Benzinga - by Anusuya Lahiri, Benzinga Editor.

Arm Holdings Plc (NASDAQ:ARM) stock is trading higher Monday after the broader sector selloff on Friday when the U.S. government imposed sanctions on the Middle East regarding AI chips.

The British chip designer CEO Rene Haas expects artificial intelligence readiness of 100 billion Arm devices globally by 2025 end, Reuters cites Haas at the Computex forum in Taipei.

Also Read: AMD Grabs 33% of Server CPU Market and Prepares for Major Processor Launch: Report

Analysts maintained their bullish projections on Arm Holdings, citing licensing interest and royalty as critical growth drivers. They also flagged Arm’s potential in AI and datacenter markets.

Arm Holdings plans to debut its AI chip in 2025 and commercialize it by fall 2025. Arm Parent SoftBank eyes meaningful investments in data centers powered by its own AI chips and renewable energy sources.

Recently, Advanced Micro Devices, Inc (NASDAQ:AMD) CFO Jean Hu hinted at the chip designer’s possible foray into next-generation AI PC to launch in the year’s second half, sparking a rivalry with Arm.

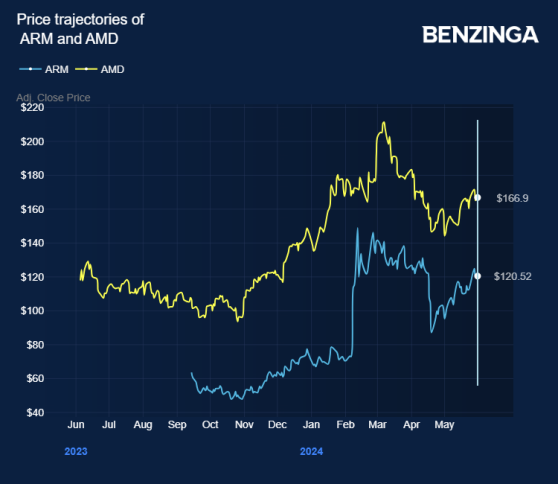

Arm stock gained 90% in the last 12 months. Investors can gain exposure to the stock via iShares Robotics And Artificial Intelligence Multisector ETF (NYSE:IRBO) and SPDR Portfolio Developed World Ex-US ETF (NYSE:SPDW).

ARM Price Action: Arm shares traded higher by 2.97% at $124.10 premarket at the last check on Monday.

Also Read: Arm Holdings Poised To Challenge Qualcomm, Intel, AMD In AI, Analysts Predict Growth In Chip Design

Photo via Wikimedia Commons

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga