Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Molson Coors Beverage Company (NYSE:TAP)

- On May 22, Molson Coors Beverage Company announced the pricing of its public offering of euro-denominated senior notes. The company's stock fell around 7% over the past month and has a 52-week low of $52.60.

- RSI Value: 23.78

- TAP Price Action: Shares of Molson Coors Beverage gained 0.4% to close at $53.22 on Thursday.

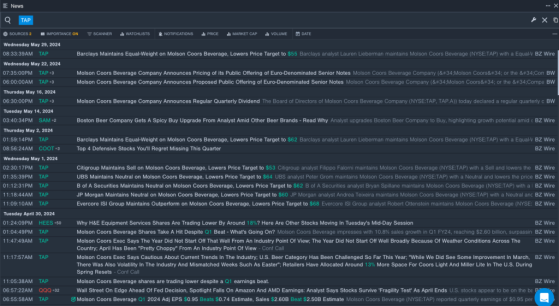

- Benzinga Pro's real-time newsfeed alerted to latest TAP news.

Adecoagro S.A. (NYSE:AGRO)

- On May 16, Adecoagro posted better-than-expected quarterly sales. The company's stock fell around 10% over the past month. It has a 52-week low of $8.82.

- RSI Value: 29.47

- AGRO Price Action: Shares of Adecoagro gained 0.8% to close at $9.78 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in Adecoagro's stock.

The Kroger Co. (NYSE:KR)

- On May 15, GoodRx Holdings announced a new direct contracting agreement with Kroger. The company's stock fell around 3% over the past five days and has a 52-week low of $42.10.

- RSI Value: 29.17

- KR Price Action: Shares of Kroger rose 0.2% to close at $51.98 on Thursday.

- Benzinga Pro's earnings calendar was used to track Kroger's upcoming earnings report

The Boston Beer Company, Inc.. (NYSE:SAM)

- On April 25, Boston Beer reported better-than-expected first-quarter financial results and issued FY24 GAAP EPS guidance. “We were pleased to see flat depletion trends in the first quarter and to deliver revenue growth,” said Chairman and Founder Jim Koch. “We remain committed to investing across our portfolio of brands to drive long-term revenue growth while also expanding our margins.” The company's shares lost around 8% over the past month. The company's 52-week low is $254.40.

- RSI Value: 29.37

- SAM Price Action: Shares of Boston Beer rose 0.2% to close at $256.41 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in Boston Beer shares.

Hormel Foods Corporation (NYSE:HRL)

- On May 30, Hormel Foods reported second-quarter fiscal 2024 sales declined 3% year-over-year to $2.887 billion, missing the consensus of $2.967 billion. "To reflect our solid first-half performance and our expectations for continued growth from our Foodservice and International segments, ongoing improvements across our supply chain, and further benefits from our transform and modernize initiative, we are updating our full-year earnings outlook," stated Jim Snee, chairman of the board, president and chief executive officer. The company's shares fell around 13% over the past five days. The company has a 52-week low of $28.51.

- RSI Value: 22.95

- HRL Price Action: Shares of Hormel Foods fell 9.7% to close at $30.79 on Thursday.

- Insider trades for Hormel Foods were monitored using Benzinga Pro.

Read More: Dell, Asana And 3 Stocks To Watch Heading Into Friday

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga