The fallout from the prolonged U.S.-China trade war on U.S. companies has investors bracing this week as Wall Street's third-quarter earnings season ramps up.

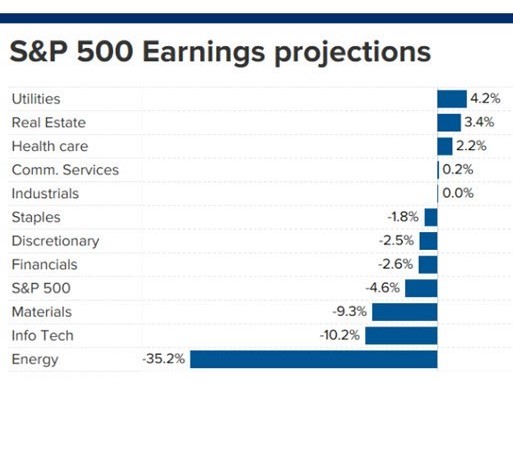

FactSet data shows analysts expect third quarter S&P 500 earnings to fall by 4.1% on a year-over-year (Y-o-Y) basis. That follows a drop of 0.4% in the second quarter and 0.3% in the first. If confirmed, Q3 2019 would mark the first time in three years that the benchmark index reported three consecutive quarters of earnings declines and the largest slide in earnings reported by the index since Q1 2016 when it contracted 6.9%.

At the sector level, six are projected to report a Y-o-Y decline in earnings, led by Energy, Information Technology and Materials. While only four are expected to report annualized earnings growth, led by Utilities and Real Estate.

Industrials is the single sector forecast to post flat Y-o-Y earnings.

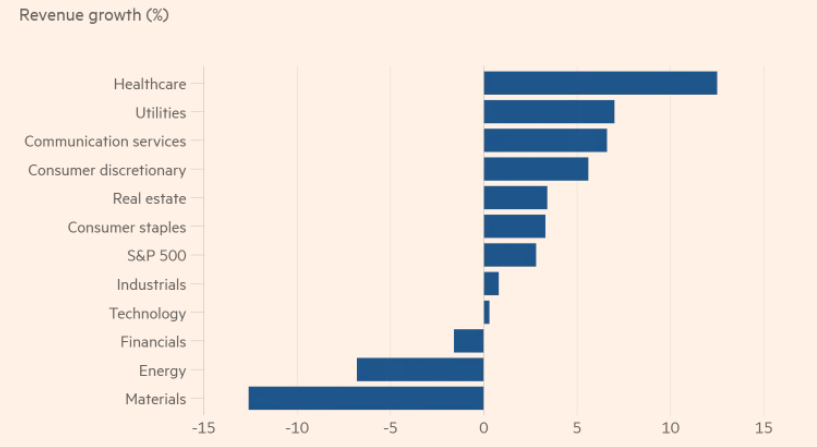

Revenue growth expectations are equally concerning. The estimated Y-o-Y rate for Q3 2019 is just 2.7% and would mark the lowest revenue growth rate for the index since Q3 2016. Three of the eleven sectors are predicted to report a Y-o-Y drop in revenue, led once again by the Materials and Energy sectors. Meanwhile, eight sectors are projected to report Y-o-Y revenue growth, with Health Care and Utilities leading.

2 Sectors Set To Disappoint

1. Energy: Sliding Crude Oil Prices

Lower crude oil prices are taking their toll on the Energy sector, which is expected to report the largest Y-o-Y decline in earnings of all eleven sectors at -35.2%. The average price of oil in the June-September period was $56.44, down 19% from the same period a year earlier.

Three of the six sub-industries in the Energy sector are projected to report a decline in earnings for the quarter. Stocks in the Oil & Gas Exploration & Production group are anticipated to fare the worst, with an EPS predicted to drop a whopping -46%. Integrated Oil & Gas, and Oil & Gas Refining & Marketing are also forecast to see a decline in their respective earnings, at -45% and -15%.

With West Texas Intermediate crude down 7.5% in the third quarter alone, 25 of the 28 companies in the group (89%) have seen a decrease in their mean EPS estimate, led by Exxon Mobil (NYSE:XOM) (down from $1.15 to $0.73), Chevron (NYSE:CVX) (to $1.66 from $2.10) and Occidental Petroleum (NYSE:OXY) (to $0.51 from $1.00).

2. Materials: Dropping Commodity Prices

The Materials sector is expected to report the third-highest Y-o-Y earnings decline of all eleven sectors, at a dismal -9.3%. The sector is also forecast to suffer the largest Y-o-Y plunge in revenue, at -12.8%, as sliding prices of commodities help drive the drop.

Two of the four sub-industries in the sector are projected to report double-digit earnings declines: Metals & Mining (-55%) and Containers & Packaging (-15%). The companies anticipated to lead the earnings slide for the sector are Nucor (NYSE:NUE) and Freeport-McMoran (NYSE:FCX). For Nucor, the mean Q3 2019 EPS estimate is $0.87, while the EPS a year-ago was $2.33. For Freeport-McMoRan, the mean Q3 2019 EPS estimate is $0.02, compared to the year-ago EPS of $0.35.

Expect Strong Results From This Sector

1. Utilities: All Sub-Industries Forecast Growth

The Utilities sector is set to enjoy tailwinds from the Federal Reserve’s rate cuts, as it is expected to report the highest Y-o-Y earnings growth of all eleven sectors, at +4.2%.

All five of the sub-industries in the sector are anticipated to report EPS growth, with Gas Utilities expecting a double-digit increase (+20%).

At a company level, Duke Energy (NYSE:DUK) and Nextera Energy (NYSE:NEE) are two to watch. Duke's revenue forecast is 7.13B compared to 6.63B a year-ago, while Nextera is expecting to report 5.15B revenue, beating last year's 4.42B reading.

The sector’s main ETF—the Utilities Select Sector SPDR Fund (NYSE:XLU)—rose 11% in the third quarter, outpacing the S&P 500’s 8% increase over the same timeframe. XLU is trading near all-time highs as the group tends to outperform in low interest rate environments due to their attractive dividend yield.