Benzinga - The May non-farm payrolls report, which showed that the economy added 339,000 jobs, may have raised hopes that all might not be doom and gloom, but one economic researcher recently painted a more muted outlook by looking at the underlying business cycle trends.

What Happened: The labor market is decelerating “with a growth rate that is just on the cusp of turning negative,” said Eric Basmajian, who provides economic research through his firm EPB Research, in a blog post. This historically occurs only when an economy is in recession, he explained.

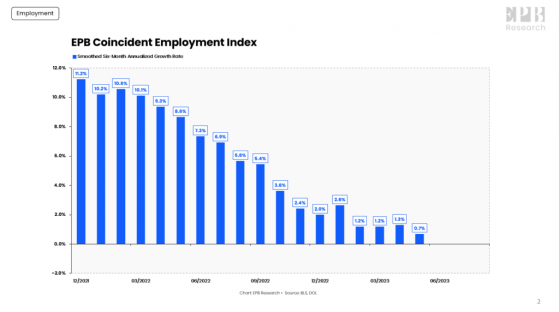

The Thesis: Basmajian's deduction is based on the coincident employment index, a basket of five labor market metrics, including non-farm payrolls, employment level and aggregate weekly hours.

The composite index, according to the economist, is preferable when it comes to analyzing the nonfarm payrolls number in isolation because it includes both the surveys of employment from the Bureau of Labor Statistics and the insured unemployment rate from the Department of Labor, he added.

On a smoothed six-month, annualized growth basis, the coincident employment index fell to 0.7% in May, the weakest growth rate of this cycle, Basmajian said.

Source: EPB Research

The economist also noted that the leading employment Index, a basket of six leading employment indicators, remained in contraction territory.

“Despite this reality from a more reliable indicator of the labor market, the headline shock factor of +339,000 is a challenging narrative to dispute,” the economist said.

Read Next: Economist Flags This As A ‘Sure-Fire Recession Signal’: ‘Economy Is A Dead Man Walking’

Image: Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI