Benzinga - by Shanthi Rexaline, Benzinga Editor.

A Tesla, Inc. (NASDAQ:TSLA (NASDAQ:TSLA)) analyst predicts a potential 5% drop in the stock price if shareholders vote down CEO Elon Musk‘s controversial $56 billion pay package.

What Happened: Toni Sacconaghi, an analyst at Bernstein with an “Underperform” rating on Tesla shares, believes passing the proposal will be difficult, Business Insider reported.

“I think it’s going to be tough to pass. The math is relatively straightforward. You have to get a majority of votes of shareholders that vote, and part of the challenge for Tesla is that not everyone votes,” Sacconaghi told CNBC, as per the report.

He cited low historical voter turnout (63% maximum) and the influence of proxy advisory firms ISS and Glass Lewis, who both recommend rejecting the plan.

Sacconaghi anticipates a significant number of passive investors, who comprise roughly 20% of Tesla’s shareholder base, will follow the proxy firms’ advice. This could lead to a “No” vote majority and a predicted sell-off due to concerns about Musk’s divided attention between his other ventures (X, xAI, SpaceX, etc.) at the expense of Tesla.

Source: Benzinga

“Very quickly, you see a pretty big ‘No’ cohort. I think mathematically it’s going to be a real challenge for the pay package to be approved,” he said.

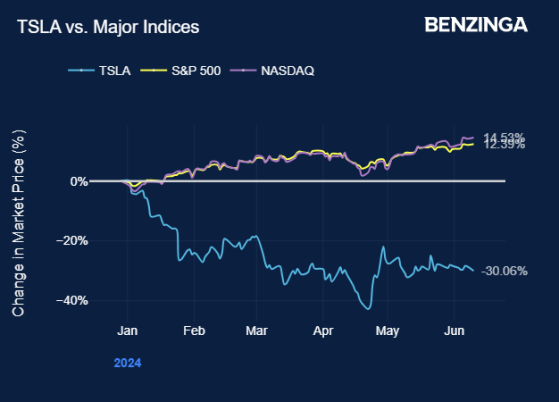

The analyst has reportedly given a “sell” rating for Tesla with a $120 price target, a 30% downside from current levels.

Silver Lining & Opposing Views: Despite the predicted drop, Sacconaghi sees a potential benefit. If the proposal fails, he said Tesla’s diluted share count would decrease by about 9%, leading to a 10% boost in earnings per share.

However, some prominent investors are aligned against Sacconaghi’s outlook. Tesla bulls like Ron Baron and Cathie Wood, along with Baillie Gifford & Co., support the proposal, citing Musk’s leadership and Tesla’s future potential, Bloomberg reported.

Future Fund‘s Gary Black believes the proposal will pass, referencing past approval with 73% support and Tesla’s strong stock performance (despite recent weakness). He also argues for the plan’s fairness and Musk’s importance in Tesla’s AI-driven future.

What About Retail Investors? Musk himself is banking on retail investor support. He claims on X that “roughly 90% of retail shareholders who have voted have voted in favor.”

If approved, the package would allow Musk to purchase up to 304 million shares (valued at $53 billion) and potentially increase his voting control to 25%, aiding his vision for Tesla as an AI leader.

Price Action: As of Monday’s close, Tesla’s stock price sits at $173.79, down 2.08%, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: Attention, Tesla Investors! Fund Manager Lists 4 Key Catalysts That May Boost Ailing Stock

Image made via photos on Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga