Benzinga - by Avi Kapoor, Benzinga Staff Writer.

The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

National Grid plc (NYSE:NGG)

- On May 23, National Grid reported an equity raise of £7 billion and a year-over-year decrease in full-year revenue results. John Pettigrew, Chief Executive, said, "Alongside our new five-year financial framework, we are also today further evolving our strategy to focus on networks and will therefore be streamlining our business as we announce our intention to sell Grain LNG, our UK LNG asset, and National Grid Renewables, our US onshore renewables business." The company's stock fell around 22% over the past month and has a 52-week low of $55.13.

- RSI Value: 28.78

- NGG Price Action: Shares of National Grid fell 1.8% to close at $55.50 on Tuesday.

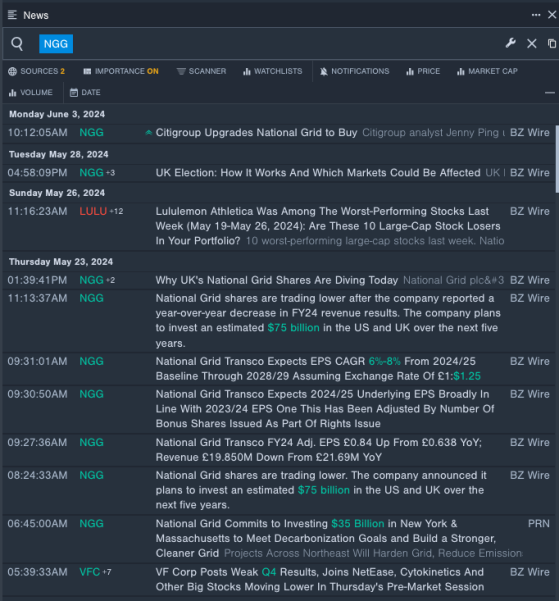

- Benzinga Pro's real-time newsfeed alerted to latest National Grid’s news.

Pure Cycle Corporation (NASDAQ:PCYO)

- On April 10, Pure Cycle posted an increase in quarterly sales. “Due to the continued success of our Sky Ranch Master Planned community, we have three phases of lot development now under construction accelerating the timing of delivering our lots to our home builder customers as well as lots for our single-family rental segment. As we complete final landscaping in Phase 2A, lot production through our seasonally slow winter months will see accelerated deliveries in the remaining half of our fiscal year with completion of approximately 211 lots in Phase 2B and substantial progress on our overlapping production of 228 lots in Phase 2C” commented Mark Harding, CEO of Pure Cycle. The company's stock fell around 4% over the past month. It has a 52-week low of $9.00.

- RSI Value: 21.49

- PCYO Price Action: Shares of Pure Cycle rose 0.9% to close at $9.23 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in Pure Cycle's stock.

Also Check This Out: S&P 500, Nasdaq Hit Record Highs As Apple Shares Surge: Fear And Greed Index Shows Progress Amid Improving Market Sentiment

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga