Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

AT&T Inc. (NYSE:T)

- Dividend Yield: 6.05%

- Scotiabank analyst Maher Yaghi maintained a Sector Outperform rating and raised the price target from $22 to $22.5 on April 25. This analyst has an accuracy rate of 64%.

- Citigroup analyst Michael Rollins maintained a Buy rating and raised the price target from $19 to $20 on Feb. 1. This analyst has an accuracy rate of 75%.

- Recent News: The company is set to release its second-quarter results on Wednesday, July 24.

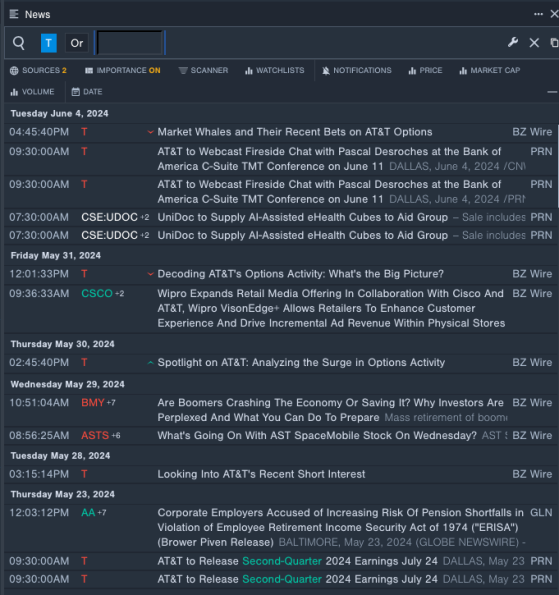

- Benzinga Pro's real-time newsfeed alerted to latest AT&T's news

Verizon Communications Inc. (NYSE:VZ)

- Dividend Yield: 6.40%

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and increased the price target from $50 to $52 on May 17. This analyst has an accuracy rate of 71%.

- Oppenheimer analyst Timothy Horan maintained an Outperform rating with a price target of $48 on April 23. This analyst has an accuracy rate of 70%.

- Recent News: AST SpaceMobile, last week, announced a partnership with Verizon Communications to provide Verizon customers with direct-to-cellular AST SpaceMobile service when needed..

- Benzinga Pro's charting tool helped identify the trend in Verizon's stock.

Omnicom Group Inc. (NYSE:OMC)

- Dividend Yield: 3.07%

- JP Morgan analyst David Karnovsky maintained an Overweight rating and raised the price target from $104 to $108 on April 17. This analyst has an accuracy rate of 67%.

- Citigroup analyst Jason Bazinetmaintained a Buy rating and cut the price target from $113 to $112 on Oct. 19, 2023. This analyst has an accuracy rate of 67%.

- Recent News: On May 30, Omnicom named Mazen Abd Rabbo as SVP of newly formed Omnicom Group Qatar.

- Benzinga Pro's signals feature notified of a potential breakout in Omnicom shares.

Read More: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for VZ

| Jan 2022 | JP Morgan | Downgrades | Overweight | Neutral |

| Jan 2022 | Tigress Financial | Maintains | Buy | |

| Dec 2021 | Daiwa Capital | Initiates Coverage On | Neutral |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga