Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

Altria Group, Inc. (NYSE:MO)

- Dividend Yield: 8.40%

- Stifel analyst Matthew Smith reiterated a Buy rating with a price target of $50 on March 25. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Pamela Kaufman reiterated an Equal-Weight rating with a price target of $45 on July 18, 2023. This analyst has an accuracy rate of 69%.

- Recent News: On April 25, Altria Group reported a first-quarter FY24 sales decline of 2.5% year-on-year to $5.58 billion, beating the analyst consensus estimate of $4.71 billion.

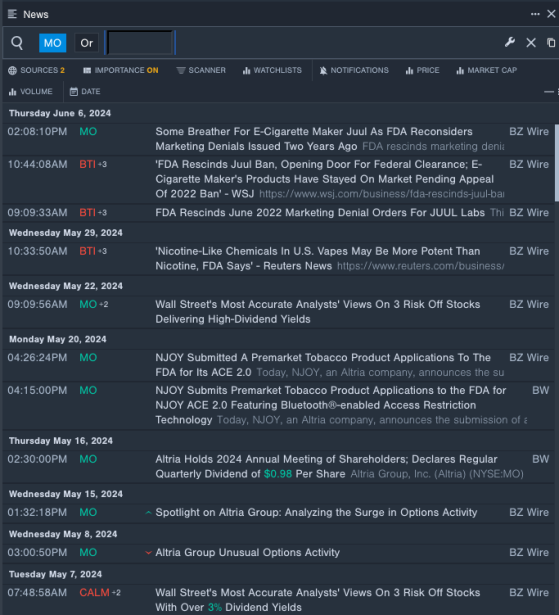

- Benzinga Pro's real-time newsfeed alerted to latest Altria Group's news

Kellanova (NYSE:K)

- Dividend Yield: 3.73%

- JP Morgan analyst Ken Goldman maintained a Neutral rating and raised the price target from $59 to $66 on May 3. This analyst has an accuracy rate of 80%.

- Piper Sandler analyst Michael Lavery maintained a Neutral rating and raised the price target from $59 to $60 on Feb. 12. This analyst has an accuracy rate of 72%.

- Recent News: On May 2, Kellanova reported better-than-expected first-quarter financial results and reaffirmed its guidance.

- Benzinga Pro's charting tool helped identify the trend in Kellanova's stock.

The Kraft Heinz Company (NASDAQ:KHC)

- Dividend Yield: 4.63%

- Piper Sandler analyst Michael Laveryupgraded the stock from Neutral to Overweight with a price target of $42 on May 22. This analyst has an accuracy rate of 72%.

- Evercore ISI Group analyst David Palmer upgraded the stock from In-Line to Outperform and raised the price target from $40 to $42 on Dec 11, 2023. This analyst has an accuracy rate of 70%.

- Recent News: On May 1, Kraft Heinz posted mixed first-quarter financial results.

- Benzinga Pro's signals feature notified of a potential breakout in Kraft Heinz’s shares.

Check This Out: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for KHC

| Feb 2022 | Credit Suisse | Maintains | Underperform | |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Underperform |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga