Benzinga - by Anusuya Lahiri, Benzinga Editor.

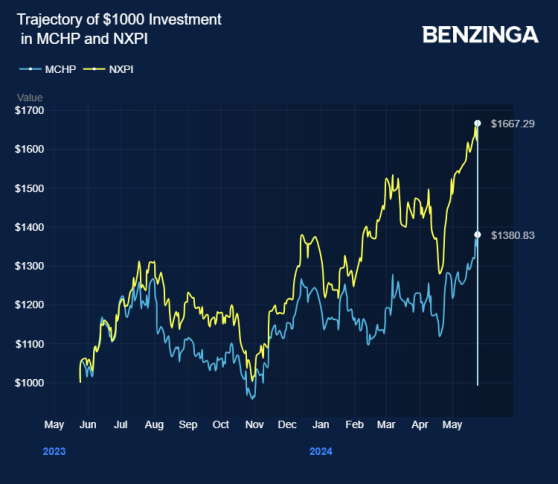

Microchip Technology Inc (NASDAQ:MCHP) and NXP Semiconductors NV (NASDAQ:NXPI) shares are trading higher after Mizuho analyst Vijay Rakesh upgraded the stock ratings to Buy from Neutral. The analyst gave price targets of $115 for Microchip and $325 for NXPI.

Rakesh noted that after 2-3 years of underperformance, the Analog group has baked in the 2023-24 slowdown and could start catching up with the SOX, in particular as inventories peak and utilization gets cut across the supply chain despite the overhang of increasing fab capacity and supply.

NXPI has traded in line with the SOX P/E during 2018-22 with strong top-line growth, Rakesh noted. But since the second half of 2022, NXPI has shown a disconnect in P/E to SOX with flat to down top line and high inventories. The analyst noted that peaking inventories, potentially improving business sentiment, industrial outlooks, and global PMIs, will position NXPI better in the second half of 2024 and 2025.

Rakesh maintained his June quarter revenue and EPS at $3.1 billion and $3.20 (consensus $3.11 billion and $3.17) while raising fiscal 2024 from $13.2 billion and $13.94 to $13.2 billion and $13.98 (above consensus $13.1 billion and $13.95) and fiscal 2025 from $14.2 billion and $15.17 to $14.6 billion and $16.10 (above consensus $14.3 billion and $15.90). The analyst introduced fiscal 2026 at $15.5 billion and $17.30 (above consensus $15.3 billion and $16.99).

For MCHP, after three consecutive quarters of down 15%-25% sequential top line guides, gross margin down from 68% to 60%, and utilization cut to 65%-70%, fiscal 2025 Capex down 35%-40% year-on-year, Rakesh noted inventories could start to peak, setting up for a modest improvement into the second half of 2024 and 2025. However, he noted offsets with OEMs moving auto/industrial design architectures from MCU to Arm-based processors and domain/zonal control and central computing.

For MCHP, Rakesh maintained his June quarter revenue and EPS at $1.2 billion and $0.52 (consensus $1.2 billion and $0.52) and fiscal 2025 at $5.8 billion and $2.91 (consensus $5.5 billion and $2.64). He raised fiscal 2026 from $7 billion and $4.38 to $7.1 billion and $4.50 (above consensus $6.9 billion and $4.19) and introduced fiscal 2027 at $8 billion and $5.26 (above consensus $7.7 billion and $4.99).

Price Actions: MCHP shares traded higher by 2.24% at $100.34 at the last check Friday. NXPI is up 2.78% at $280.31.

Image via Shutterstock

Latest Ratings for NXPI

| Feb 2022 | Needham | Maintains | Strong Buy | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Raymond James | Maintains | Outperform |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga