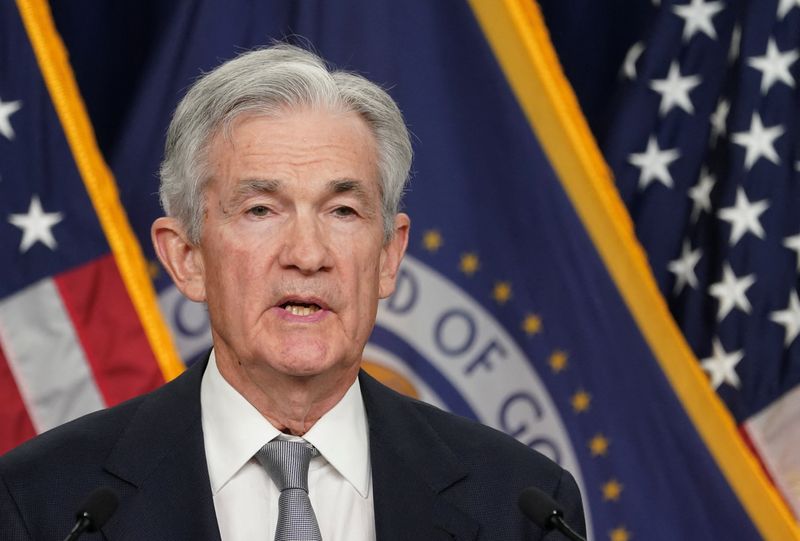

Markets are bracing for a crucial week, with Federal Reserve Chair Jerome Powell scheduled to testify today and tomorrow, potentially offering insights into the monetary policy path ahead. Furthermore, June CPI data will be released on Thursday.

While the CPI release is pivotal, Evercore ISI strategists said they will be looking for indications from Powell that the Fed is moving closer to deciding on a rate cut in September, provided ongoing inflation data confirms a reduction in the run-rate post-Q1.

“With election fever mounting, there is pressure to set out the central bank’s reasoning in a transparent manner to deflect accusations that the Fed might act in a political manner,” strategists said in a note.

“Powell will also be pressed on a range of issues relating to fiscal policy, including the upward pressure on longer-term bond yields driven by rising market expectations of a Republican clean sweep that would deliver easier fiscal and a reflationary policy shock overall,” they added.

The Fed chair will endeavor to steer clear of political entanglements and avoid detailing the Fed’s analysis, even when the implications are clear, such as the impact of immigration crackdowns on labor supply.

If questioned about bond yields, Powell is expected to acknowledge that many factors influence yields and that the Fed will consider market developments when setting policy, without speculating on specific causes, Evercore noted.

Regarding core monetary policy signaling, Evercore ISI strategists sense that the Fed's risk assessment is shifting slightly. There is increasing evidence that the economy is moderating, supporting the notion that current policies are restrictive. This is reinforced by recent cooler inflation data, which suggests that upside inflation risks are easing.

At the same time, less robust labor data is raising concerns about future employment risks, making policymakers less inclined to maintain a prolonged wait-and-see approach to triple-check the inflation trend.

“In our view – subject to support from Thursday’s CPI print – the evidence is gradually accumulating that the time has indeed come for the Fed to cash in its chips and start edging rates down to secure the soft landing, and we are looking for Powell’s testimony to inch further in this direction, without committing to anything,” strategists wrote.