Benzinga - by Anusuya Lahiri, Benzinga Editor.

On Thursday, Taiwanese contract chipmaker Taiwan Semiconductor Manufacturing Co (NYSE:TSM) projected a 10% annual revenue growth in the global semiconductor industry, excluding memory chips.

"This is a new golden age of opportunity with artificial intelligence applications (AI)," Reuters quoted SVP Cliff Hou as saying at an event in Hsinchu.

In April, the key supplier of Nvidia Corp (NASDAQ:NVDA) and Apple Inc (NASDAQ:AAPL) slashed its outlook for the global semiconductor industry, excluding memory, to a growth rate of ~10% from a previous forecast of over 10%.

Also Read: ASML and Taiwan Semi Prep for Potential China-Taiwan Conflict with Remote Shutdown Feature

World Semiconductor Trade Statistics projected 13.1% growth for the global semiconductor market in 2024.

Thanks to the AI frenzy, TSMC expects second-quarter sales to grow by up to 30%.

Analysts noted that TSMC plans to triple its 3 nm family capacity from 2023 to 2024, with Chip-on-wafer-on-substrate (CoWoS) capacity growing at a CAGR of 60%+ from 2022 to 2026.

CoWoS is an advanced packaging technology for high-performance computing (HPC) and artificial intelligence (AI) components. Also, Nvidia has chosen TSMC's CoWoS-L for Blackwell in a major capacity ramp-up.

TSMC reported first-quarter revenue growth of 16.5% to $18.87 billion, surpassing the analyst consensus of $18.40 billion. Advanced technologies formed 65% of TSMC's total revenue.

Reportedly, big techs led by Microsoft Corp (NASDAQ:MSFT) earmarked over $32 billion in AI infrastructure in the first quarter.

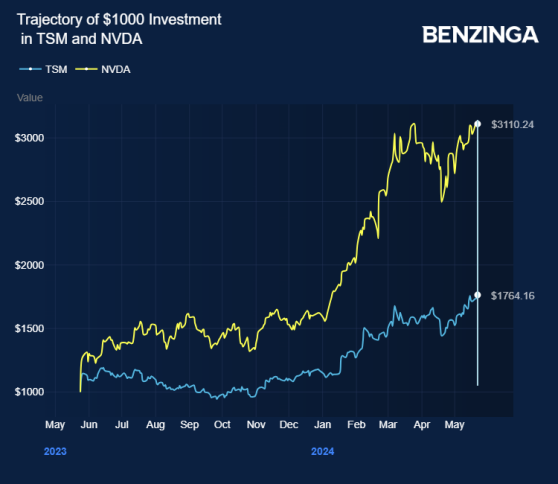

TSMC stock gained 73% in the last 12 months. Investors can gain exposure to the semiconductor sector via Direxion Daily Semiconductor Bull 3x Shares (NYSE:SOXL) and Direxion Daily Semiconductor Bear 3x Shares (NYSE:SOXS).

Price Action: TSM shares were trading higher by 2.54% at $160.11 at the last check on Thursday.

Also Read: Taiwan Semi Set to Build $11B Chip Plant in Germany, Aiming for 2027 Production Start

Photo by Jack Hong via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga