Benzinga - by Avi Kapoor, Benzinga Staff Writer.

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

Dine Brands Global, Inc. (NYSE:DIN)

- Dividend Yield: 5.31%

- Barclays analyst Jeff Kessler maintained an Overweight rating and cut the price target from $57 to $54 on May 9. This analyst has an accuracy rate of 79%.

- Wedbush analyst Nick Setyan maintained a Neutral rating and lowered the price target from $48 to $46 on May 9. This analyst has an accuracy rate of 83%.

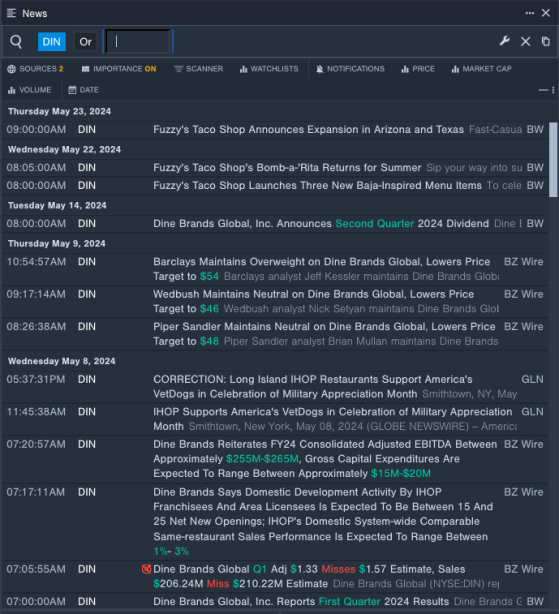

- Recent News: On May 8, Dine Brands Global posted downbeat quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest Dine Brands Global's news

Ford Motor Company (NYSE:F)

- Dividend Yield: 4.97%

- Piper Sandler analyst Alexander Potter initiated coverage on the stock with a Neutral rating and a price target of $13 on March 15. This analyst has an accuracy rate of 77%.

- Morgan Stanley analyst Adam Jonas maintained an Overweight rating and raised the price target from $15 to $16 on Feb. 13. This analyst has an accuracy rate of 63%.

- Recent News: Ford Motor on Wednesday reported a whopping 88% jump in electric vehicle sales in the U.S. for the first five months of 2024.

- Benzinga Pro's Earnings Calendar was used to track Ford’s upcoming earnings report.

Hasbro, Inc. (NASDAQ:HAS)

- Dividend Yield: 4.78%

- JP Morgan analyst Christopher Horvers upgraded the stock from Neutral to Overweight rating and raised the price target from $61 to $74 on May 23. This analyst has an accuracy rate of 71%.

- Jefferies analyst StephanieWissinkmaintained a Buy rating and increased the price target from $61 to $63 on April 19. This analyst has an accuracy rate of 79%.

- Recent News: On May 8, Hasbro said it has raised $500 million of corporate debt through a sale of 10-year bonds, its first bond sale since 2019.

- Benzinga Pro's signals feature notified of a potential breakout in Hasbro's shares.

Have A Look At This: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for DIN

| Mar 2022 | Truist Securities | Maintains | Buy | |

| Mar 2022 | Deutsche Bank | Maintains | Buy | |

| Mar 2022 | Barclays | Maintains | Overweight |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga