Investing.com — As tech stocks face a challenging earnings season due to the mismatch between valuations and shifting interest rate expectations for the months ahead, knowing which of the sector's stocks to buy can prove to be the difference between success and failure amid this year's bull market.

The recent market reactions to Meta's (NASDAQ:META), Tesla's (NASDAQ:TSLA), and Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) reports have only underscored the fact that we may be facing a particularly volatile season for tech earnings.

But amid all that noise, what is the best big tech stock to hold right now?

Tough question, right? Well, not for our predictive AI.

In fact, bought in September 2020, Microsoft (NASDAQ:MSFT) has been the longest-held mega-cap stock in our portfolio, a period during which the stock rallied a hefty 81%.

But Microsoft is only a small part of our strategy - a one-hundredth part, to be precise. Our real strength lies in our best-in-breed, monthly updated selection of 70+ winners.

For less than $9 a month, you can gain access to our AI-powered fresh list of monthly winners. This subscription will help you make informed investment decisions and stay ahead in the market.

Once again, this earnings season has been a testament to our AI's ability to outperform the market. Among the tech mega-caps, it has advised users to buy four stocks - two of which have already reported results, namely:

- Tesla (NASDAQ:TSLA): up 17.6% since reporting last Wednesday

- Microsoft Corporation (NASDAQ:MSFT): Up 4.3% since reporting last night.

And there are two more mega-caps in our portfolio ready to smash earnings. Want to find out which stocks we're talking about?

Subscribe here for less than $2 a week and outperform with our AI-generated picks! (Yes, that's really how cheap it is.)

But how does our AI manage to stay ahead of the market? Simple: By using state-of-the-art AI-powered financial modeling, our AI manages to keep its users one step ahead of everyone else.

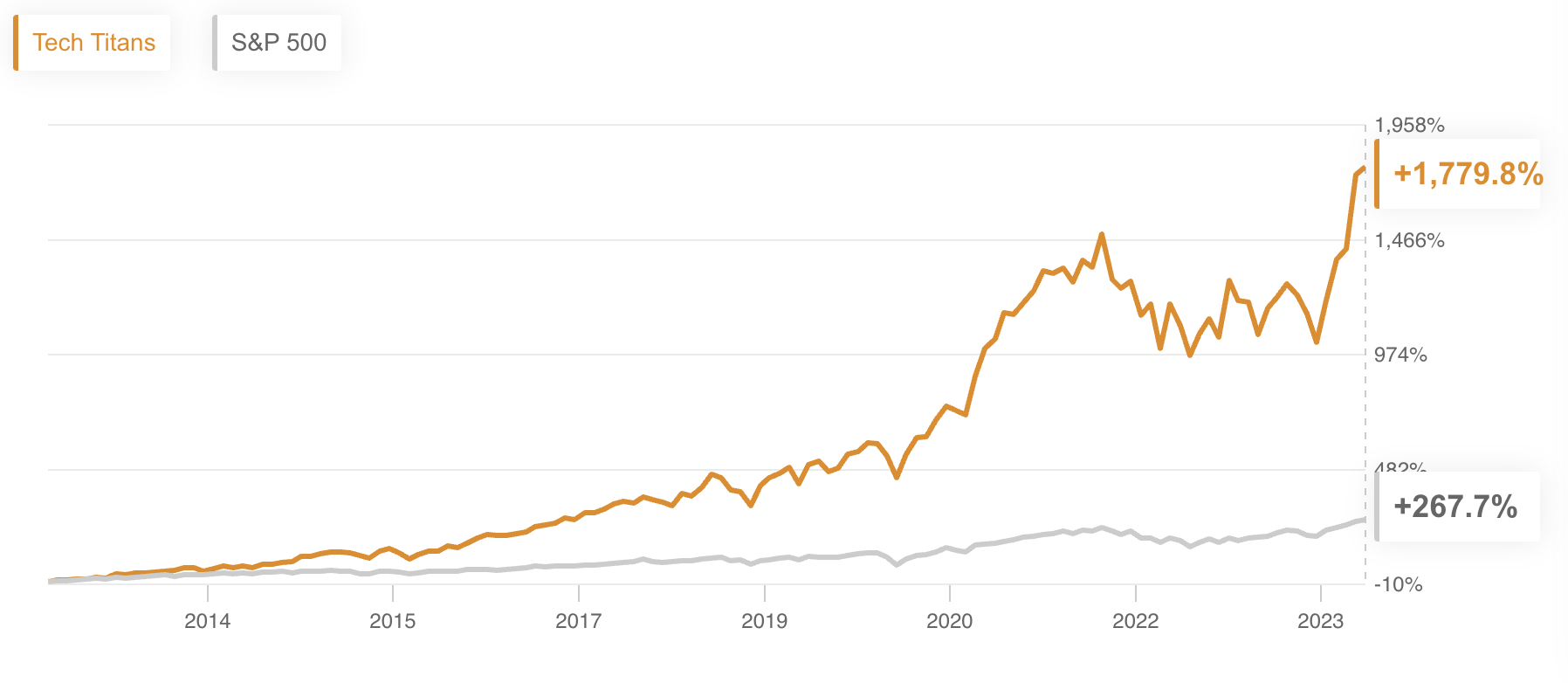

In fact, this exact methodology has led our flagship Tech Titans strategy to garnish an eye-popping 1,779% over the last decade.

Do not miss out on the next winner; subscribe now for less than $9 a month, and never miss another bull market again by not knowing which stocks to buy!

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

Now, as earnings season heats up, the question is: Will you keep on guessing or have an insight into the winners?

For less than $9 a month, that decision has never been easier.

Join now and never miss another bull market again!

*And since you made it all the way to the end of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS20242.