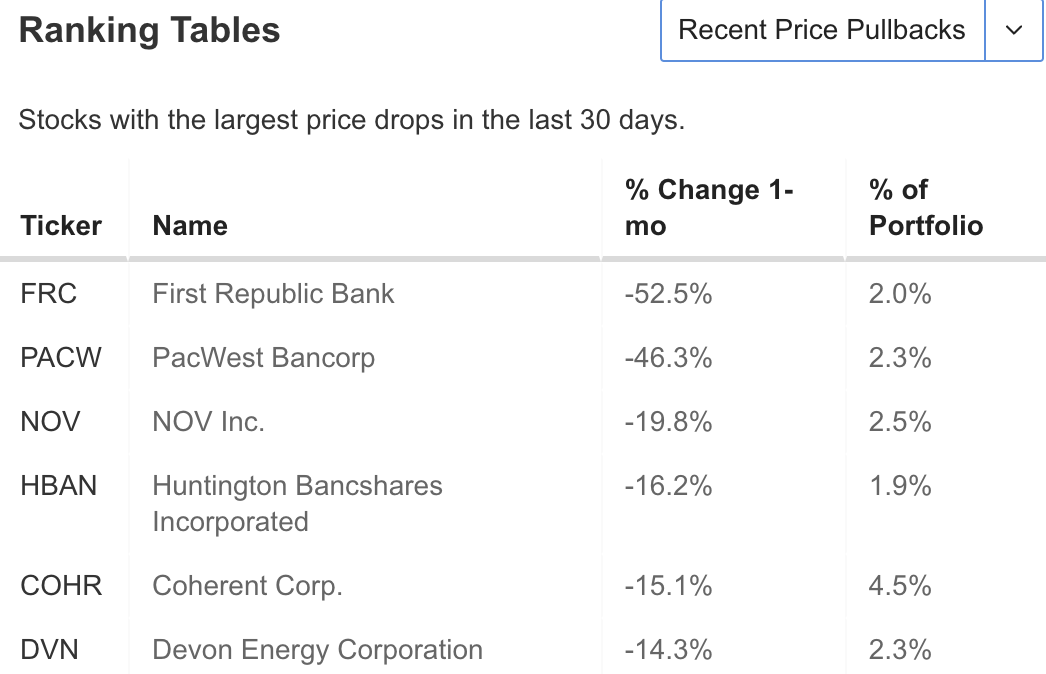

InvestingPro rankings tables also indicate that the famous bear has lived up to his contrarian philosophy, buying mostly shares of companies that sold off over the last year.

Source: InvestingPro, Investor Overview Screen

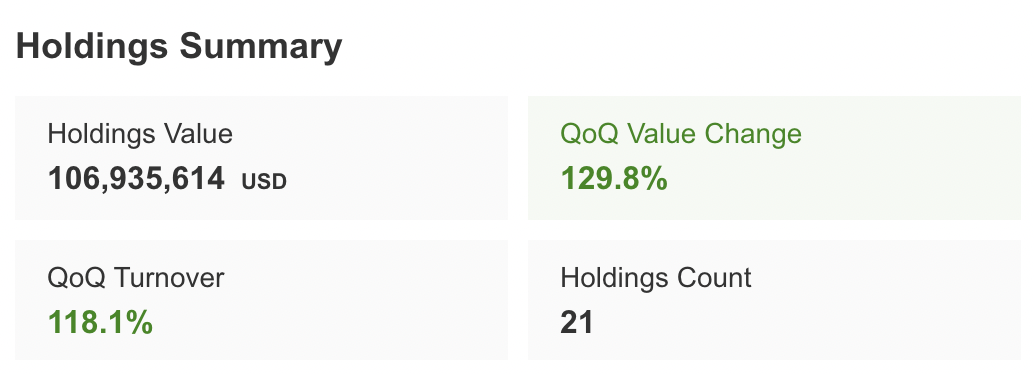

According to the most recent 13F filing, Burry's equity holdings jumped an impressive 129% this quarter, showcasing that even the bear of all bears has been buying up shares at current prices.

Source: InvestingPro, Investor Overview Screen

Buffett Doubles Down on Big Banks, Sells Car Companies

Similarly, legendary investor Warren Buffett also bought the dip in US banks. However, differently from Michael Burry, the Oracle of Omaha took a more conservative approach and did it by selling other long-held financial companies he considered riskier at the moment.

According to the latest 13F filing, Berkshire Hathaway (NYSE:BRKb) (NYSE:BRKa) acquired nearly 10 million shares of Capital One (NYSE:COF) stock and increased its stake in Bank of America (NYSE:BAC) and Citigroup (NYSE:C). On the other hand, the fund decided to completely exit its long-held positions in U.S. Bancorp (NYSE:USB) and at Bank of New York Mellon (NYSE:BK).

Moreover, the legendary investor also scooped up billions of dollars worth of Occidental Petroleum (NYSE:OXY) shares, despite dwindling oil prices and meager earnings from the Houston-based energy behemoth.

Buffett's BRK also bought shares of HP (NYSE:HPQ), Diageo (NYSE:DEO), and Markel (NYSE:MKL). Here's the full list of Buffett's biggest acquisitions in the quarter, found on InvestingPro:

Source: InvestingPro, Investor Overview Screen

On the sell side, Buffett reduced his exposure to Activision Blizzard (NASDAQ:ATVI) during the quarter, dropping his holdings from 52.7 million shares at the start of the year to 49.4 million shares as of May the 15th. He also reduced his exposure to the automotive sector by selling shares of General Motors (NYSE:GM) and almost dropping his entire stake in Chinese EV maker BYD (OTC:BYDDY) (HK:1211) — which was reported separately on the Hong Kong Exchange.

Finally, Berkshire Hathaway knowingly dropped a big chunk of its stake in Taiwan Semiconductor Manufacturing (NYSE:TSM) due to the geopolitical risks incoming from growing tensions between Taiwan and China.

However, as 13Fs showed, the Taiwan-based company was picked up by Macquarie Group Ltd., Fidelity, Tiger Global Management, and Coatue Management.

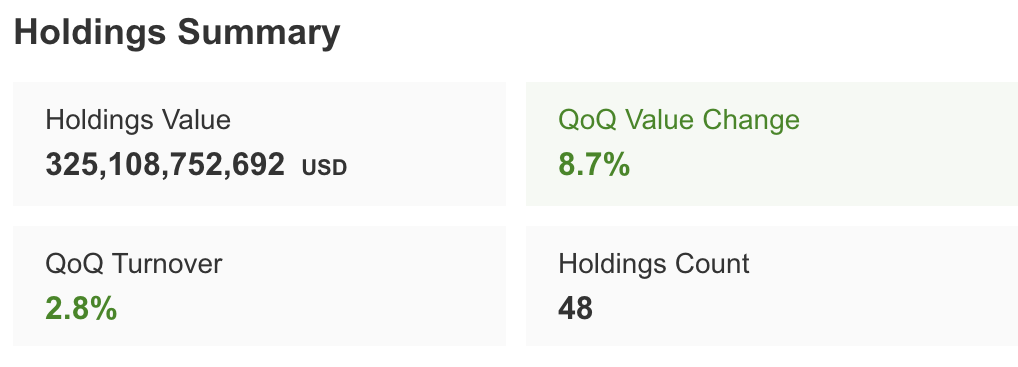

With the most recent changes, Buffett has increased its equity exposure by 8% from the last quarter.

Source: InvestingPro, Investor Overview Screen

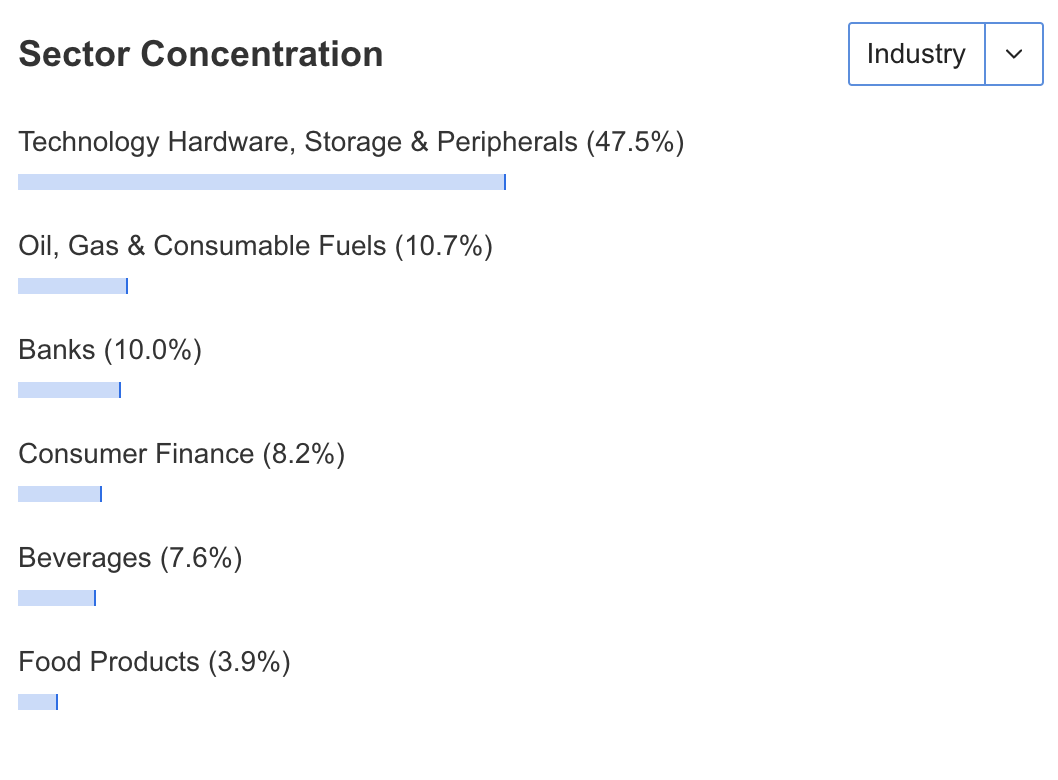

However, in terms of sectors, Buffett's portfolio remains nearly unchanged, with Apple (NASDAQ:AAPL) still accounting for the greatest chunk of the mixture.

Source: InvestingPro, Investor Overview Screen

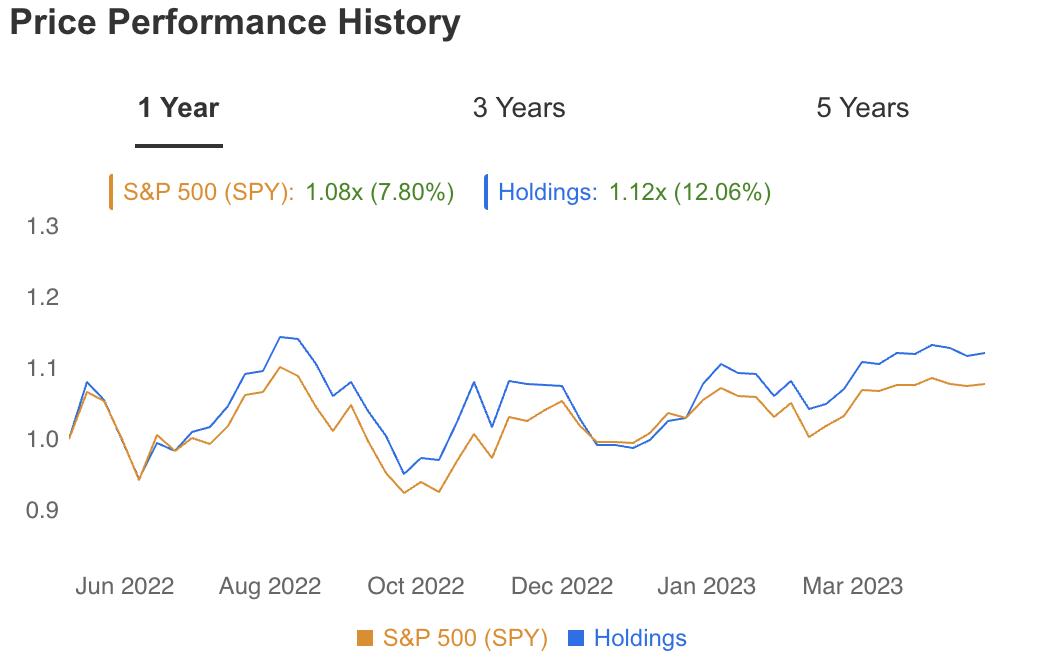

The strategy would have returned nearly 12.06% during the year, easily outperforming the S&P 500.

Source: InvestingPro, Investor Overview Screen

(Note: holdings were changed during the quarter. Numbers reflect the YoY performance of all the stocks currently in his portfolio).

Ackman Bets on Consumer Discretionaries and Google

In a sign that he still believes in the strength of the US economy going forward, billionaire investor and founder of Pershing Square (NYSE:SQ) Holdings, Bill Ackman, bought up a significant amount of shares in the consumer discretionary sector over the last quarter.

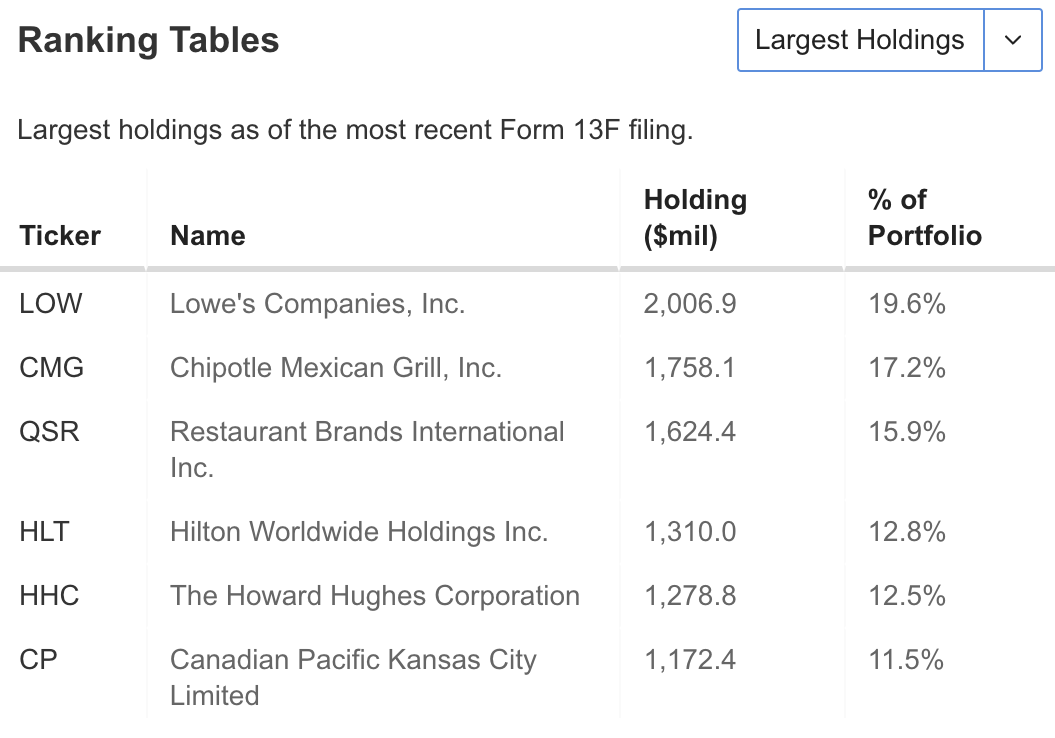

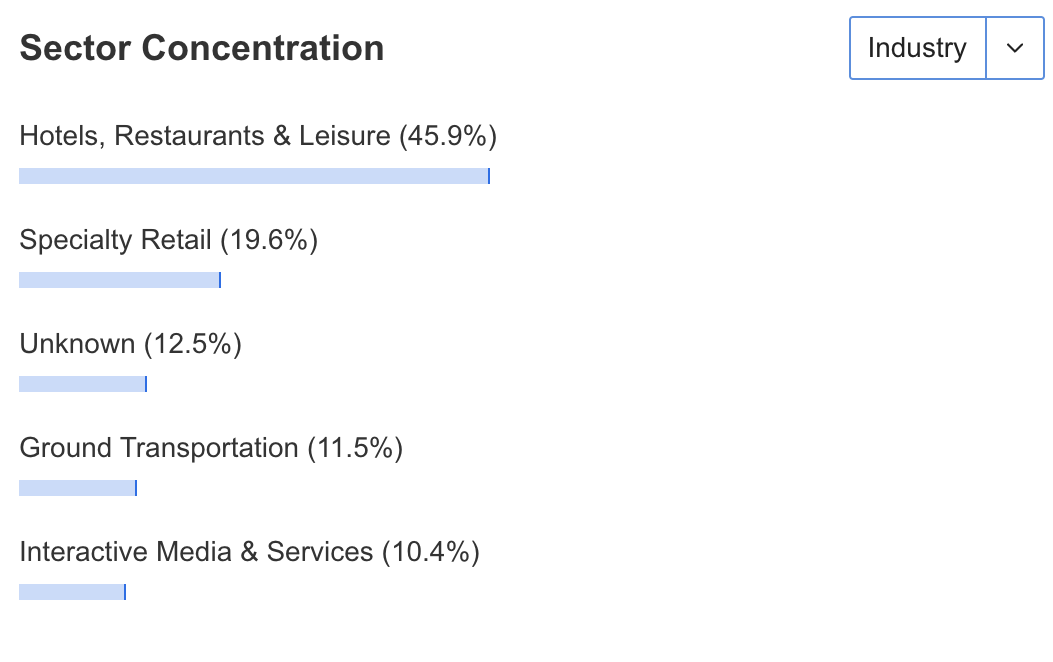

Topping the list was Lowe’s Companies (NYSE:LOW), which now makes up a substantial 19.64% of Pershing Square Holdings’ portfolio. Despite a slight decrease in shares held by about 3%, the firm retained over ten million shares worth approximately $2 billion by quarter-end.

Chipotle Mexican Grill (NYSE:CMG) now comes in second place, accounting for an also impressive 17.21% of Pershing Square’s investment pool. Ackman also raised his stake in Restaurant Brands International (NYSE:QSR) – the parent company of Burger King, Tim Hortons, and Popeyes.

Other significant investments included Hilton Worldwide (NYSE:HLT) and Canadian Pacific Kansas City Limited (NYSE:CP), which now constitute 12.82% and 11.48% of Pershing Squares’ portfolio, respectively.

Finally, Ackman initiated a new position in Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock. With more than ten million combined shares across both classes, this investment now accounts for over 10% of Pershing Square Holdings’ total assets under management.

Source: InvestingPro, Investor Overview Screen

The recent acquisitions have had a significant impact on Ackman’s portfolio composition, as seen from the InvestingPro tool.

Source: InvestingPro, Investor Overview Screen

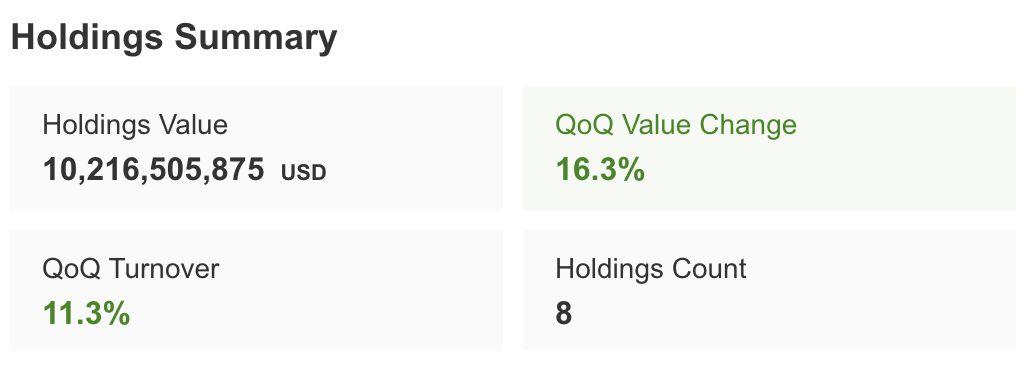

They also indicate a much higher equity exposure from the famous investor, up 16.3% in value this quarter.

Source: InvestingPro, Investor Overview Screen

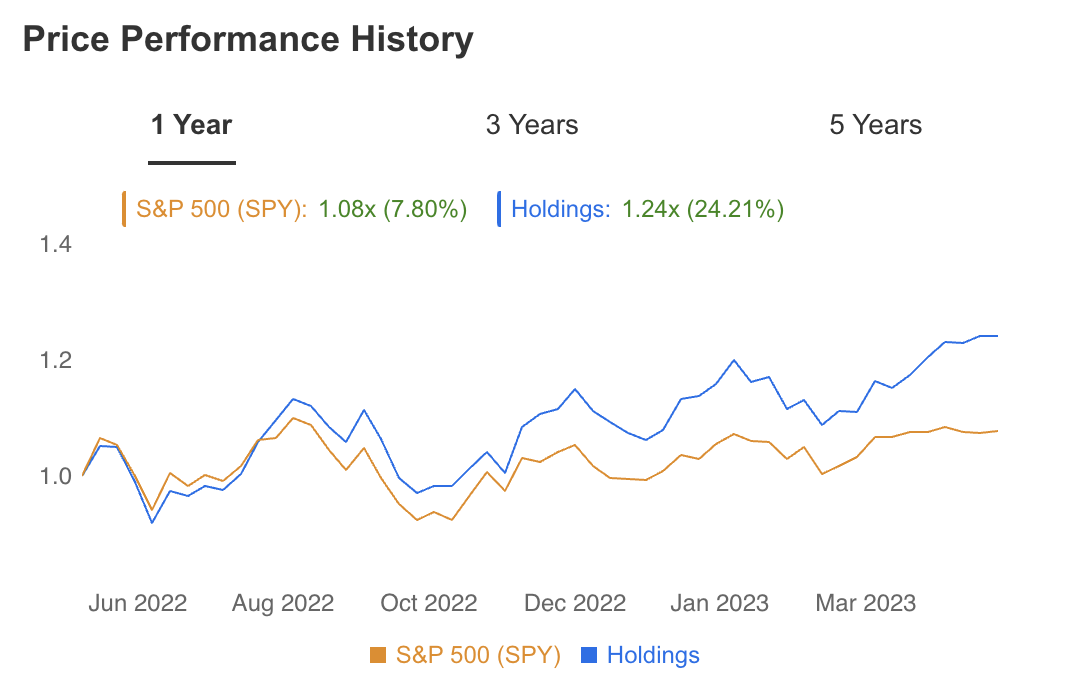

Ackman’s strategy would have returned nearly 24.21% during the year, easily outperforming the S&P 500.

Source: InvestingPro, Investor Overview Screen

(Note: holdings were changed during the quarter. Numbers reflect the YoY performance of all the stocks currently in his portfolio).

***

Disclosure: The author is long on Google and Hilton.