Benzinga - by Zacks, Benzinga Contributor.

Tesla (NASDAQ: TSLA) posted disappointing first-quarter 2024 results, missing both earnings and revenue estimates. This marked the third earnings miss in a row for the electric vehicle behemoth, following 10 straight quarters of beat. The company remained cautious about its vehicle volume growth rate for 2024, which is expected to be noticeably lower than 2023.

First-quarter earnings per share of 45 cents missed the Zacks Consensus Estimate of 46 cents and also declined from the year-ago figure of 85 cents. Total revenues of $21.3 billion missed the consensus mark of $22.6 billion and declined 9% year over year.

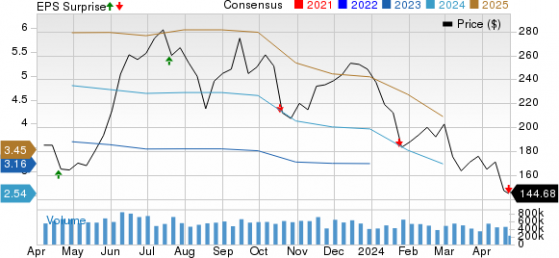

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Key Takeaways Tesla's first-quarter production totaled 433,371 units (412,376 Model 3/Y and 20,995 other models), which declined 2% year over year and missed our estimate of 474,571 units. The company delivered 386,810 vehicles, reflecting a year-over-year decline of 9% and lagging our estimate of 439,292 units. The Model 3/Y registered deliveries of 369,783 vehicles, marking a year-over-year decline of 10% and missing our projection of 413,323 units.

Total automotive revenues of $17.38 billion were down 13% year over year and lagged our estimate of $20.87 billion. The reported figure also included $442 million from the sale of regulatory credits for electric vehicles, which decreased 15.2% year over year. Automotive sales, excluding revenues from leasing and regulatory credits, totaled $16.46 billion, missing our projection of $19.85 billion.

Automotive gross profit came in at $3.2 billion. Automotive gross margin came in at 18.5%, which declined from 21.1% reported in the first quarter of 2023 and missed our forecast of 18.6%. Tesla's operating margin declined 592 basis points year over year to 5.5% in the quarter under discussion and also lagged our estimate of 8.2%.

Energy Generation and Storage revenues came in at $1.64 billion in first-quarter 2024, which was higher than the year-ago quarter's figure of $1.53 billion but missed our estimate of $1.84 billion. Notably, energy storage deployments came in at 4.05 GWh, falling short of our projection of 4.2 GWh.

Services and Other revenues were $2,288 million, which increased 25% year over year and topped our estimate of $2,273.7 million. Supercharging, part sales, used vehicle sales and merchandise sales drove growth on a year-over-year basis.

Financials Tesla had cash/cash equivalents/investments of $26.86 billion as of Mar 31, 2024, compared with $29.1 billion as of Dec 31, 2023. Long-term debt and finance leases, net of the current portion, totaled $2,899 million, up from $2,857 million as of Dec 31, 2023.

Net cash provided by operating activities amounted to $242 million in first-quarter 2024. Capital expenditure totaled $2.77 billion in the quarter under review. Tesla registered a negative free cash flow of $2.53 billion during the reported quarter against a positive free cash flow of $441 million generated in the year-ago period.

Zacks Rank & Key Picks TSLA currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked players in the auto space are Geely Automobile Holdings Limited (OTC: GELYY), Allison Transmission Holdings, Inc. (NYSE: ALSN) and Volkswagen AG (OTC: VWAGY), each sporting a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for GELYY's 2024 sales suggests year-over-year growth of 36.6%. The EPS estimates for 2024 and 2025 have moved up 34 cents and 54 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for ALSN's 2024 sales and earnings suggests year-over-year growth of 2.81% and 4.73%, respectively. The EPS estimates for 2025 have improved 32 cents in the past 30 days.

The Zacks Consensus Estimate for VWAGY's 2024 sales suggests year-over-year growth of 20.16%. The EPS estimates for 2024 and 2025 have improved 7 cents and 29 cents, respectively, in the past 30 days.

To read this article on Zacks.com click here.

Read the original article on Benzinga