Benzinga - by Anusuya Lahiri, Benzinga Editor.

Supermicro, Inc (NASDAQ:SMCI) announced additions to the Advanced Micro Devices, Inc (NASDAQ:AMD)—based H13 generation of CPU Servers powered by the AMD EPYC 4004 Series processors.

Supermicro will feature its new MicroCloud multi-node solution, which supports up to ten nodes in a 3U form factor for cloud-native workloads.

Supermicro CEO Charles Liang said, “In a single rack, 160 individual nodes can be made available for cloud-native applications, which reduces real estate need and decreases a data center TCO.”

Also Read: SMCI To Use S&P 500 Status To Raise Funds, Predicts AI Breakthroughs In Medicine, Weather Forecasting

The AMD EPYC 4004 CPUs, support a wide range of solutions, from 1U, 2U, and Tower systems to the new 3U multi-node MicroCloud enclosure. With ten servers in just 3U of rack space, customers can increase their computing density by over 3.3X.

The 3U multi-node MicroCloud system offers a space-saving design and low power consumption optimized for web and dedicated hosting, cloud gaming, and content delivery networks.

Supermicro’s servers, powered by AMD EPYC 4004 CPUs, cater to small to mid-sized businesses looking to expand into new opportunities.

In April, Supermicro reported third-quarter sales of $3.85 billion, up by 200% year-on-year, which missed the analyst consensus of $3.95 billion. The company reported EPS of $6.65, which beat the analyst consensus of $5.78.

Analysts noted continued sales momentum for the pure-play AI server vendor, thanks to strong demand from Tier-2 CSPs and enterprises . They also flagged concerns over potential margin erosion and the need for additional capital.

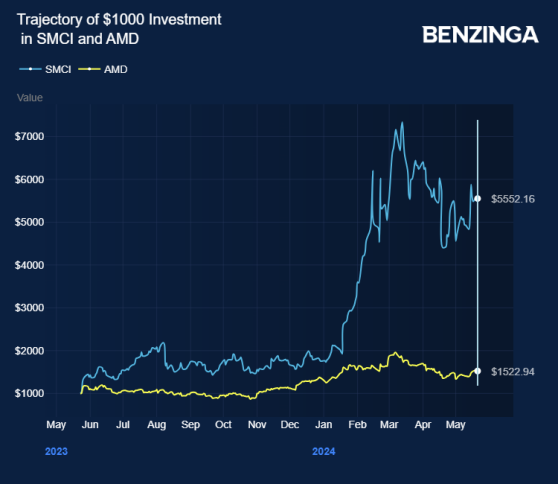

Super Micro Computer stock gained 446% in the last 12 months. Investors can gain exposure to the stock via ERShares Entrepreneurs ETF (NASDAQ:ENTR) and Global X Data Center & Digital Infrastructure ETF (NASDAQ:DTCR).

Price Action: SMCI shares were up 0.79% at $906.01 premarket at last check Wednesday.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga