By Luc Cohen and Jonathan Stempel

NEW YORK (Reuters) -A U.S. judge on Thursday stopped short of approving Deutsche Bank AG (ETR:DBKGn)'s $75 million settlement with women who said that Jeffrey Epstein abused them, and that the German bank facilitated the late financier's sex trafficking.

At a hearing in Manhattan federal court to consider preliminary approval of the settlement, U.S. District Judge Jed Rakoff said he needed more specifics about who qualified as members of the proposed class of Epstein victims.

Rakoff said people without legal training might not be able to figure out whether they qualified, and that lawyers were required to make it easy for them to understand whether they did.

"If I had consensual sex with Jeffrey Epstein when I was a minor, am I covered?" Rakoff asked rhetorically. "I'm disappointed in the notice, I'm disappointed in the proposed order, and we will need to get them revised promptly."

The judge directed lawyers for Deutsche Bank and Epstein's accusers to submit a revised settlement by June 12, and said he would be inclined to grant approval with appropriate changes.

David Boies, a lawyer for Epstein's accusers, told reporters after the hearing he agreed that the settlement needed to be clearer. A Deutsche Bank spokesperson declined to comment.

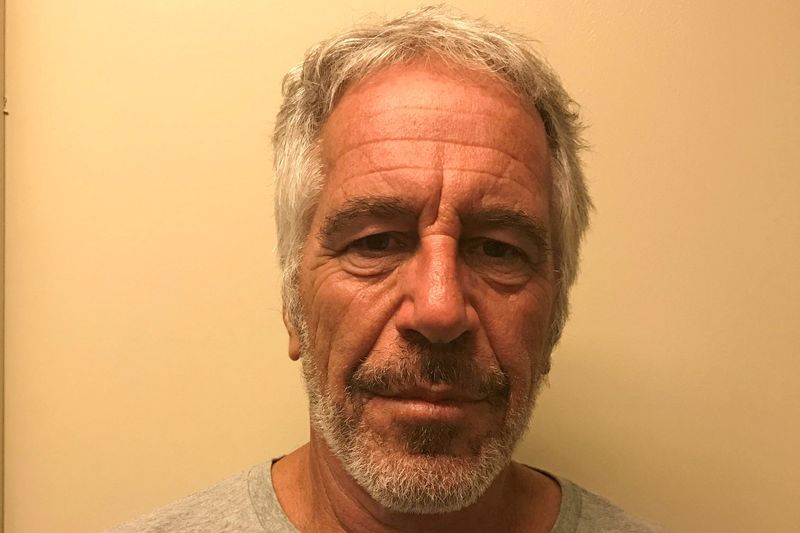

Epstein, who pleaded guilty in 2008 to a Florida prostitution charge and registered as a sex offender, had been a Deutsche Bank client from 2013 to 2018.

He died in August 2019 at age 66 in a Manhattan jail while awaiting trial for sex trafficking, in what New York City's medical examiner called a suicide.

Filed in November, the lawsuit is led by a woman, known as Jane Doe 1, who said Epstein sexually abused her from 2003 to 2018. She accused Deutsche Bank of missing red flags in Epstein's accounts that he was engaged in wrongdoing.

At Thursday's hearing, Rakoff also suggested the proposed fees for the plaintiffs' lawyers of up to 30% of the settlement amount may be too high.

The lawyers are also representing Epstein's accusers in a separate lawsuit against JPMorgan Chase & Co (NYSE:JPM), where Epstein was a client from 1998 until 2013 when he was terminated.

JPMorgan has denied liability, and says it would have dismissed Epstein sooner if it knew about his alleged sex trafficking.