Stocks on Wall Street rallied on Friday, with the major averages all closing within sight of their recent records. This, after the latest jobs report boosted optimism a bit over the U.S. economic recovery.

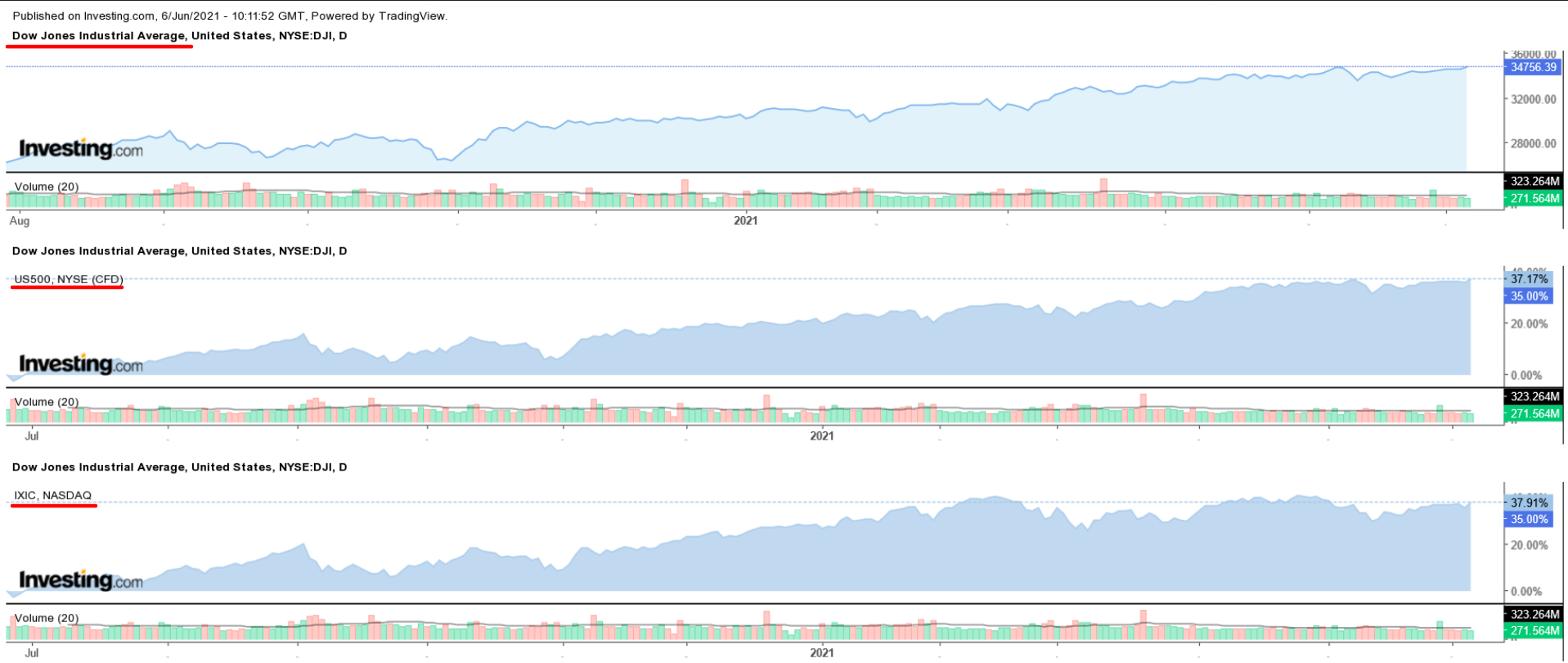

The blue-chip Dow Jones Industrial Average and the benchmark S&P 500 climbed about 0.7% and 0.6%, respectively, on the week for their second straight weekly gain. The tech-heavy NASDAQ Composite, meanwhile, advanced roughly 0.5% over the same timeframe to record its third winning week in a row.

This week is lining up to be another busy economic one with more high-profile earnings reports from companies like GameStop (NYSE:GME), Chewy (NYSE:CHWY), and Stitch Fix (NASDAQ:SFIX), coming out, plus important data, e.g., the anticipated consumer price inflation report, also scheduled to be released as well.

Regardless of how the markets react, we've highlighted one stock likely to be in demand, and another which, unfortunately, could see itself fall further south.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Academy Sports and Outdoors

Academy Sports Outdoors Inc. (NASDAQ:ASO) will be in focus this week, as investors await the latest financial results from one of the nation’s leading athletic-gear retailers, due ahead of Tuesday’s opening bell.

Consensus estimates call for earnings per share (EPS) of $0.82 for the first quarter, while revenue is forecast to clock in at $1.58 billion, when Academy delivers earnings for just the third time as a public company. As such, it faces no year-over-year comparisons.

Beyond the top- and bottom-line numbers, growth in the company’s same-store sales and e-commerce sales will be closely watched, after increasing by 16.1% and 60.7% respectively in the previous quarter.

In addition, investors are hoping Academy’s management will maintain its upbeat view regarding its outlook for full-year fiscal 2021, as the sporting goods retailer continues to benefit from favorable consumer trends and customer demand.

The Katy, Texas-based sporting goods store chain, which currently operates 259 stores located across 16 states, mostly in the U.S. Southeast and Midwest, has thrived this year amid soaring demand for sports and recreation clothing and equipment.

In addition to selling sports apparel, footwear, and exercise gear, the popular Texas chain also offers a wide assortment of products and equipment for the outdoors, such as hunting, fishing, boating, and kayaking.

Year-to-date, Academy—which made its trading debut on the NASDAQ in October after going public at $13.00 per share—has seen its stock soar by 79%, easily making it one of the biggest retail-industry winners of 2021.

ASO stock—which has gained 185% since making its trading debut—ended at $37.12 on Friday, a tad below its all-time high of $37.90 reached on June 2. At current levels, the sporting goods retailer has a market cap of around $3.5 billion.

Stock To Dump: New Oriental Education Group

Shares of New Oriental Education & Technology (NYSE:EDU), which provides online tutoring services for primary and secondary school students in China, look set to remain on the back foot in the days ahead.

Despite already losing nearly half its value so far this year, investors continue to worry over the negative impact of several factors plaguing the Beijing-based for-profit education giant.

Sentiment on the once high-flying for-profit China-based online education service have taken a substantial hit recently amid a growing crackdown on the sector.

EDU stock closed Friday’s session at $9.22, more than 53% below its all-time high of $19.97 touched on Feb. 16, earning the Chinese education behemoth a valuation of about $15.8 billion.

The latest negative news came after China's State Administration for Market Regulation last week fined 15 private tutoring firms a combined 36.5 million yuan ($5.73 million) for false advertising and pricing frauds.

The penalized firms included the aforementioned New Oriental Education, as well as New York-listed peers TAL Education Group (NYSE:TAL), and OneSmart International Education Group Ltd (NYSE:ONE).

Despite the fines, lingering fears remain that Chinese authorities will further escalate their attempts to crack down on the country’s booming market for private tutoring services.

Indeed, previous media reports have stated that China’s Ministry of Education is drafting new regulations that could be rolled out as soon as late June.

Ultimately, market players are concerned that the ongoing clampdown will lead to an outright ban on tutoring services for pre-K kids, which, if confirmed, would have a damaging impact on New Oriental’s business.

Underlining those fears, GSX Techedu (NYSE:GOTU) announced late last month that it would be shutting down its pre-school business in response to the increased regulatory scrutiny, causing its stock to tank to new lows.

Taking this into consideration, EDU shares look set to remain on the defensive in the days ahead as the after-school tutoring service provider continues to face tough challenges ahead.