Benzinga - by Anusuya Lahiri, Benzinga Editor.

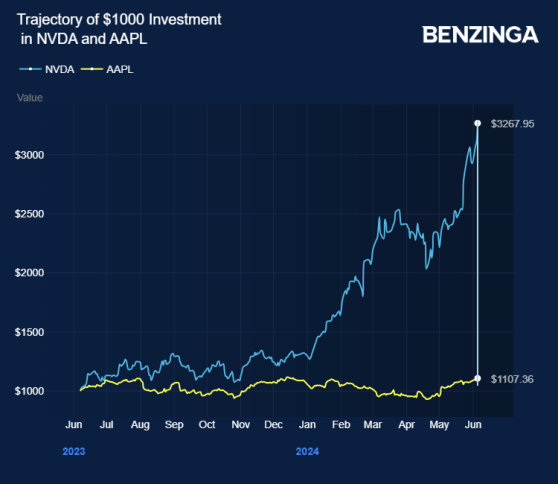

Nvidia Corp’s (NASDAQ:NVDA) stock surged to record highs on Wednesday, valuing the company at over $3 trillion and making it the world’s second most valuable company, surpassing Apple Inc (NASDAQ:AAPL).

Nvidia plans a ten-for-one stock split on June 7 to attract more individual investors.

Nvidia’s valuation has soared 147% in 2024 due to strong demand for AI processors from companies like Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc (NASDAQ:META), and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL).

On Wednesday, Nvidia added nearly $150 billion in market capitalization, more than the entire value of AT&T Inc (NYSE:T), Reuters reports.

Jake Dollarhide, CEO of Longbow Asset Management, remarked, “Nvidia is making money on AI right now, and companies like Apple and Meta are spending on AI.”

Nvidia’s CEO Jensen Huang received widespread media coverage at Computex in Taipei. Meanwhile, Apple faces weak iPhone demand and stiff competition in China.

According to S&P Dow Jones Indices, five companies, including Nvidia, Microsoft, Meta, Alphabet, and Amazon.Com Inc (NASDAQ:AMZN), account for about 60% of the S&P 500’s total return of over 12% this year. Nvidia alone has contributed roughly a third of this gain, following a 147% surge in 2024.

Angelo Kourkafas, senior investment strategist at Edward Jones, highlighted potential market vulnerability if these key stocks falter and the rest of the market does not provide support.

Tajinder Dhillon, senior research analyst at LSEG, expects the earnings gap between the “Magnificent Seven” companies and the rest of the S&P 500 to narrow as 2024 progresses.

Recent reports indicated that Nvidia is preparing to ramp up investments in Taiwan, with plans to build its second supercomputer there. This underscores the importance of crucial supplier Taiwan Semiconductor Manufacturing Co (NYSE:TSM).

Nvidia has already tapped Samsung Electronics Co for the supply of high-bandwidth memory (HBM) chips and is now eying Intel Corp (NASDAQ:INTC) as a potential supplier to overcome the supply chain constraints.

Analysts reaffirmed Nvidia as the lead AI beneficiary after the recent Taiwan event, citing opportunities with its Hopper platform and Blackwell B100/200.

Nvidia stock gained over 217% in the last 12 months. Investors can gain exposure to the stock via SPDR S&P 500 (NYSE:SPY) and iShares Core S&P 500 ETF (NYSE:IVV).

Price Action: NVDA shares traded lower by 0.83% at $1,214.17 at the last check on Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga