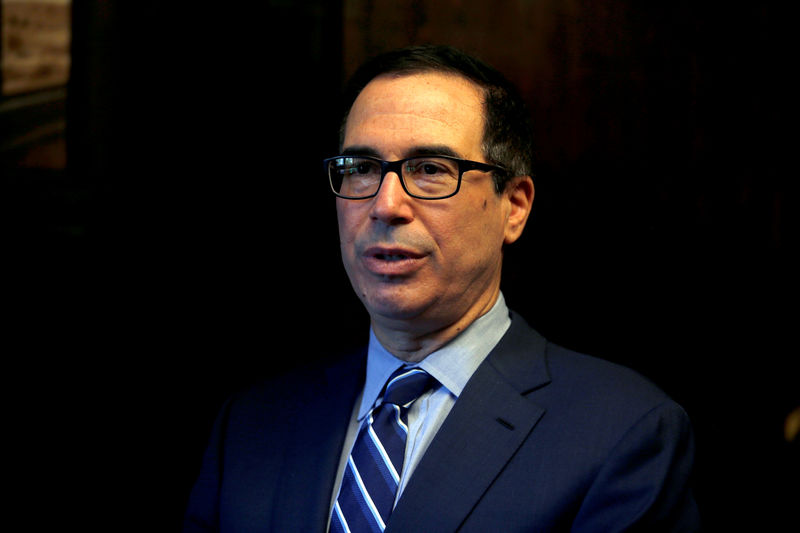

WASHINGTON (Reuters) - U.S. Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs imposed on Chinese imports and suggested offering a tariff rollback during trade discussions scheduled for Jan. 30, the Wall Street Journal reported on Thursday, citing people familiar with the internal deliberations.

But Trade Representative Robert Lighthizer has resisted the idea, and the proposal had not yet been introduced to President Donald Trump, according to the Journal.

U.S. stocks advanced on the news even as a Treasury spokesman working with the administration's trade team denied the report. (N)

"Neither Secretary Mnuchin nor Ambassador Lighthizer have made any recommendations to anyone with respect to tariffs or other parts of the negotiation with China," the spokesman said. "This an ongoing process with the Chinese that is nowhere near completion.”

Chinese Vice Premier Liu He will visit the United States on Jan. 30 and 31 for the latest round of trade talks aimed at resolving a bitter trade dispute between the world's two largest economies.

In December, Washington and Beijing agreed to a 90-day truce in a trade war that has disrupted the flow of hundreds of billions of dollars of goods.

Mid-level U.S. and Chinese officials met in Beijing last week to discuss China's offers to address U.S. complaints about intellectual property theft and increase purchases of U.S. goods and services.

Lighthizer did not see any progress made on structural issues during those talks, Republican U.S. Senator Chuck Grassley said earlier this week.

The Trump administration is scheduled to increase tariffs on $200 billion worth of Chinese goods to 25 percent on March 2 from 10 percent.

The timeline is seen as ambitious, but the resumption of face-to-face negotiations has bolstered hopes of a deal.

China has repeatedly played down complaints about intellectual property abuses, and has rejected accusations that foreign companies face forced technology transfers.

Industrial stocks (SPLRCI), which have been sensitive to trade developments, jumped 1.4 percent after the Wall Street Journal report.