Benzinga - by Anusuya Lahiri, Benzinga Editor.

Taiwan Semiconductor Manufacturing Co (NYSE:TSMC) saw a 30% increase in May sales, reaching $229.6 billion New Taiwan dollars ($7.1 billion), due to high demand for AI and recovering consumer electronics.

As the world’s largest contract chipmaker, TSMC produces semiconductors for Nvidia Corp (NASDAQ:NVDA), which supplies companies like Microsoft Corp (NASDAQ:MSFT) and OpenAI, Bloomberg reports.

Additionally, global smartphone sales rebounded in early 2023, boosting mobile chip orders.

Also Read: Broadcom Rises As Top AI Chip Supplier After Nvidia, Thanks To Google And Meta Partnerships: Analyst

TSMC maintains high margins, producing advanced AI accelerators for Nvidia and semiconductors for Apple Inc (NASDAQ:AAPL) and Advanced Micro Devices, Inc (NASDAQ:AMD). CEO C.C. Wei expects AI development to drive a sector-wide recovery in 2024. The company is eying a price hike to tap its moat.

For 2024, TSMC expects a 10% annual growth in the semiconductor industry, excluding memory chips.

Nvidia and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google have significantly boosted the number of generative AI unicorns, nearly doubling the count to 37 by the end of April.

This 85% increase from the previous year reflects the tech giants’ investments in promising startups, the Nikkei Asia reports.

Nvidia has invested in seven of the new unicorns, including Canada’s Cohere, while Alphabet has backed four, such as video generation specialist Runway.

The global landscape has also diversified, with ten of the 17 new unicorns based outside the U.S., including China’s 01.AI and France’s Mistral AI. Major tech companies are driving this trend, shifting focus from electric vehicles and fintech to AI, aiming to capture new technologies and talent for expanding their services.

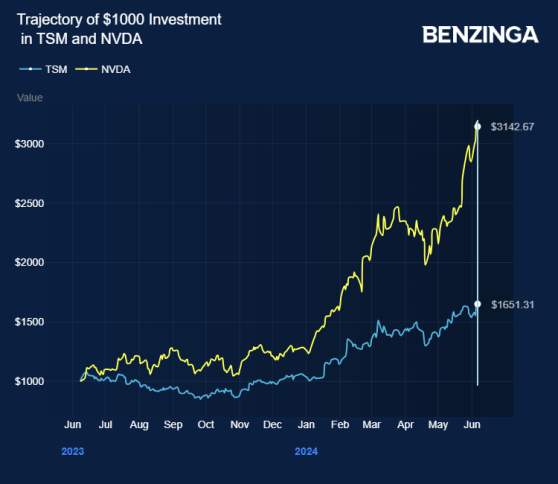

TSMC stock gained 62% in the last 12 months. Investors can gain exposure to the semiconductor sector via First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and ProShares UltraShort Semiconductors (NYSE:SSG).

Price Action: TSM shares were trading lower by 0.48% to $161.30 premarket at the last check on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Ivan Marc via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga