Benzinga - by Zacks, Benzinga Contributor.

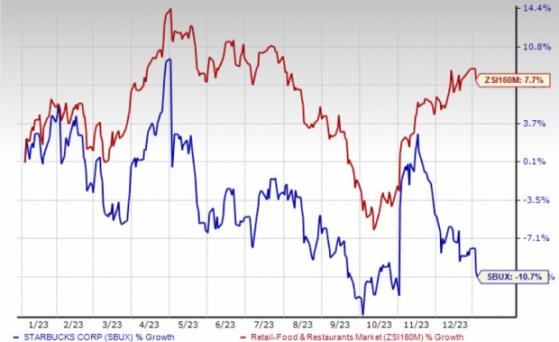

Shares of Starbucks Corporation (NASDAQ: SBUX) have declined 10.7% in the past year against the industry's 7.7% growth. The company's performance is likely to have been hurt by ongoing inflationary pressure. Its ingredients are witnessing a price hike in the last few quarters.

However, the Zacks Rank #3 (Hold) company's sales and earnings in fiscal 2024 are likely to witness a gain of 10% and 17%, respectively. In the past 60 days, earnings estimates for fiscal 2024 have witnessed an upward revision of 0.7% to $4.14 per share.

Let's delve into the factors likely to drive SBUX's performance in 2024.

Growth Drivers Starbucks is likely to benefit from expansion efforts. In fiscal 2019, 2020, 2021 and 2022, it added 1,900, 1,400, 1,173 and 1,120 net new stores, respectively. In the first, second, third and fourth quarters of fiscal 2023, Starbucks opened 459, 464, 588 and 816 net new stores worldwide, respectively. This resulted in 2,327 net new stores in fiscal 2023, bringing the total global store count to a record of 38,038 stores.

For fiscal 2024, SBUX expects store count in the United States and China to grow approximately 4% and 13%, respectively, on a year-over-year basis. Management projects global store growth to be approximately 7%. Capital expenditures in fiscal 2024 are estimated to be approximately $3 billion.

Starbucks is strengthening its product portfolio with significant innovation around beverages, refreshments, health and wellness, tea and core food offerings. It is leaning toward fast-growing categories like Cold Brew, Draft Nitro beverages, and plant-based modifiers, including almond, coconut and soy milk alternatives. Apart from the numerous beverage innovations, Starbucks has also been making an effort to offer more nutritional and healthy products to its customers.

Image Source: Zacks Investment Research

Along with menu innovation, the company indulges in other investments that reduce manual labor and increase efficiency. During fourth-quarter fiscal 2023 earnings, Starbucks mentioned its focus on certain upgrades in its stores. To support the growing demand for cold beverages, it delivered more than 550 new Nugget ice machines and is on track to install the same in its most ice-constrained stores in fiscal 2024.

Furthermore, its single-cup brewer, Clover Vertica, is now installed in more than 600 stores across the United States. Also, the rollout of Siren System cold and food stations is moving forward as planned, especially to new stores and renovation locations.

For fiscal 2024, management anticipates global comparable sales to reach 5-7% target range. Consolidated revenues are anticipated to be in the low end of the 10-12% range on a year-over-year basis. SBUX estimates non-GAAP earnings per share (ETF:EPS) growth in the 15-20% band.

Key Picks Below we present some better-ranked stocks from the Zacks Retail-Wholesale sector.

Arcos Dorados Holdings Inc. ARCO sports a Zacks Rank #1 (Strong Buy) at present. It has a trailing four-quarter earnings surprise of 28.3%, on average. Shares of ARCO have jumped 53.2% in the past year.

The Zacks Consensus Estimate for ARCO's 2024 sales and EPS indicates 10.6% and 15.5% growth, respectively, from the year-ago levels.

Brinker International, Inc. EAT currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 223.6%, on average. Shares of EAT have gained 18.8% in the past year.

The Zacks Consensus Estimate for EAT's 2024 sales and EPS implies 5.1% and 26.2% growth, respectively, from the year-earlier numbers.

Wingstop Inc. WING presently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 28.9%, on average. The stock has risen 83.6% in the past year.

The Zacks Consensus Estimate for WING's 2024 sales and EPS suggests 15.8% and 18.2% growth, respectively, from the prior-year actuals.

To read this article on Zacks.com click here.

Read the original article on Benzinga