(Bloomberg Gadfly) -- "Why did the market go up today?"

"There must have been more buyers than sellers."

That piece of circular logic is a sort of laconic joke among traders, equivalent to saying: "I have no idea." Naturally, prices will only rise if the enthusiasm of buyers outweighs the fear of sellers.

At the same time, it captures a worthwhile nugget of wisdom about where bitcoin and other cryptocurrencies will head now they've had sign-off from U.S. derivatives regulators to begin integrating with the world's futures and options markets.

That's because to date, the logistical difficulties of investing in bitcoin have represented a barrier to entry that's tended to keep matters firmly skewed toward buyers. For the most part, those prepared to look past day-long transaction times and risks of a Mt. Gox-style heist have either had an abiding faith in the cryptocurrency, or at the very least a misplaced confidence that past performance is a guarantee of future returns. With an increasing number of such buyers, it's no surprise that prices have been rising so fast.

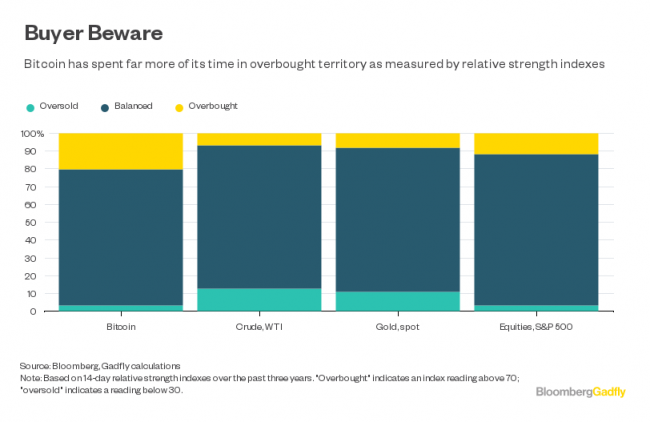

You can actually measure this skew, at one remove, by looking at technical indicators. Momentum oscillators like the relative strength index suggest whether an asset is overbought or oversold by comparing the magnitudes of up days and down days. Over the past three years, bitcoin has been in "overbought" territory about 20 percent of the time and "oversold" just 3.3 percent of the time -- a far sharper tilt toward buyers than seen in spot gold, WTI crude, or the S&P 500 Index.

A futures market ought to change that. Bitcoin's clunky infrastructure has hitherto been one of its most salient features, but that more or less disappears with derivatives: One of their key advantages, as Gadfly has argued before, is their ability to replace the Rube Goldberg mechanisms of real-world trading with smooth, centralized exchange and clearing operations.

That's likely to bring in a much more diverse group of investors. Protected by the ability to hedge some of that pricing risk with options, those who argue that $10,000 is a ridiculous price for something that cost $1,000 a year ago will finally have a decent way of putting their money where their mouth is, by short-selling.

It's tempting to regard that as the end of the story. Futures trading mushrooms; professional investors come in to break up the bitcoin bugs' little game; sanity returns to financial markets.

In truth, it's likely to be more complicated than that. To be sure, a bitcoin derivatives market is likely to become vastly larger and more liquid than the underlying blockchain-based trade -- that's the nature of futures and options. The $376 billion notional value of gold derivatives outstanding at the end of June, for instance, is equivalent to about 10 times the 953 metric tons of physical gold purchased in that quarter.

But size isn't everything. For all that liquidity is meant to aid in price discovery, futures take their cue from the spot market as often as the other way around, as Bloomberg's macro strategist Cameron Crise argued Monday. And just as a derivatives market is likely to bring in more short-sellers, it could get more longs into the trade, as well. That could drive prices up further, particularly as investors rotate out of the much larger equity, debt and commodity markets into the crowded crypto space.

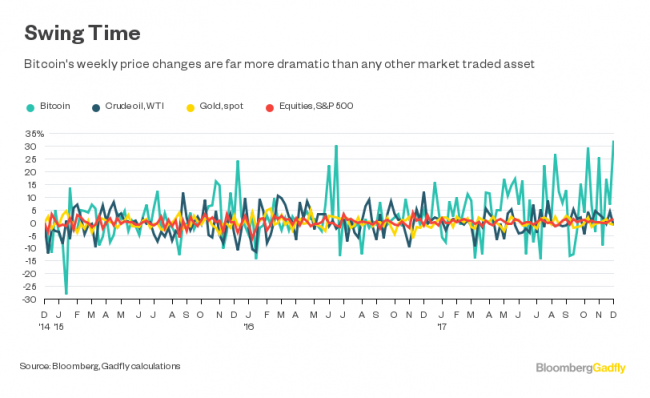

The more likely immediate effect will be not on prices, but volatility. To date, bitcoin has operated with no guardrails, rising at double-digit rates in three out of the past five weeks and gaining as much as 17 percent in a day last Monday. A futures market ought to take the edge off that in two ways: Firstly, by tripping the 20 percent daily trading limits already incorporated in the CME Group Inc. (NASDAQ:CME) futures contract; and secondly, by unleashing a wave of automated buy and sell orders whenever it crashes through key levels, helping to cancel out the effect of the underlying move.

Bitcoin's one-day gain last Monday

+17%

Still, don't expect to see a dramatic bursting of bitcoin's bubble. A year after spot gold's nominal peak at $1,900 an ounce in September 2011, it had fallen only 11 percent and even now it's only a third lower than its record. The narrative of gold's strength took two decades to demolish after its 1980 peak and another decade to build back up, and it still holds a lot of currency.

Bitcoin may not be very different. A one-third fall like gold has suffered may sound dramatic -- but in the weird world of bitcoin, it would only return things to the levels of three weeks ago.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

David Fickling is a Bloomberg Gadfly columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.