By Stanley White

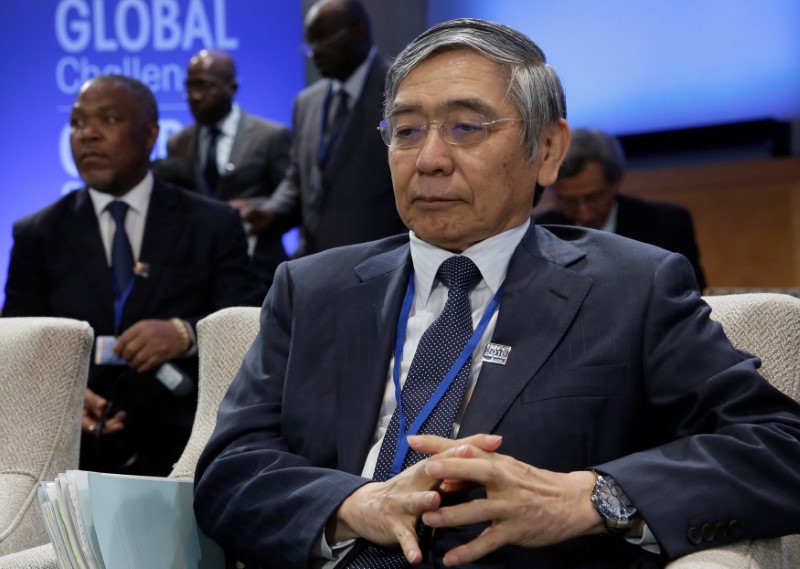

TOKYO (Reuters) - Bank of Japan Governor Haruhiko Kuroda said on Wednesday he is prepared to ease monetary policy again if needed, including pushing short-term interest rates further into negative territory, to jump-start a sluggish economy and stoke inflation.

Kuroda, speaking in the lower house budget committee, said the BOJ's government debt purchases may fluctuate around 80 trillion yen ($778 billion) but emphasised that the central bank will continue to buy a lot of debt to influence the yield curve.

"We are prepared to ease policy again, including lowering short-term rates, if we judge that the merits outweigh the costs," Kuroda told lawmakers in parliament.

The BOJ last month switched its policy target to interest rates from its reliance on massive injections of money into the financial system as the strategy failed to jolt the economy out of decades of stagnation.

Under a new "yield curve control" (YCC) framework, the BOJ's main means for easing would be to deepen negative rates from the current minus 0.1 percent, or lower its new 10-year government bond yield target - now set at around zero percent.

Some analysts saw the move as laying the grounds for a future tapering of the BOJ's huge balance sheet.

Kuroda on Wednesday reiterated that the BOJ will maintain its current pace of government debt purchases and stressed that purchases will remain large under its new policy framework.

Sources have told Reuters the BOJ would deepen negative rates to thwart any sharp spikes in the yen, which it sees as an obstacle to stoking inflation and economic growth.

About 70 percent of the analysts surveyed by Reuters said the BOJ would add more stimulus at its January meeting or later, while a handful of analysts predicted the central bank would ease further at its Oct. 30-Nov. 1 meeting when it releases its long-term growth and inflation outlook.

($1 = 102.9000 yen)