Proactive Investors - Sovereign Metals Ltd (LON:SVML) aims to become the world’s largest, lowest cost and lowest-emissions producer of two critical minerals – titanium (rutile) and graphite.

The company is focused on the exploration and development of its flagship Kasiya Rutile-Graphite Project in Malawi along with its strategic investor, Rio Tinto (LON:RIO). It is aiming to develop a large-scale, long-life rutile-graphite operation, focusing on developing an environmentally responsible, sustainable and socially uplifting operation.

Kasiya is the largest known rutile deposit and the second-largest flake graphite resource globally — two commodities in which China currently dominates supply.

The company is targeting annual production of 222,000 tonnes of rutile and 244,000 tonnes of graphite which would make Sovereign the market leader and largest producer of both rutile and graphite outside of China.

Sovereign is also targeting to be the lowest-cost producer, averaging US$415 million EBITDA annually during an initial 25-year mine life. The project has a projected post-tax NPV8 of US$1.6 billion and post-tax IRR of 28% for an initial capital outlay of US$597 million.

Potential for major project

A scoping study for Kasiya is based on the updated MRE reported in April 2022, of 1.8 billion tonnes containing 18 million tonnes of rutile at 1.01% and 23.4 million tonnes of graphite at 1.32%.

The study envisages a 25-year mine life during which time rutile and graphite are produced during two stages of development (Stage 1: 12 million tonnes per annum and Stage 2: 24 million tonnes per annum).

In September 2023, Sovereign released a pre-feasibility study (PFS) confirming that Kasiya has the potential to be one of the world’s largest and lowest-cost producers of natural rutile and natural graphite. As a low-cost producer, Sovereign will be able to better withstand fluctuating commodity cycles.

Kasiya would also have a carbon footprint substantially lower than current alternatives, while significantly contributing to the social and economic development of Malawi.

The PFS confirmed Kasiya as potentially a major critical minerals project with an extremely low CO2-footprint delivering major volumes of natural rutile and graphite while generating significant economic returns.

Rio Tinto, a strategic partner

Rio Tinto is a strategic investor in the company, having invested $40.4 million in July 2023 for an initial 15% to advance the Kasiya definitive feasibility study (DFS). Rio has the option to acquire additional 4.99% by the end of July 2024. It also has the option to be the project operator upon completion of the DFS.

Decarbonising supply chains

The company seeks to have the lowest carbon footprint operations and end products. It boasts a reduction in Scope 1 and 2 emissions of up to 99%, plus a significant reduction in Scope 3 emissions for end users.

Kasiya graphite – lowest emissions natural graphite globally

Graphite comprises around half of the material in a lithium-ion battery and is a major contributor to an EV battery carbon footprint.

It is a critical mineral for the US, EU and Japan, however, China dominates supply which threatens the uptake of electric vehicles. Exacerbating graphite supply concerns, in December 2023, China implemented restrictions on graphite exports for national security reasons.

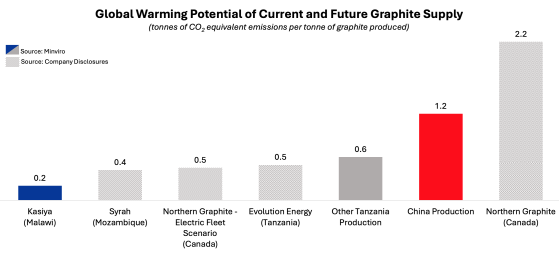

Sovereign is qualifying the graphite product from Kasiya for the lithium-ion battery anode industry. The company is poised to have the lowest carbon footprint of all graphite producers, and natural graphite from Kasiya would have a significantly lower carbon footprint than Chinese supply.

Sovereign is poised to have the lowest carbon-footprint of all graphite producers.

Rutile is highest-purity titanium mineral

Titanium is an essential ingredient for various industries including in chemical processing, construction, aircraft and vehicles.

It is commercially mined in two mineral forms: ilmenite and rutile. An estimated 95% of the world’s titanium is derived from a low-purity ilmenite (30-60% titanium dioxide).

Ilmenite must be upgraded via costly and carbon-intensive processes to Titania Slag (>85% titanium dioxide) or synthetic rutile (>88% titanium dioxide).

Since it is a 'direct feed' mineral, rutile (>95% titanium dioxide) is the preferred titanium mineral but is extremely rare with supply diminishing.

Importantly, natural rutile has Scope 1 and 2 emissions orders of magnitude lower than ilmenite-derived alternatives. It also provides substantially lower Scope 3 emissions – reducing emissions of titanium downstream industry.

However, rutile supply has been suffering from depleting reserves and lowering grades of current producing mines, further highlighting the opportunity for Sovereign if it can increase rutile supply to the market.

Natural rutile is a genuinely scarce commodity with no other known large rutile dominant deposits being discovered in over half a century.

Central Malawi now hosts the largest known rutile province in the world and Kasiya is the largest single rutile deposit, with more than double the contained rutile as its nearest rutile peer, Sierra Rutile.

Rutile supply has been suffering from depleting reserves and lowering grades of current producing mines.

Malawi emerging mining destination

The mining potential of Malawi has been flying under the radar, but the country has significant potential to develop its mining sector. Endowed with numerous mineral deposits, including its emerging rutile province, Malawi has plenty of potential to progress as an African mining destination.

Malawi is a stable, transparent jurisdiction with exceptional existing infrastructure including grid power, road network and an established labour pool. The Nacala Logistics Corridor also passes through Malawi to the Indian Ocean and the Nacala Port, providing a low-cost transportation solution.