By Samuel Indyk

Investing.com – At 07:30GMT, FTSE 100 futures are trading higher by 1.7% at 7,139.

In FX markets, GBP/USD is trading at 1.3326, EUR/GBP is trading at 0.8454. The US Dollar Index is up 0.2%.

Today’s calendar highlights include UK Mortgage Approvals, Eurozone Consumer Confidence, German CPI, Canadian IPPI, US Pending Home Sales, Fed Chair Powell Speaks

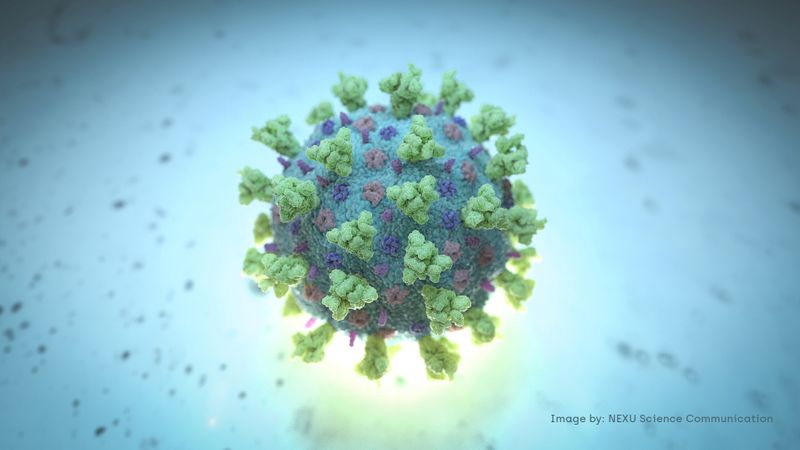

Coronavirus

The World Health Organization designated B.1.1.529 a Variant of Concern and named it Omicron. WHO said primary evidence suggests Omicron carries a greater risk of infection.

UK announced temporary measures, including mandatory face covering in shops and on public transport. All international arrivals must now take a 2-day PCR test and self-isolate until they receive a negative result. The UK has recorded three cases of the new variant.

Stocks

BT (LON:BT) - India’s Reliance Industries is reportedly considering a bid for BT. Reliance may also propose to partner with BT’s fibre optic arm Openreach and fund its expansion plans. (Economic Times)

AstraZeneca (LON:AZN) - Said they are conducting research in Botswana and Eswatini to obtain real world data about how the vaccine performs against the Omicron variant.

AJ Bell (LON:AJBA) - To launch new commission-free mobile app called Dodl by AJ Bell, aimed at competing with low cost investment platforms and be straightforward and accessible for retail traders. The app will be commission free but have an annual charge of 0.15%.

Hammerson (LON:HMSO) - Confirms it is in discussions on terms of a possible disposal of Silverburn, its flagship destination near Glasgow. The site is currently held in a 50/50 joint venture with CPPIB. The Company confirms the pricing under discussion is £140 million.

A.G.Barr (LON:BAG) - Positive momentum reported in September has continued and sales have grown ahead of expectations. As a result of continued strong volume performance and despite ongoing near term operating cost pressures, now anticipate both revenue and profit before tax for the full year to be ahead of current market expectations. Assuming no significant changes to current market conditions, expect revenue to be in the order of £264 million and profit before tax to be around £41 million.

Marshall Motor Holdings (LON:MMHM) - Constellation Automotive Holdings has made an offer for Marshall Motor Holdings of 400 pence per share in cash or approximately £322.9 million. Constellation has received an undertaking to accept the offer from 64.4% shareholder Marshall of Cambridge.

Molten Ventures (LON:GROW) - 27% Gross Portfolio fair value growth in the six-month period to 30 September 2021. NAV per share increased to 887 pence from 743 pence. Anticipate fair value growth in the region of 35% for the full year to 31 March 2022, subject to wider market conditions.

IP Group (LON:IPO) - Following the completion of a funding round by a portfolio company in its top twenty most valuable holdings, it has recorded a net unrealised fair value gain of approximately £27.4 million or 3p per share.

McColl's (LON:MCLSM) - Terms have been agreed with Morrisons to extend the number of Morrisons Daily conversions from 350 to 450 stores. Separately, agreement has been reached to defer a financial covenant test due on 28 November 2021 to 31 December 2021, and thereafter it is expected to roll on a monthly basis.

Amigo Holdings (LON:AMGO) - Board continues to pursue a new Scheme to address the complaints liability and provide a solution for customers with a valid complaint. A revised offer, which incorporates two Scheme options, was submitted to the Independent Customer Committee on 12 November. The Board's view is that a Scheme that is contingent on a continuing business will provide creditors with more value and a more certain outcome. Neither of the proposed Schemes is expected to satisfy the liability owed to redress creditors with valid claims in full, but the contribution to the new Scheme will be significantly increased. Without an approved Scheme, Amigo expects to have to file for administration or other insolvency process.