The Federal Reserve paused rate hikes at last week’s policy meeting, but Fed Chairman Jerome Powell told the House Financial Services Committee on Wednesday that more increases were likely.

“Inflation has moderated somewhat since the middle of last year,” he said, but “inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go.” He added: “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

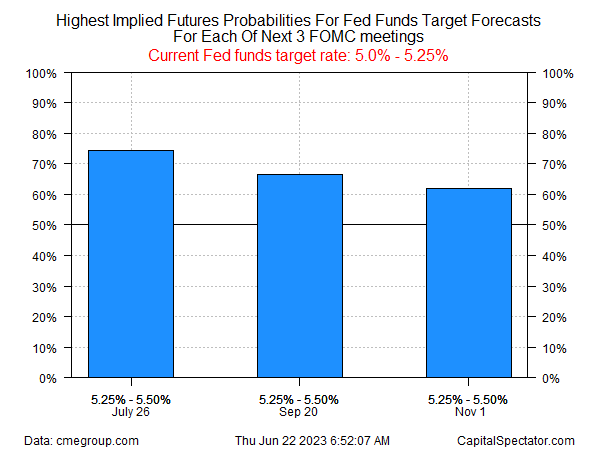

Meanwhile, Fed funds futures continue to lean toward a one-and-done scenario based on the highest estimated probability estimates for the next three Fed meetings. After a 25-basis-points increase at the July meeting, the crowd assumes the Fed funds target rate will peak at 5.25%-5.50%.

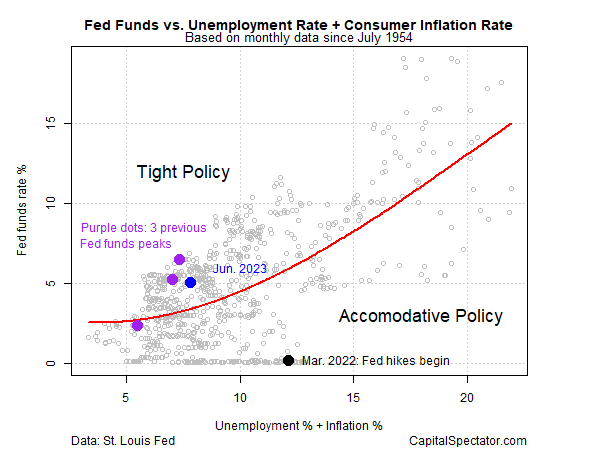

A simple model using unemployment and consumer prices to profile Fed policy suggests that a moderately tight profile prevails. That’s a plausible but unproven scenario for expecting that rate hikes may soon end.

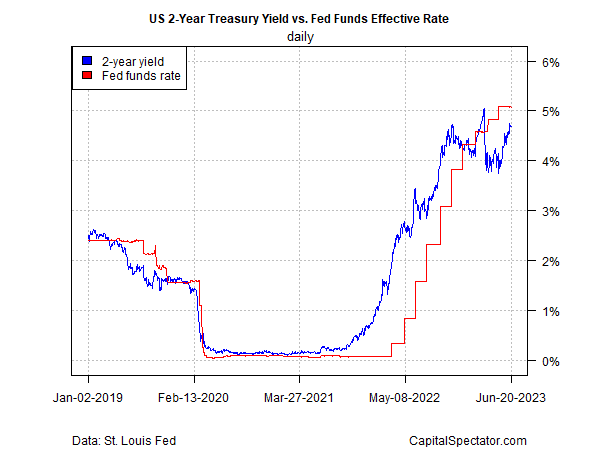

The United States 2-Year Treasury yield is also priced in anticipation that the Fed funds target rate is at or near a peak. The policy-sensitive 2-year yield was unchanged yesterday at 4.68% (June 21).

Although this key Treasury yield is up a sharp 90 basis points over the past month, the fact that it remains below the Fed funds rate reflects the market’s view that rate hikes are close to peaking.

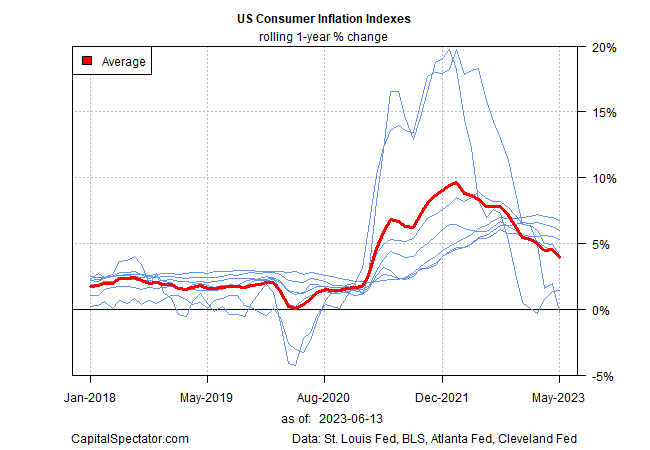

The final arbiter on what happens next will almost certainly be the incoming inflation numbers. There is concern that while inflation has peaked, the easing of pricing pressures has been slower and less persistent than the Fed prefers.

The good news is that the downside bias looks set to persist based on the average change in the 1-year pace of seven inflation measures (for a list, see page 3 here).

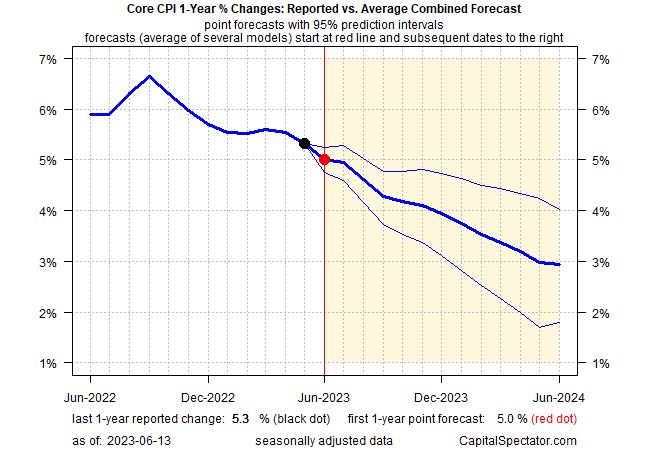

CapitalSpectator.com’s ensemble forecasting model for core CPI also points to softer pricing pressure in the months ahead, albeit at a slow pace, which supports the view that more than a rate hike is possible and perhaps likely.

The acid test, as always, is the actual data. The next key reality check is the June CPI report, due in a few weeks. Currently, there is a prevailing cautiously optimistic outlook suggesting that the path ahead may be shorter than what the Hawks anticipate.

But if the doves are jumping the gun, again, the source for disappointment seems likely to come from a resilient economy, advises Tim Duy, chief US economist at SGH Macro Advisors. In a note sent to clients last week after the Fed announced a pause, he explained:

The tightening cycle continues. We shouldn’t discount the most recent SEP and its projection of another 50bp of rate hikes. The economy simply has not cracked as anticipated. As we have written, activity is more resilient than economists tend to expect. It’s built with an internal bias for growth and is currently benefiting from fiscal and demographic support. The longer this continues, the more market participants, and the Fed, will suspect that the neutral rate has risen.

To reprise and revise a famous line from the era of the Clinton administration,

“It’s [still] the economy, stupid.”

In turn, the crucial question is: Will the economy stay resilient?