- CPI inflation, retail sales, producer prices, and retailer earnings will be in focus this week.

- Walmart is a buy with strong earnings, guidance beat on deck.

- Deere is a sell with disappointing profit growth, outlook expected.

- Looking for more actionable trade ideas? Try InvestingPro for under $8/Month.

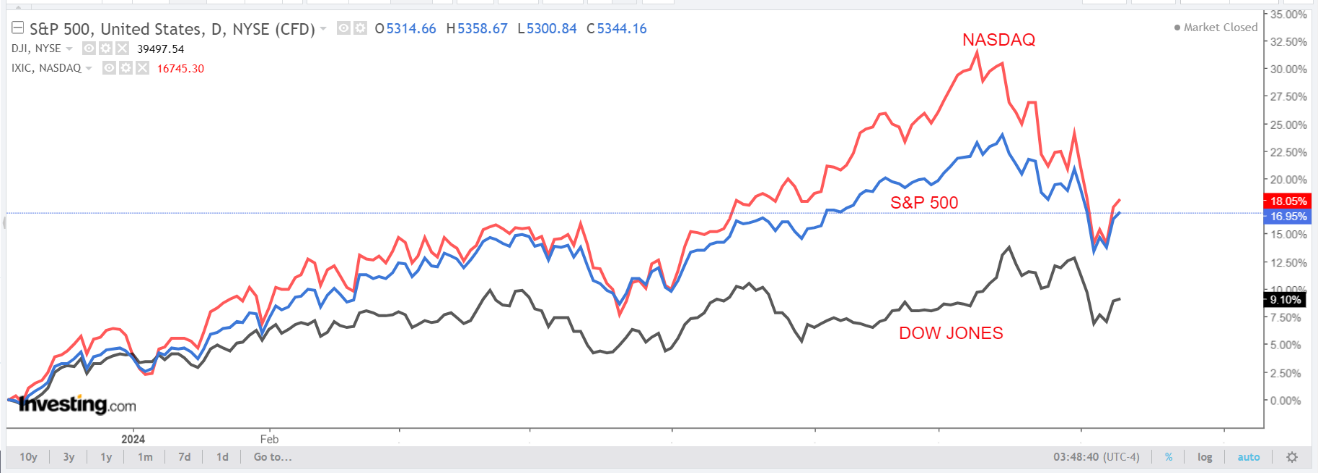

U.S. stocks ticked up on Friday to end a volatile week, with the major indices managing to recover most of their losses from the violent market rout earlier in the week. After a steep 3% drop on Monday, the broader market made its way back to an almost flat performance for the week.

Source: Investing.com

The benchmark S&P 500 and the tech-heavy Nasdaq Composite lost 0.1% and 0.2% respectively, while the blue-chip Dow Jones Industrial Average shed 0.6%.

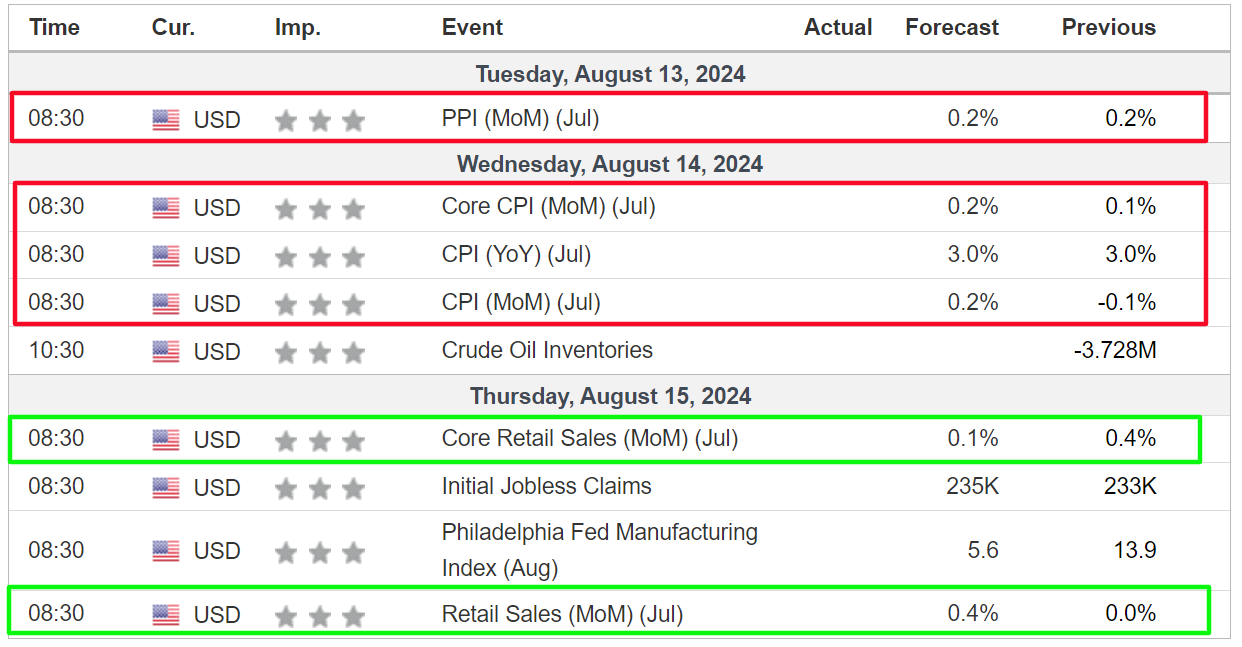

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for the economy and interest rates. As of Sunday morning, investors see a 51% chance of the Fed cutting rates by 50 basis points at its September meeting, and a 49% chance of a quarter-percentage point rate cut.

On the economic calendar, most important will be Wednesday’s U.S. consumer price inflation report for July, which is forecast to show headline annual CPI rising 3.0% year-over-year.

Source: Investing.com

The CPI data will be accompanied by the release of the latest retail sales figures as well as a report on producer prices, will help fill out the inflation picture.

Meanwhile, the reporting season’s last big week sees earnings roll in from notable retailers such as Walmart (NYSE:WMT), and Home Depot (NYSE:HD). Other notable reporters include Cisco (NASDAQ:CSCO), Applied Materials (NASDAQ:AMAT), Deere (NYSE:DE), and Alibaba (NYSE:BABA).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, August 12 - Friday, August 16.

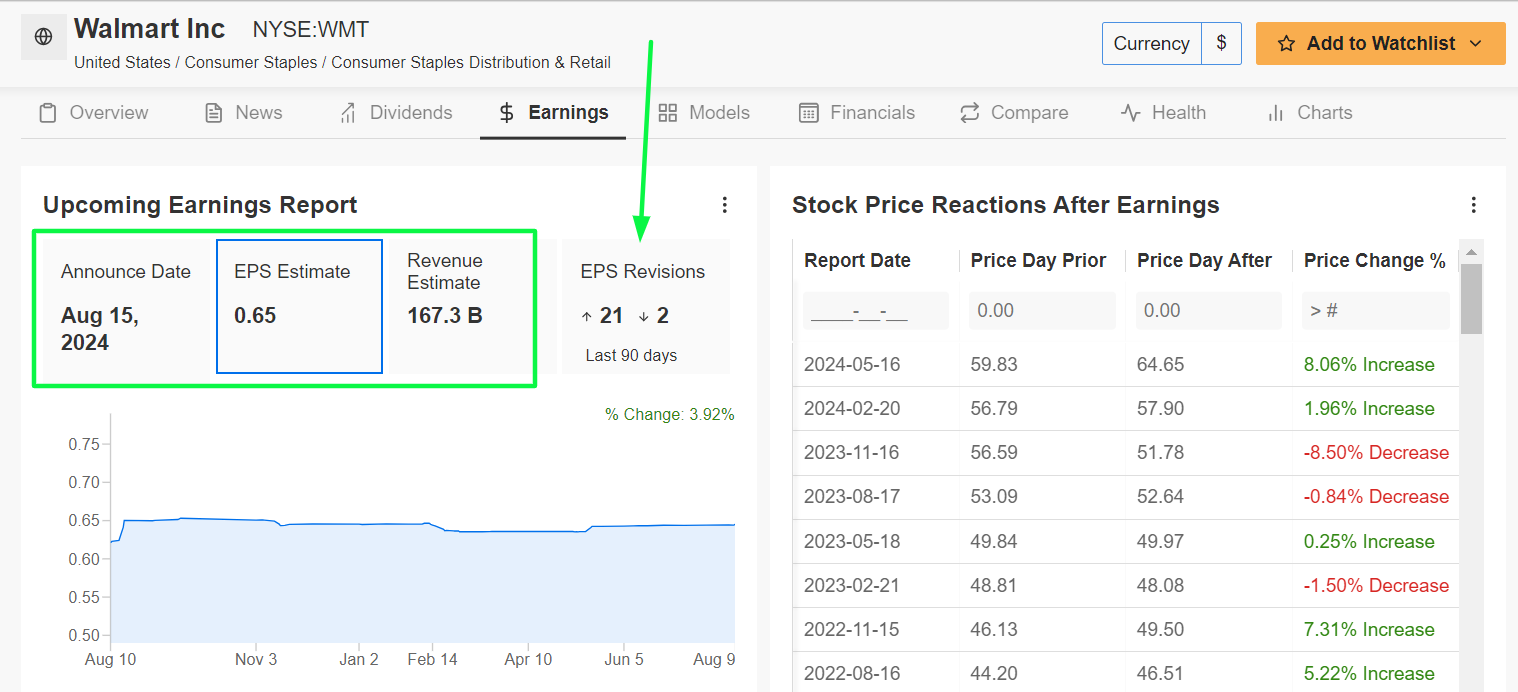

Stock to Buy: Walmart

I expect a strong performance from Walmart this week, with shares likely to break out to a new record high, as the discount retailer will likely deliver another quarter of solid top-and bottom-line growth and provide an upbeat outlook thanks to favorable consumer demand trends.

Despite a challenging environment for retailers, the company’s focus on everyday low prices has positioned it well to capture a larger share of frugal consumers, who are increasingly prioritizing value amid economic uncertainties.

The Bentonville, Arkansas-based retailer - which operates more than 5,000 stores across the U.S. - is scheduled to deliver its second quarter earnings update before the U.S. market opens on Thursday at 7:00AM ET.

Market participants expect a sizable swing in WMT stock after the print drops, according to the options market, with a possible implied move of roughly 5% in either direction. Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with Walmart shares gapping up by 8% when the company last reported quarterly numbers in mid-May.

In a sign of increasing optimism, analysts have made substantial upward revisions to their EPS forecasts in the weeks leading up to the earnings report. Notably, 21 out of the last 23 EPS revisions have been to the upside, reflecting growing confidence in the retail giant’s financial performance.

Source: InvestingPro

Consensus calls for Walmart to post earnings per share of $0.65, rising 6.5% from EPS of $0.61 in the year-ago period. Revenue is seen increasing 3.5% annually to $167.3 billion, reflecting strong grocery sales and as more shoppers sign up for its Walmart+ membership program.

It should be noted that the big-box retailer has topped Wall Street’s sales expectations for 16 consecutive quarters, demonstrating the strength and resilience of its business.

Walmart’s U.S. same-store sales as well as e-commerce spending - which gained 3.8% and 22% respectively in the last quarter - will likely top estimates again as consumers flock to its stores and website to place more orders for store pickup and delivery.

Looking ahead, I believe Walmart CEO Doug McMillion will provide solid guidance for the second half of the year as the discounter continues to gain market share in the food and grocery business, a sector that remains robust even in a challenging economic environment.

WMT stock ended Friday’s session at $67.95, within sight of its record high of $71.33 reached on July 19. With a market cap of $546 billion, Walmart is the world’s most valuable brick-and-mortar retailer and the 12th largest company trading on the U.S. stock exchange.

Source: Investing.com

Walmart has stood apart from other retailers, with shares rising 29.3% year-to-date. That compares to a gain of just 1.5% recorded by the SPDR® S&P Retail ETF (NYSE:XRT), which tracks a broad-based, equal-weighted index of U.S. retail companies in the S&P 500.

As InvestingPro points out, Walmart is in great financial health condition, thanks to strong profit and sales growth prospects, combined with its attractive valuation and pristine balance sheet. Additionally, it should be noted that the company has raised its annual dividend payout for 29 years in a row.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to InvestingPro for 50% OFF and position your portfolio one step ahead of everyone else!

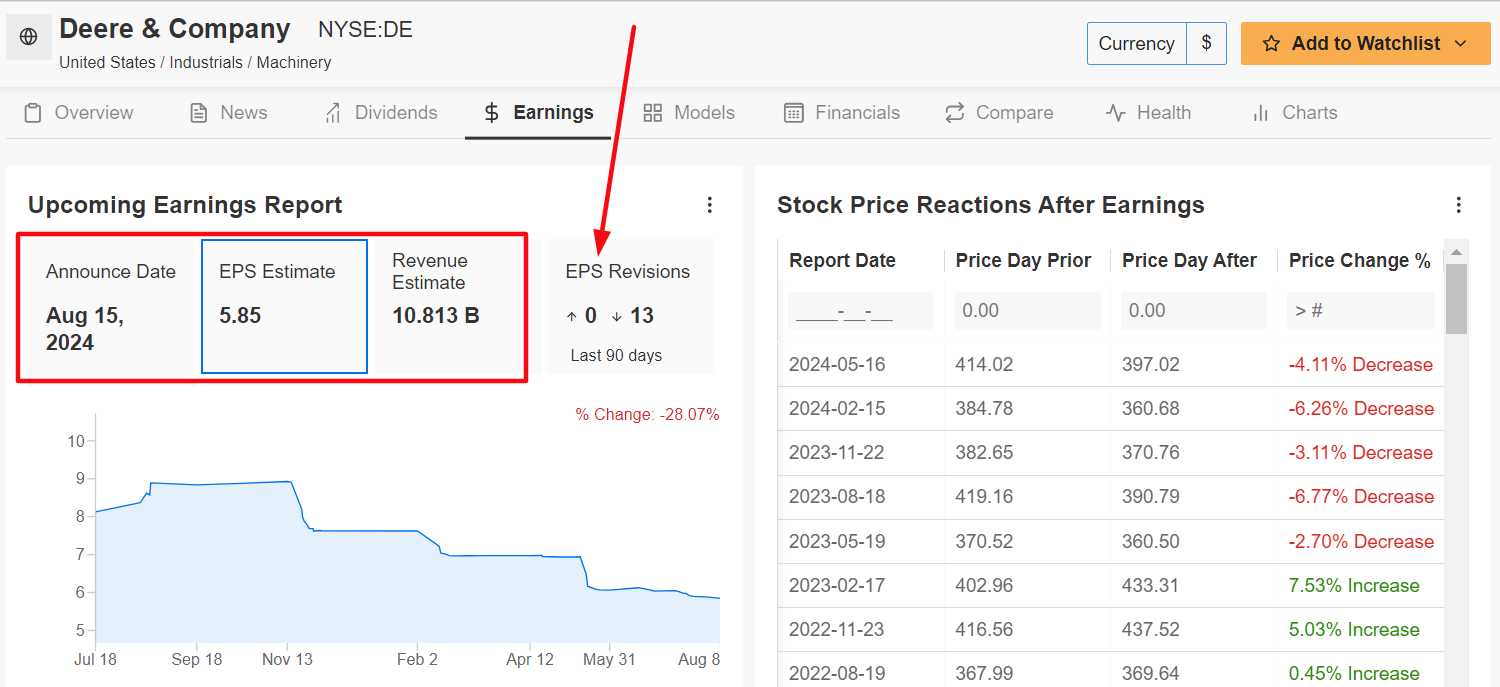

Stock to Sell: Deere

On the other side of the spectrum, I foresee a disappointing week ahead for Deere stock, with a potential breakdown to new lows on the horizon, as the farm equipment maker’s latest earnings and guidance will underwhelm investors due to weakening industry demand trends and an uncertain fundamental outlook.

Deere’s fiscal third quarter report is set to come out before the opening bell on Thursday at 6:20AM ET and results are likely to take a hit from slowing global agricultural machinery demand amid declining crop prices.

Corn prices are down 16% this year, while prices for wheat and soybeans are off by around 14% and 24% respectively over the same timeframe.

Based on moves in the options market, traders are pricing in a possible implied move of 6.5% in either direction in Deere’s shares following the update. Notably, DE stock lost 4% after its last earnings report to suffer their fifth consecutive negative earnings-day selloff.

Underscoring several headwinds Deere faces amid the current environment, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the FQ3 print, with all 13 analysts lowering their EPS estimates in the last 90 days.

Source: InvestingPro

Deere, which is widely viewed as the bellwether for agricultural markets, is seen earning $5.85 a share, tumbling 42.6% from EPS of $10.20 in the year-ago period. To make matters worse, revenue is forecast to plunge 31.6% year-over-year to $10.8 billion, reflecting slowing demand for its wide range of agricultural, mining, and construction equipment amid a soft agricultural commodities market.

If that is confirmed, it would mark the tractor maker’s fourth straight quarter of declining sales, with more pain seen ahead in 2025.

As such, it is my belief that Deere’s management will disappoint investors in their forward guidance and strike a cautious tone given the bleak outlook for farm and mining machinery sales due to the challenging operating environment.

DE stock closed at $346.03 on Friday, not far from its lowest level since September 2022. The Moline, Illinois-based agriculture equipment maker has a market cap of $95.3 billion.

Source: Investing.com

Shares of the agriculture and construction equipment company have lagged the year-to-date performance of the broader market by a wide margin so far in 2024, falling 13.5% in contrast to the S&P 500’s 12% gain.

It should be noted that InvestingPro paints a negative picture of Deere’s stock, citing concerns over declining profit and sales growth prospects. Furthermore, the company faces challenges from rising input costs and supply chain disruptions, which are likely to further pressure its margins.

Be sure to check out InvestingPro to stay in sync with the latest market trend and what it means for your trading decisions.

This summer, get exclusive discounts on InvestingPro subscriptions, including annual plans for less than $8 a month!

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Don't miss this limited time offer.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (NYSE:SPY), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.