Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

FutureFuel Corp. (NYSE:FF)

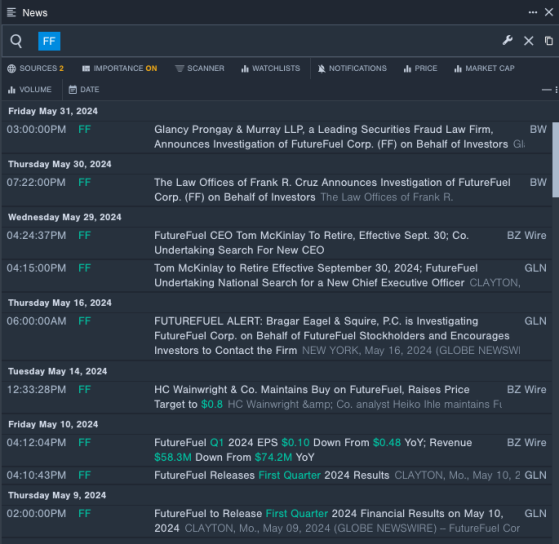

- On May 29, FutureFuel said its CEO Tom McKinlay will retire, effective Sept. 30. The company's stock fell around 10% over the past five days and has a 52-week low of $4.26.

- RSI Value: 24.57

- FF Price Action: Shares of FutureFuel closed at $4.28 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest FutureFuel news.

Green Plains Inc. (NASDAQ:GPRE)

- On May 3, Green Plains posted weaker-than-expected quarterly sales. “Margins in the first quarter were weaker across our product mix and we were impacted by industry oversupply during a mild winter leading to stock builds and lower prices realized, though margins have improved from the first quarter lows, and compared to this time frame in prior years the forward curve looks better for the rest of the year,” said Todd Becker, President and Chief Executive Officer. The company's stock fell around 15% over the past month. It has a 52-week low of $16.74.

- RSI Value: 28.67

- GPRE Price Action: Shares of Green Plains gained 1.1% to close at $17.17 on Friday.

- Benzinga Pro's charting tool helped identify the trend in GPRE's stock.

Ultrapar Participações S.A. (NYSE:UGP)

- The company's stock fell around 17% over the past month and has a 52-week low of $3.40.

- RSI Value: 28.19

- UGP Price Action: Shares of Ultrapar Participações fell 3.5% to close at $4.43 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in Ultrapar Participações shares.

Read More: Investor Optimism Improves; US Stocks Record Gains For May

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga