By Geoffrey Smith

Investing.com -- When the elephants fight, it’s the ants that get trampled.

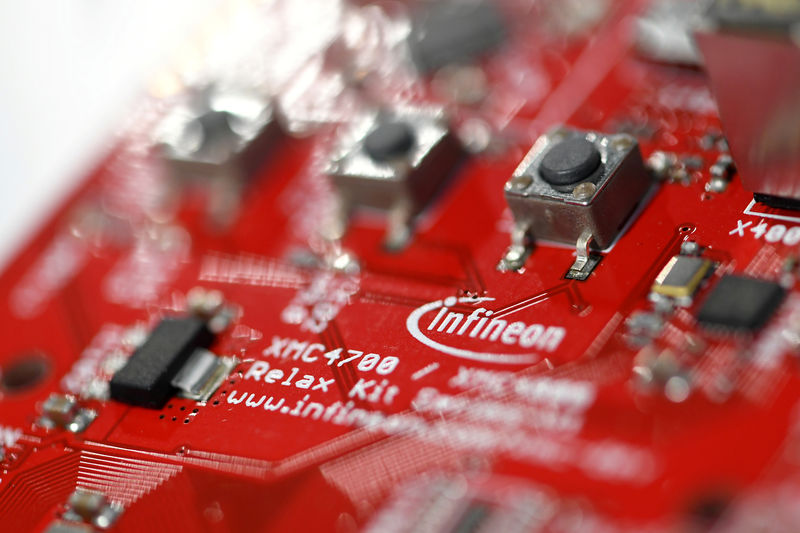

Europe’s biggest chipmakers Infineon Technologies (DE:IFXGn) and STMicroelectronics (PA:STM) – elephants in their own backyard – are getting a taste of life as an ant this morning as the trade dispute between China and the U.S. threatens to spiral out of control.

The two companies have been put in an awkward place by last week’s executive order from the U.S. effectively banning U.S. companies dealing directly with telecoms giant Huawei without a government license. Reports over the weekend suggested that companies from Alphabet (NASDAQ:GOOGL) to Qualcomm (NASDAQ:QCOM) and Broadcom (NASDAQ:AVGO) had already stopped selling to the Chinese giant.

According to a report by Japan’s Nikkei Asian Review, Germany’s Infineon has suspended sales to Huawei for fear of causing itself legal trouble in the U.S., while French-based STMicro (PA:STM) has scheduled meetings with the Chinese company for later this week to clarify its situation.

As of 4 AM ET (0800 GMT), Infineon was down 3.1%, while STMicro was down 3.8%, both at the bottom of their respective indexes. Germany’s Dax and the CAC 40 were both down a little less than 0.1%, while the benchmark Euro Stoxx 600 opened the week effectively flat at 381.60.

According to Nikkei, Infineon’s direct sales to Huawei are minimal – less than $100 million a year (compared to annual revenue of .7.94 billion euros. For STMicro, the direct impact would be larger as Huawei is one of its 10 biggest clients, according to regulatory filings cited by Reuters.

However, it isn’t just the direct effects that the two companies need to worry about. Restrictions on sales to China, the world’s biggest market for semiconductors, will create yet more overcapacity headaches for the industry outside China, putting more pressure on prices and margins.

It’s less than two months since Infineon was forced to cut its outlook for both revenue and profit this year due to “continued sluggishness in end markets”, while STMicro kept its guidance, but trimmed its planned capital expenditure.

Even if demand does pick up, the German company said it would only slowly feed through to the bottom line because global inventories are already at high levels. Huawei has been stockpiling for months to protect itself against being cut off from western suppliers, according to various reports.