Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

Royalty Pharma plc (NASDAQ:RPRX)

- Dividend Yield: 3.06%

- B of A Securities analyst Geoff Meacham maintained a Buy rating and cut the price target from $40 to $38 on April 12. This analyst has an accuracy rate of 64%.

- JP Morgan analyst Chris Schott maintained an Overweight rating and slashed the price target from $45 to $42 on Feb. 20. This analyst has an accuracy rate of 62%.

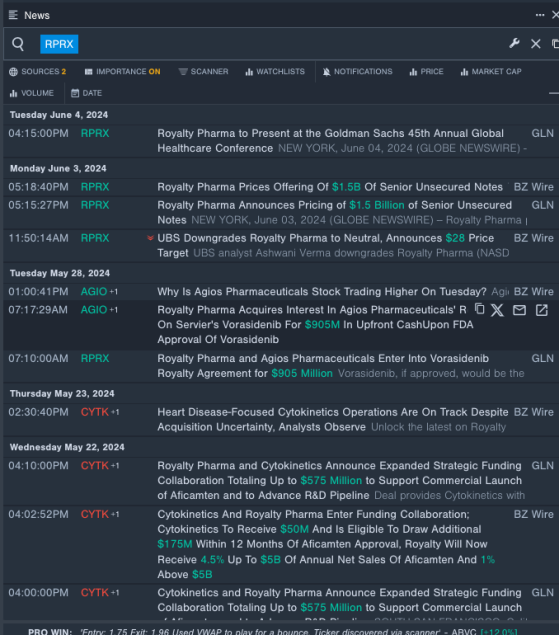

- Recent News: On June 3, Royalty Pharma priced offering of $1.5 billion of senior unsecured notes.

- Benzinga Pro's real-time newsfeed alerted to latest Royalty Pharma news

Johnson & Johnson (NYSE:JNJ)

- Dividend Yield: 3.38%

- Cantor Fitzgerald analyst Louise Chen reiterated an Overweight rating with a price target of $215 on May 6. This analyst has an accuracy rate of 68%.

- Morgan Stanley analyst Terence Flynn maintained an Equal-Weight rating and cut the price target from $168 to $167 on April 17. This analyst has an accuracy rate of 70%.

- Recent News: Johnson & Johnson is scheduled to host a conference call for investors on Wednesday, July 17 to review second-quarter results.

- Benzinga Pro's charting tool helped identify the trend in Johnson & Johnson's stock.

Medtronic plc (NYSE:MDT)

- Dividend Yield: 3.42%

- Wells Fargo analyst Larry Biegelsen maintained an Overweight rating and increased the price target from $102 to $105 on May 24. This analyst has an accuracy rate of 71%.

- Truist Securities analyst Richard Newitter maintained a Hold rating and cut the price target from $90 to $88 on May 24. This analyst has an accuracy rate of 74%.

- Recent News: Medtronic, last week, initiated a recall for some versions of its StealthStation S8 application.

- Benzinga Pro's signals feature notified of a potential breakout in Medtronic's shares.

Check This Out: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for RPRX

| Oct 2021 | Citigroup | Upgrades | Neutral | Buy |

| Aug 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Jul 2021 | Tigress Financial | Initiates Coverage On | Buy |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga